Thank you guys for joining me and welcome to Episode 25 of Season 2 brought to you by Magnelibra Trading & Research (MTR). This episode is entitled “Liberation Day is Near as Trump Enacts Pro America Tariffs”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

The world is awaiting in intense fervor as April 2nd is almost upon us and as President Trump has stated,

“This is the beginning of Liberation Day in America. We’re going to charge countries for doing business in our country and taking our jobs, taking our wealth, taking a lot of things that they’ve been taking over the years. They’ve taken so much out of our country, friend and foe. And, frankly, friend has been oftentimes much worse than foe.” - Trump NBC News interview

President Trump is looking to put 20% to 25% tariffs on a lot of imported goods from countries like China, Canada and Mexico and will penalize countries that continue to import oil from Venezuela.

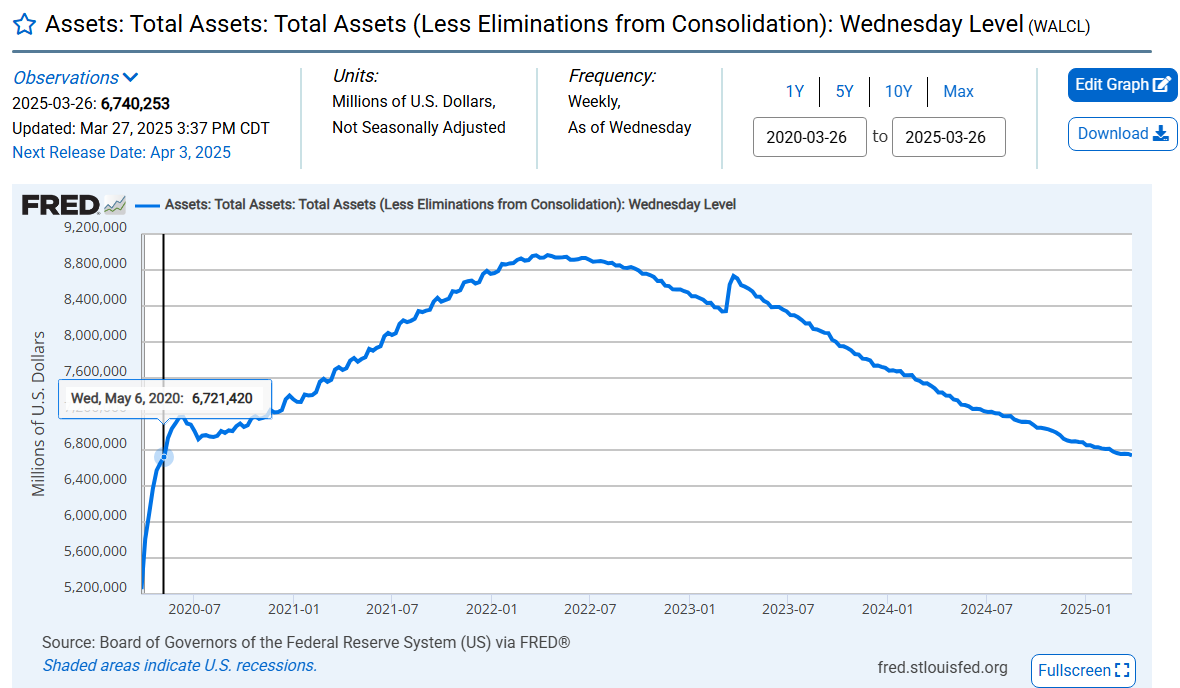

It will be interesting to see how these other countries respond, my guess is President Trump is already many moves ahead and that he will force these countries to do what America wants them to do. The rhetoric around MSMedia is that this will raise the costs for all Americans, that this will hit GDP hard. Well there are forces already at play that will do that anyway, years and years of overspending, over capacity and false economic signaling all enabled from an ever expanding global central banking system, which never solves any problems but rather masks them with continued asset expansion. Those day’s seem over for now, as interest rates have remained high and the FOMC albeit slowing their pace of QT has now seen their balance sheet shrink to $6.7T its lowest level since May of 2020!

