Alright, Traders and Investors welcome to another edition of the Magnelibra Markets Podcast. What a week for the markets and despite all this data and new information, the markets seem to be immune to anything but bullish sentiments in terms of equities however there are signs that negate some of this euphoria. Today’s episode #40 is entitled “US Federal Spending is on Tilt, We are at a Crossroads”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

Yes we had the FOMC this week, yes we had the SNB cut rates and more importantly than all of those, we once again have a US spending bill, some 1000 pages plus that was passed within just a few hours of receipt by our hapless Congress. It is no secret that our government is operating in full tilt mode. For those of you that haven’t ever heard of this saying, “being on full tilt,” well it is a saying associated with a gambler that is acting recklessly, usually due to a recent bad loss or what is more commonly referred to as a “bad beat.” Let’s use Texas Hold’em to get our point across about US government spending.

So in Texas Hold’em a player holds 2 cards and then a series of 5 cards are then displayed in the center for all players to use. The progression of these cards is 3 are dealt in the middle, then one more, then the final card, these are commonly referred to as the Flop, the Turn and the River. So for a gambler to go on tilt, we will assume that pre flop the gambler raises the stakes, but is then called by another player, then the turn comes, the gambler once again bets and is called by another player and this gambler lets assume is holding the top hand at this point, a straight lets say and his goal is to bet enough to get the player out and to force him to fold. So lets assume the other player calls his bet and then finally the River comes. The River card provides 3 available cards to everyone that are of the same suit, giving a possible Flush to any one of the remaining players. However our original gambler who held the top hand going into the River, knows he does not have the best available hand now, but bets anyway hoping the other player(s) don’t have a flush. Well the other player then raises this gambler, now setting off the player to go on Tilt. Because the original better, the gambler in our scenario is pot committed at this point, basically has too much in to fold, he then calls. Well the opposing player turns over the Flush and the gambler loses. Frustrated and “on tilt” now the gambler goes on to play the remaining hands frustrated and reckless, going in on hands like 7-2 off-suit and trying to bluff, but nobody believes this player now because everyone knows they are on Tilt…so the gambler goes onto lose everything leaves the casino, stops at the local bar for a few shots of Jack, heads home and gets pulled over and gets a DUI…So that in a nut shell is full tilt mode…obviously a hypothetical situation, but in reality, we are certain many have seen this type of play in their day. The same thing goes on in the trading world, except its called cannon balling, whereby a disgruntled trader goes on to double up positions trying to get back to even, when in reality, we all know what will happen, they will get blown out!

The point of this is to point out the fact that our own government is “On Tilt” thinking it can spend money that it has to create out of thin air, just to keep the status quo. You see we are not generating the same kind of GDP growth we once did with our increase in debt. We used to get $4 in GDP for $1 in Debt, now we get $0.70 cents in GDP growth for every $1 in debt. Obviously this is not sustainable and what it is leading to is a very misaligned and asymmetric risk/reward scenario not only for the United States, but unfortunately for the rest of the world. We know in the past that historically this type of monetary gaming never ends well, it ends with wars to facilitate because someone doesn’t want to play ball by these American rules. We believe we are on the precipice of this situation right now. We have emphasized the importance of what is going on in Ukraine and Gaza and this is of no surprise to us given the fact that our malfeasance always seems to come with bombs eventually, the major distraction and this is not good for anyone.

This bill which approves another $1.2T in spending with our debt going up by $1 Trillion every 100 days. It is quite obvious these numbers are leading to a massive decimation of middle and lower class earnings, which have to absorb this inflation of debt via inflation in prices and its eating up their entire wage base. However what it is also doing is its enriching the rentier class because they see higher nominal prices in assets and more importantly in the case of higher interest rates, they see a massive pick up in risk free interest take up. This latter reason is why we believe Powell this week was more dovish, he knows that higher rates are leading to a massive windfall of risk free interest profits and this has to be paid no matter what, this isn’t levered gains, these are actual risk free profits on base money. Let’s assume we have $10 Trillion in actual savings and a 5% interest rate, well this is $500Bn dollars per year that has to be credited to the owners of this risk free profit, THIS IS INFLATIONARY.

So many get our monetary mechanism wrong today, so many think higher rates in today’s highly leveraged and indebted economy that is bifurcated by government fiscal policy and central bank monetary policy reduces inflation. IT DOES INITIALLY but if held too long becomes an inflationary monetary mechanism as we just outlined creating half a trillion of risk free interest dollars per year.