For those that don’t know, how important it is to have a central bank that prints money to buy assets, know that nominal asset prices are driven by this mechanism. You will hear many deny that this is indeed the case, but take it from us, we have studied and followed this for over 2 decades, the only reason they need to expand above their 2% growth mandates is the game gets exponential more and more expensive. Meaning in order to keep the same level of nominal asset price value, whether it be Stocks or Real Estate or whatever, there needs to be a base layer of money to be levered up from. The global central banks provide that base layer!

Fractional reserve banking allows money creation through lending, where each dollar in reserves supports a multiple in loans (traditionally up to 10:1, depending on reserve requirements). However, this process is reversible: if deposits are withdrawn, banks must contract lending proportionally or sell assets to maintain liquidity. When credit growth stalls—whether due to falling demand, defaults, or deleveraging—the money supply shrinks. This contraction reduces demand for assets, leading to declining nominal prices and potential financial instability as leverage unwinds. This systemic fragility is an inherent risk of fractional reserve systems.

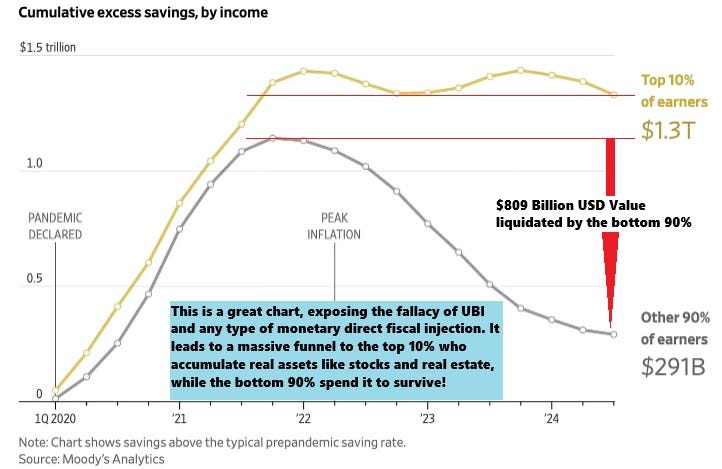

I believe this is what we are starting to see and honestly nobody even talks about this mechanism, except us here at MTR of course! You see the FOMC has everyone fooled, thinking that their “inflation mandate” is 2%, well it hasn’t been 2% well, since ever, in fact over the last 30 years or so its been 2.99% as measured by the CPI annualized. Even worse the FOMC themselves have expanded their asset base by a staggering 9.79% annualized over this same time period! So what the FOMC or Federal Reserve has done, especially post Covid is that it continues to shackle the average consumer with this high inflation, while simultaneously enriching the very upper echelon who for all intents and purposes, have no place for all this excess liquidity.

In fact here is a great graphic from Moodys Analytics and posted from my friend James Eagle of EagleI on his Substack. (BTW if anyone wants a free month, let me know via direct chat or email and I will set you up, I have 3 to give out). Anyway this is the problem with fiscal and monetary stimulus. For the bottom 90% its transitory, spent and diffused over a very short period of time till its eventually fully liquidated. As this chart points out, the bottom 90% have liquidated $809Bn from the peak in Q32021. Now contrast that with the excess savings of $1.3Tn to the top 10%, less than $100Bn has been liquidated from the peak, basically all of it is retained, saved, parked in risk assets, RE or Equity or some other MMarket or vehicle. I don’t know about you, but all this stimulus seems to do is increase the costs of living for the bottom 90%:

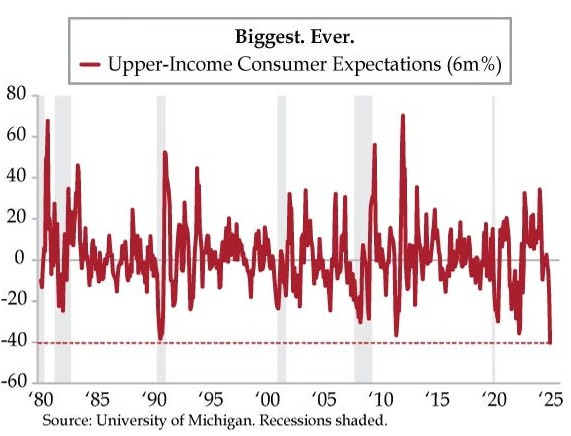

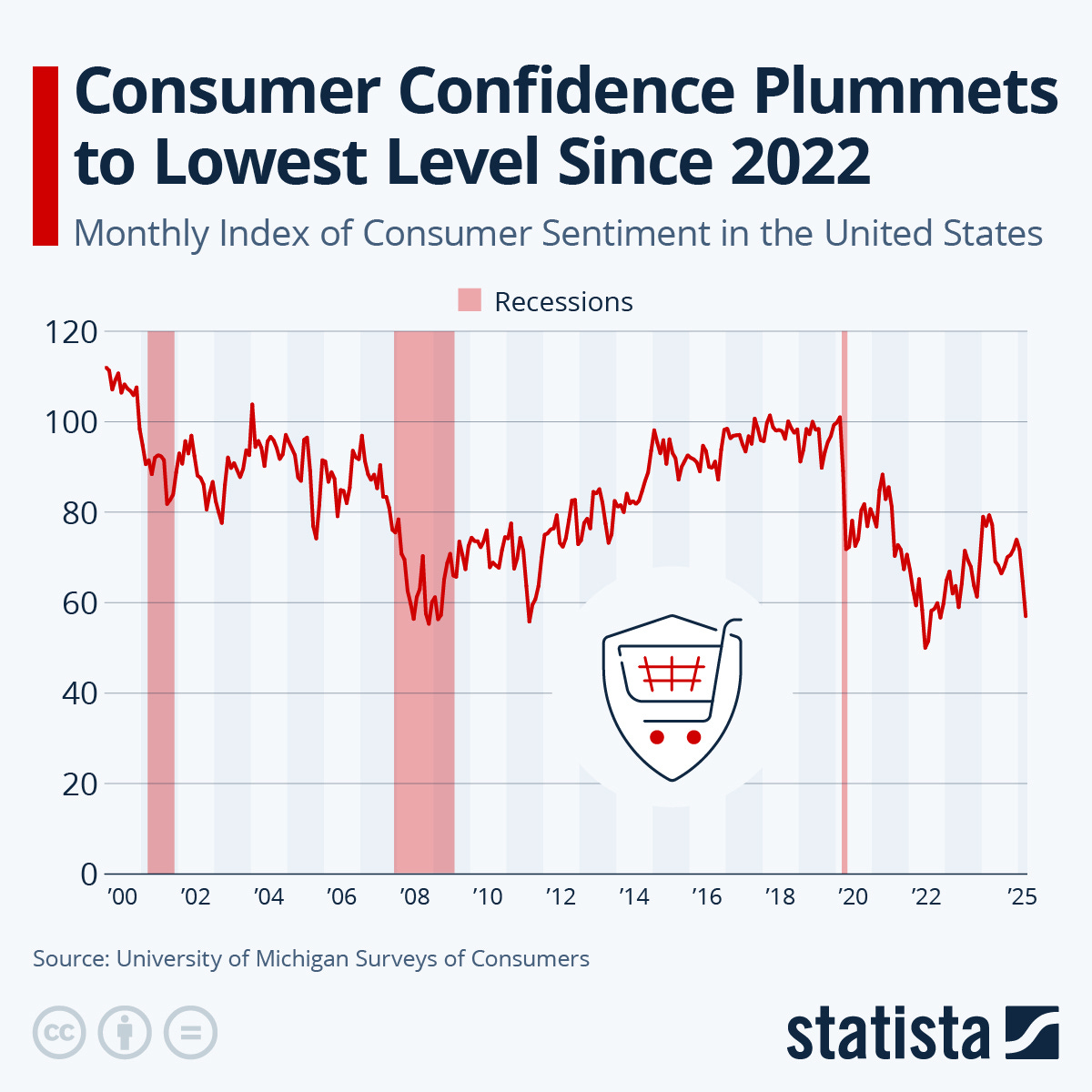

Even now though it seems that the upper income is starting to show signs of pulling in the reigns, DDBooth, shared this chart showing expectations collapsing to decadal lows:

Statista is also confirming this via the overall consumer confidence monthly data:

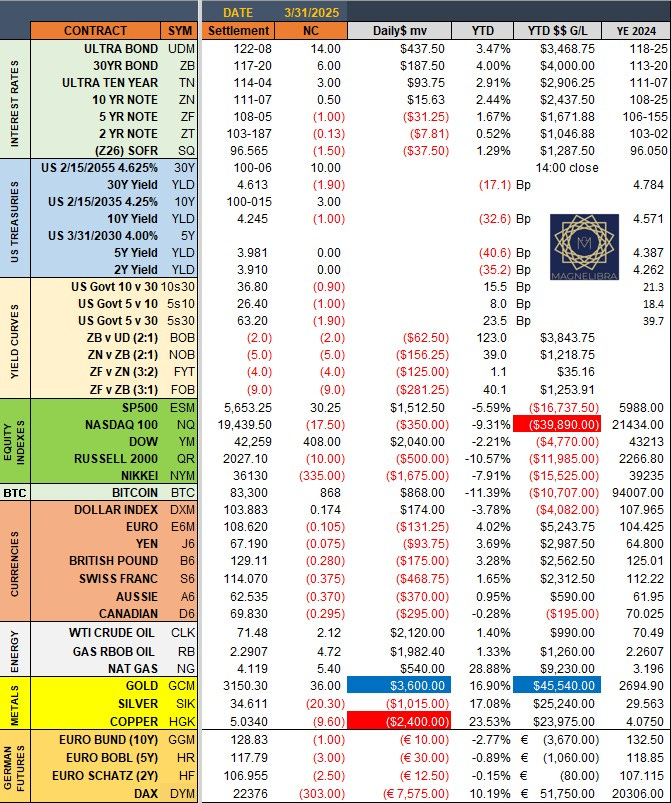

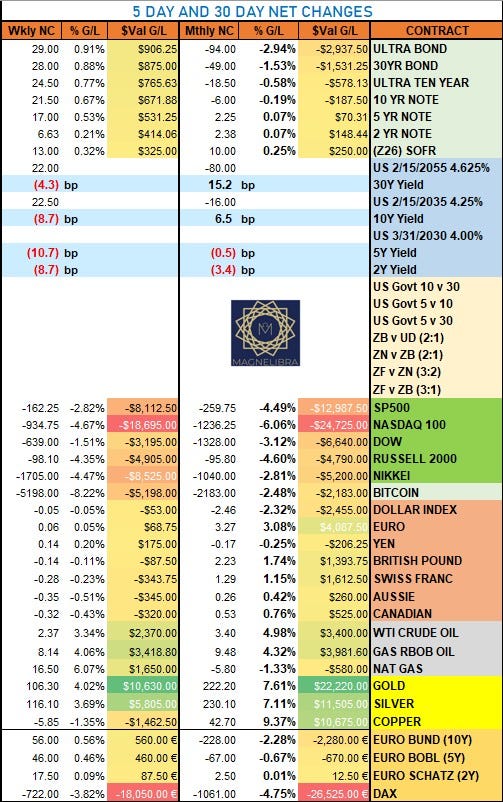

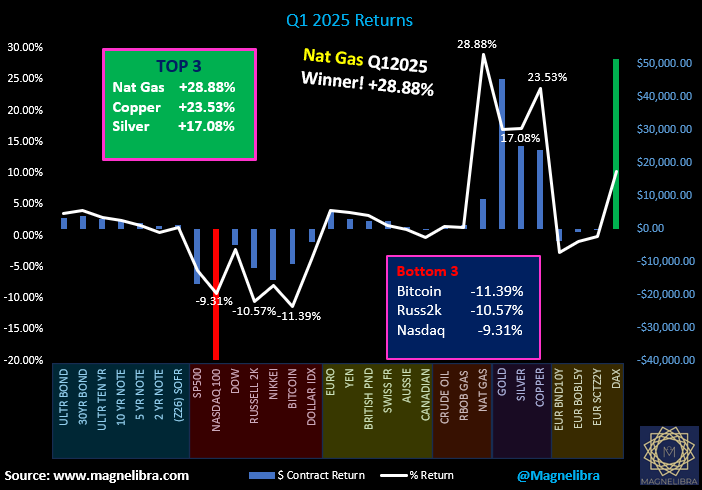

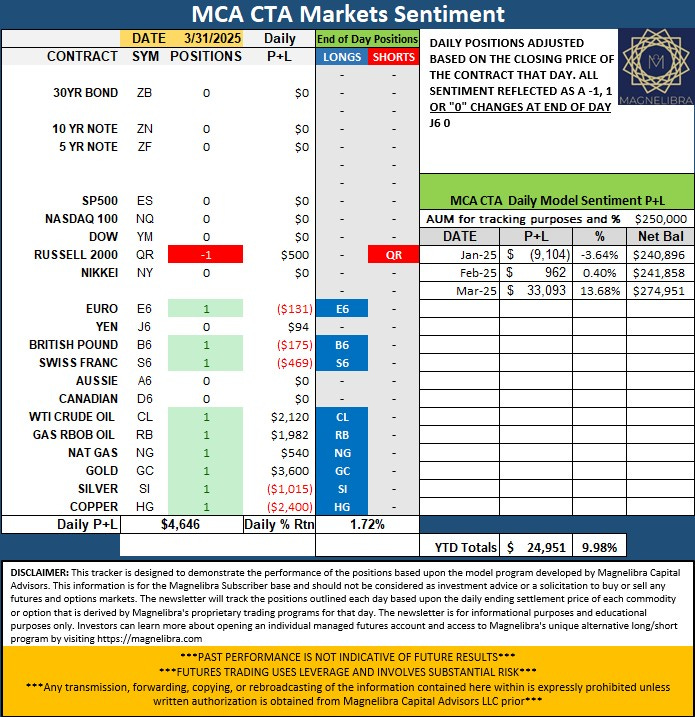

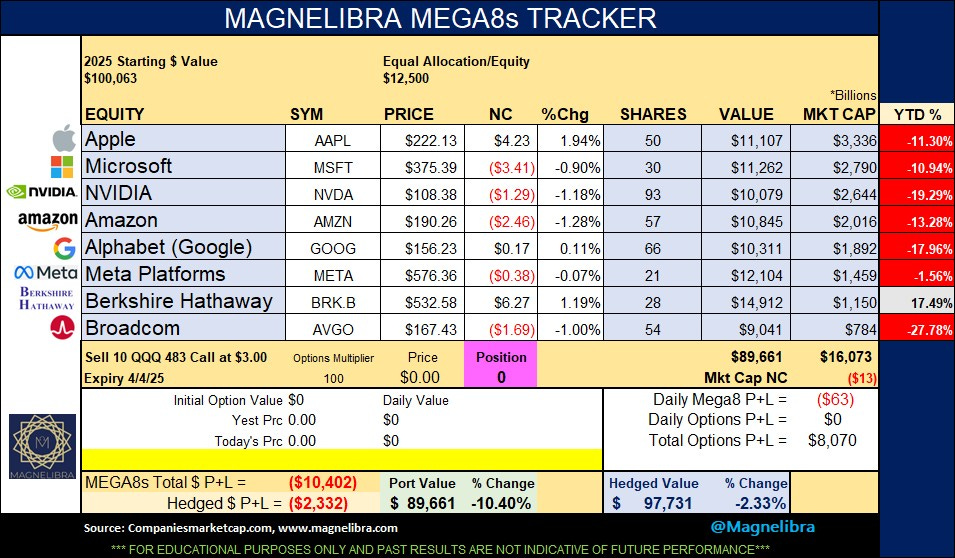

Anyway I think you get the picture! Ok before we get to the technical charts let’s just look at what MTR Subscribers get on a daily basis. By joining and subscribing you will gain access to our data which includes, our Magnelibra Commodity Trading Advisor Market Sentiments Tracker, this will give you keen insight to overall market trends for all the sectors that we cover, this will give you a greater understanding of monetary flows moving across the various market sectors covering bonds, equities, currencies, energy, metals and Bitcoin.

We often see a lot of advertising for “trader education, sign up, get funded” we can only tell you this, THERE ARE NO FREE LUNCHES, you have to put in the time, you have to get a mentor, and you need to be proactive in your learning. Nothing in life is free and you get what you pay for. Anyway hit that subscribe button and gain access to a brand new mindset!

This video is for everyone, but we just wanted to shed some light on what you can expect from our MTR on a daily basis. We know we present things drastically different than a lot of other venues out there, so if you can’t afford to subscribe, please just share our work then, we greatly appreciate it.

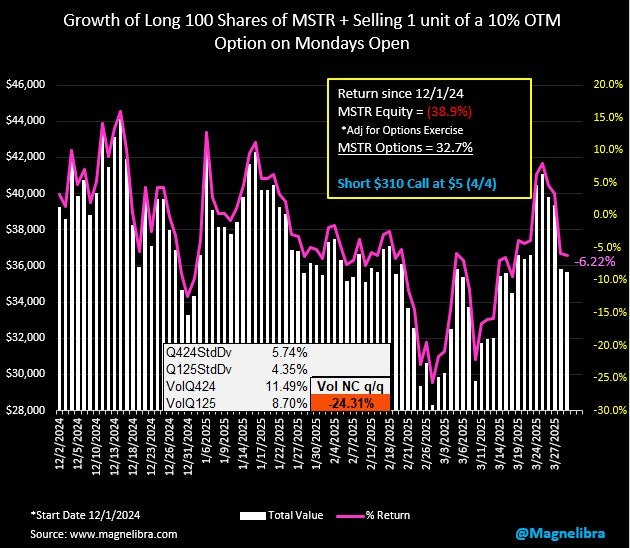

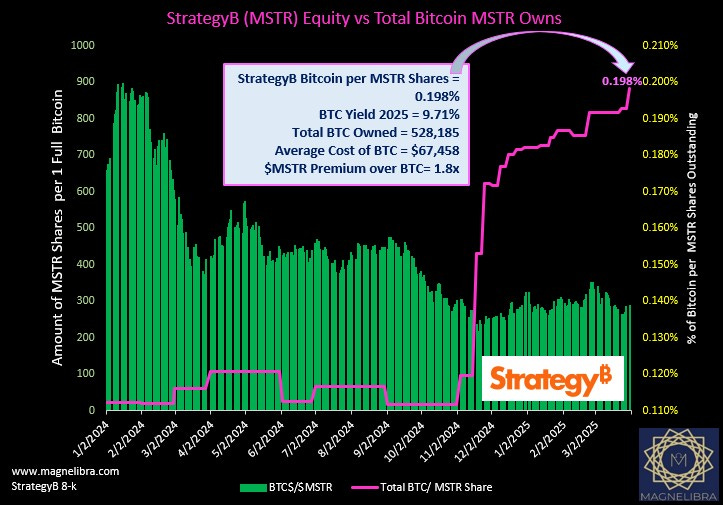

Alright we are moving to the technical charts and MTR Daily Subscriber Trackers.

Alright guys, stay positive and know that you are well informed, you have everything at your fingertips so don’t worry, start moving in the right direction, take hold of the reigns and stack the probabilities of success in your favor, every little step matters, every stumbling block that you over come matters.

You don’t owe it to anyone else, you owe it to yourself. Till next time, cheers.

Support directly to our BTC address: 3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp

Share this post