This is the real reason why we believe the FOMC will cut more than 3 times this year, also the US Treasury is already operating in a negative fiscal deficit position and they cannot afford $1.2 T in interest payments.

So a lot to digest here and we can see the start of the cutting regime began in Switzerland as the SNB cut rates this week hitting the Suisse, so let’s just say, they know what is coming and so too does the FOMC…as Powell stated in his pressor, he is comfortable and confident in knowing inflation is coming down to their target rate.

Ok let’s get into a bunch of charts but first we do want to apologize to our subscribers, because we should have put out the Lululemon ATM straddle for Friday prior to earnings. The Straddle was calling for a 9.1% move, we looked at the 480 straddle which was priced at 44 ticks. The 450/425 put was trading $5.80 at the end of the day on Thursday giving a player a decent 4.3:1 payout. Magnelibra subscribers know we have been onto the topping pattern in LULU and highlighted it last month in early February saying this in our subscriber letter that day:

Well LULU was hammered on Friday as their growth forecasts were basically cut in half and the market did not like it, LULU closed at $403.19, losing -$75.65 or 15.8%, Here is the chart:

Ok let’s first post our settlement data for last week from 3/20 for our new followers and subscribers, this is how we compile our data and structure it for the markets we follow:

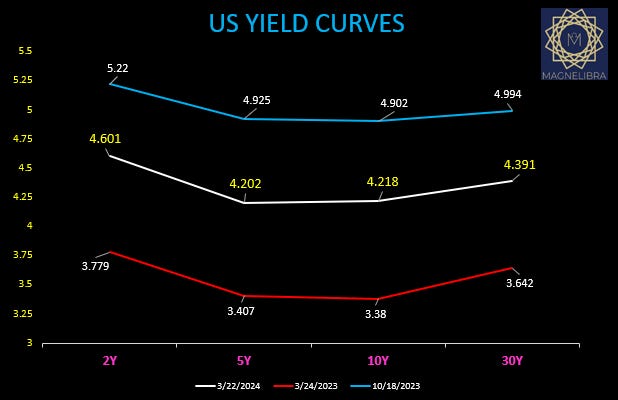

As far as the US Bond market, well the front end of the US yield curve certainly liked the FOMC rhetoric and it was well bid as indicated by the steepening moves:

When we look at the US treasury yields we can see they are nearly right in the middle wedged between the banking crisis lows and the October highs:

When we look at the US govt 2Y it has once again rejected the 4.75% area:

Alright let’s take a quick look at the Magnelibra Futures Model Sentiment Tracker, here we try to encapsulate a hypothetical position based upon our Magnelibra CTA models and the sentiments for each of the markets we cover. The goal of this tracker is to educate current and future potential futures traders as to how we look at markets in our cross asset allocation long/short modeling. We break the positions down by long or short and quantity. We also keep a hypothetical daily P+L based upon current positions and their closing prices for that given day. If there are any changes, they are done so at the end of day pricing for continuity purposes. This is a great way for new traders to learn and follow along with us, obviously not a good start to this Q1 but with this tracker its to validate how we view the markets we follow and allow you to follow along with us or create your own strategies or inter-market spreads:

As always we bring our subscribers the Magnelibra MEGA8s Tracker, where last May we began tracking this group after our data tilted us toward this all in investment thesis by the masses. What we do with this tracker is provide you a daily update to the moves by this group and we offer an inside look at a possible hedge strategy to a static long only portfolio by selling index calls, either QQQ ETF or SPY ETF. This is another educational/hypothetical learning tool that allows you to see on a daily basis how something like this would track and potentially allow you to brainstorm and create your own long only baskets and synthetic hedge strategies:

This grouping made another all time Market Cap high this week:

We chart this group on TradingView as well:

Ok this is getting a bit long but we have a bunch more charts to cover. First up let’s look at Crude Oil, the rejection from $82 has begun and we believe a short term top is in here and if you are a bear and sell here, well your stops should be very close above $83:

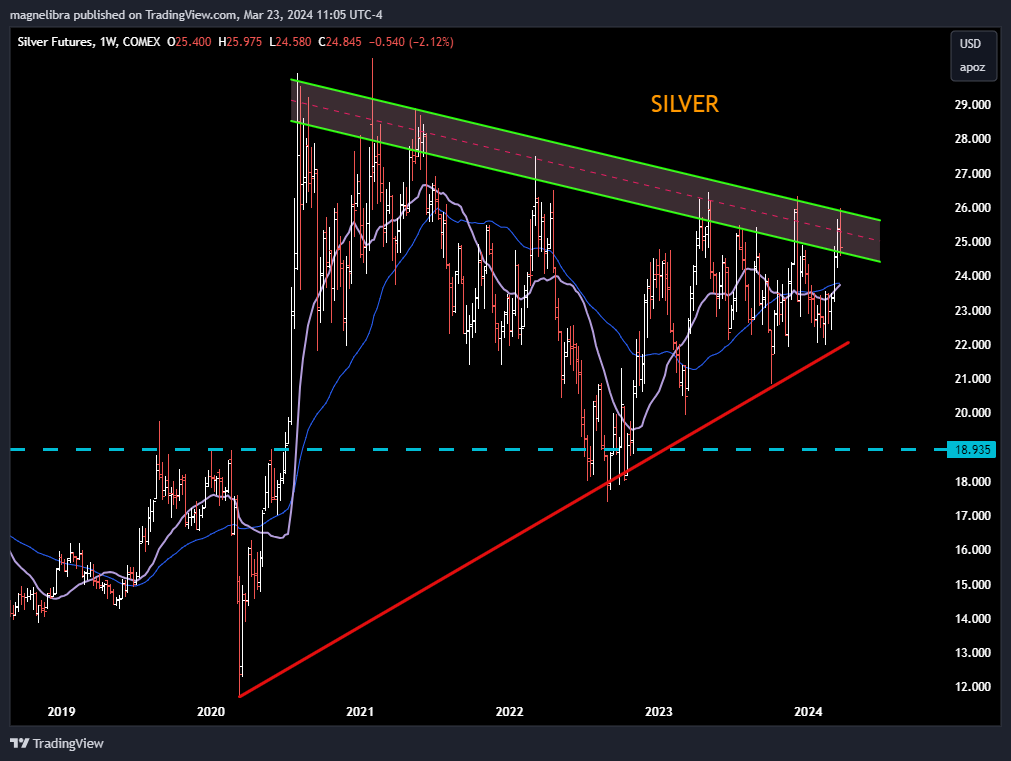

Let’s look at the metals Silver and Copper, first Silver where our downward channel has once again proven its worth and rejecting the bid to overcome $26:

As far as Copper, we like the longer term view here but with Gold and Silver retreating, we aren’t sure it can be immune from that selling, we would like to see how it acts on a test of 3.85 where new longs could be waiting to be set:

We mentioned the Suisse Franc and the SNB rate cut, well let’s just say the technical damage is done but we don’t think it will just slice here, we expect a little battle around the 112.00 area:

The Euro Currency has a similar topping pattern so it will be interesting to see if the US Dollar does go onto strengthening just exactly how far this one can be pushed, and even more so, how long till the equities notice:

As far as equities here is the Nasdaq future which continues to coil higher, the break of this trendline will be sold into hard so do not expect it to hold especially on a confirmation top break of 17850:

Finally let’s look at Apple, it continues to sour and many hopefuls are looking for it to regain $181.00 but we doubt it, the trend is down here:

Ok that is it, we hope you got something out of all of this. We hope that your trading mentality and investment mentality are improving, that they are seeing the financial landscape from a whole new perspective. We have a lot going on and we hope you continue to stay with us as we bring you content that we believe is relevant to you, that may be of keen interest and of some use in your own games that you are playing. There is a lot geopolitically going on here behind the scenes and with the Sun acting up, with the full eclipse coming, well who knows what pots these will stir. Long time subscribers know we review and cover many topics, that we study our universe which is electromagnetic in nature and that everything we do does have an impact either positive or negative. We try our best to send out positive vibes, to promote well being, to promote purpose, to deliver ideas and content in unique and inspiring ways.

Thank you to all of you who have shared our work, have followed us on Substack and more importantly to all of you who support directly and subscribe. This really does go a long way and we are certainly grateful to all of you.

Next Thursday and Friday have the real data in the form of GDP revision and PCE on Friday. For now, we have to be ready for the “turn” we know our hands, we know the Flop cards, we are waiting for the Turn and the River, so whatever you do, be patient, be smart, keep a level head, and for God sakes, never go “On Tilt!”

It is Holy Week for us here at Magnelibra a time of year we spend in reflection and prayer and a time where we move out of the physical realm and dig deeper into the spiritual. We know its not everyone’s cup of tea and we respect all religions and all walks of life, but do not be surprised at limited content. We will bring our subscribers the trackers and any changes, but most likely will be in the form of our newsletter and not the Podcast, Till next time…Cheers

Share this post