Hey everyone welcome to another edition of Magnelibra Trading & Research (MTR). This episode is entitled “Tariffs On, Tariffs Off, All a Big Game of Chicken” Episode 28 of Season 2

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

I am going to start today’s video with a little snippet from JB Shurk from the American Thinker and his piece entitled, There’s Nothing Free about ‘Free Trade’. We know that Trump is playing a massive and somewhat strange game of chicken with the global markets by announcing day to day changes to the administrations tariff strategy. Many accounts on Friday were reporting tariffs were now exempting smartphones, computers and other electrical devices imposed on Chinese imports. No doubt the markets took this to continue their bullish rebound. What is strange is this inconsistency seems to be causing volatility both up and down and this is not what we want for markets if you are an investor for the long term. This kind of rhetoric leads to a lot of uncertainty and imposes a sort of chaotic underpinning to an already fragile economic environment that has been stifled by inflation and higher interest rates.

We don’t like that the Trump Administration is playing chicken here with peoples lives, with their businesses and we do not like this game of playing hardball then to acquiesce in certain circumstances, especially when we have seen a lot of Wall Street masters crying on Social Media (Bill Ackman) about this initial tariff implementation and result.

Anyway enough, we figure we would highlight the recent post from the American Thinker.

I will share the link below and it is an absolute must read for all my readers and listeners. We believe this piece and the fundamental premise of what it states are profound and will prove to be correct in the not to distant future. His conclusion that he makes is spot on and let’s read what we think is the most important part to understand,

In truth, the American empire hasn’t been interested in “free trade” since at least WWI. The Great War, coincidentally enough, started roughly six months after the Federal Reserve System was forced upon the American public in a corrupt congressional vote two days before Christmas 1913. The creation of a “central bank” was a dead giveaway that markets would henceforth be controlled. Nothing that is centralized can be said to operate according to Adam Smith’s “invisible hand.” From that point on, central bankers chose the “winners” and “losers” in the American economy, and “free trade” became a euphemism that global oligarchs whispered to the American people while stealing every last cent from their pockets. -JB Shurk American Thinker April 10th 2025

His conclusion is dead on,

President Trump’s tariff policy is only the beginning. He is setting the stage for the end of the income tax, the IRS, and the Federal Reserve. Getting there requires unshackling the American economy and unleashing Americans’ entrepreneurial spirit. -JB Shurk American Thinker April 10th 2025

Here is the link, American Thinker

I also wanted to promote the All in Podcast and show a little bit of this weeks edition which included Larry Summers. David Sacks did his best to keep his composure, and one of the moments we enjoyed is when Summers tried to say that America’s exports did rise after letting China in the WTO, which Sacks aptly replied, yeah at the cost of massive deficits! Classic and excellent example how to argue against a single point of truth, but put in context, doesn’t sound so lucrative, meaning yea maybe our exports grew by a few percentage, but at the cost of Billions of dollars in deficits!

We also wanted to enlighten you to watch the Joe Rogan Experience, he had on Douglas Murray and Dave Smith and this was a clear cut full intention hit piece on trying to discredit main stream podcasts like Joe Rogan, main stream comics like Dave Smith and calling them out for having outlandish opinions on subjects that are “outside” of their core understanding. However what Douglas Murray came to understand is that the American population finds these outlets, informative, thought provoking and ask a lot of great questions that many do not have the answers too. In this clip Douglas Murray in his best accent tries to discredit Dave Smith for calling out the Israeli atrocities against the Palestinians on the basis that Dave has never even been to Gaza, as if that discredits his known facts and opinion. Much like Larry Summers argument, this is a tactic many debaters use to try and create for the observer a sense of lack of merit based upon not actually being physical present as if that matters. It clearly does not matter, we don’t live in a world by which information is restricted, we live in a world by which many millions report on actions each and every day, some more credible than others sure, but obviously we have access to a lot of data that we never did before. This is all part of the waking up movement, the red pill movement. Anyway here is a little snippet of that part:

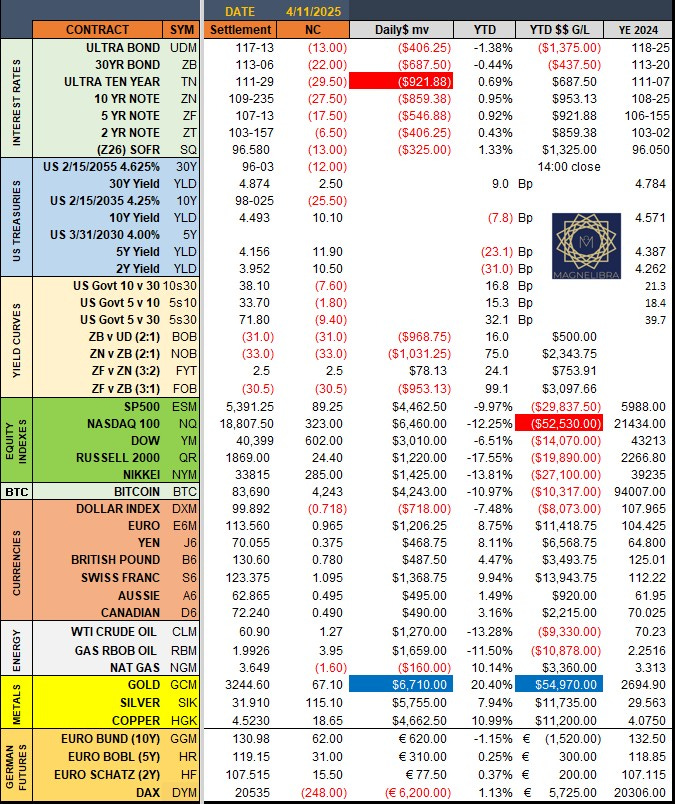

Daily Settlement Sheet- Gold the big winner again and the Dax the big loser:

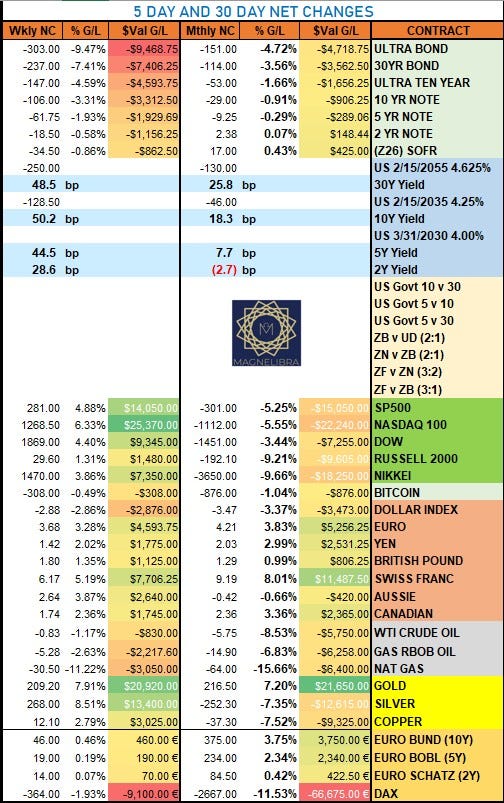

The 5 & 30 Day rolling changes: Suisse Franc and Gold winners and Nat Gas and the DAX the big losers over the last 30 days:

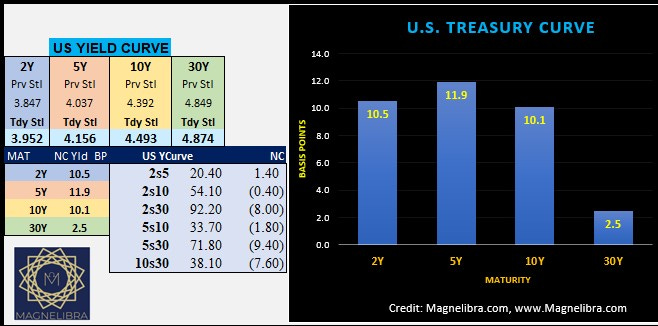

US Yield Curve Snapshot - US yield curve reversed the steepening from Thursday to flatten out Friday:

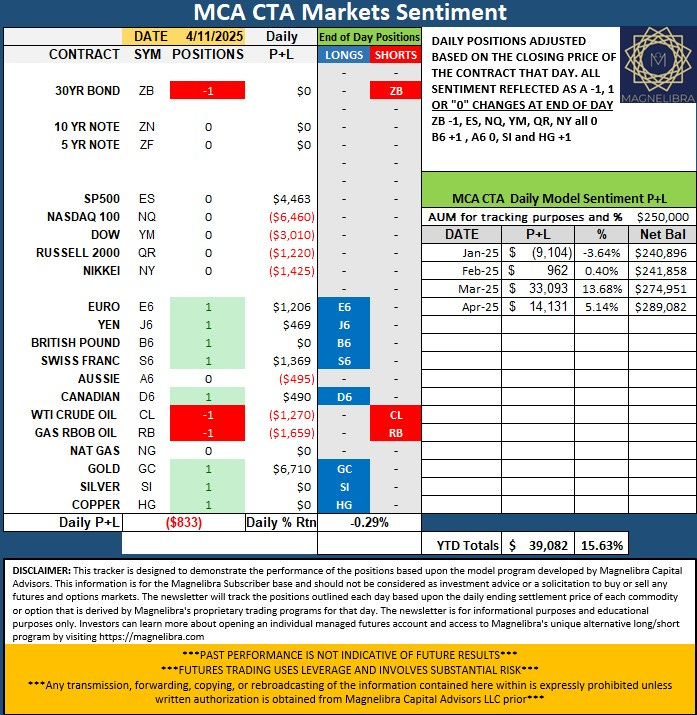

Magnelibra CTA Markets Sentiment Tracker - ZB moves to a short bias all the equities are now neutral 0 as is the Aussie (A6) 0 and B6, SI and HG move to +1 long bias:

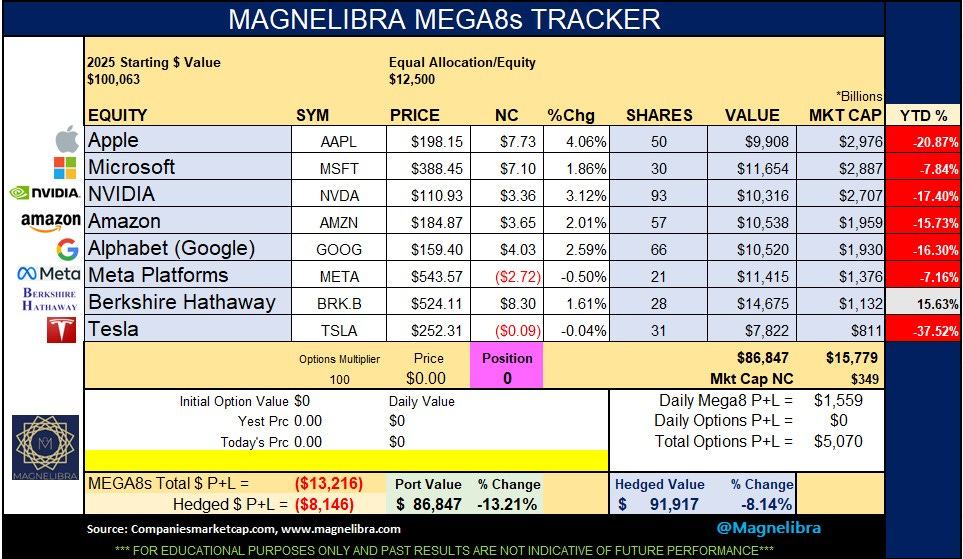

MEGA8s Data - The group gained $349Bn Friday with Apple and Nvidia the big winners, +4.1% and +3.1% respectively. Most likely target our hedge this week with the QQQ Calls above 475 to 480 strikes:

As we have noted the 21pMA is now the magnet for value for this group and the trend is still down but consolidation mode here seems likely as we have discussed:

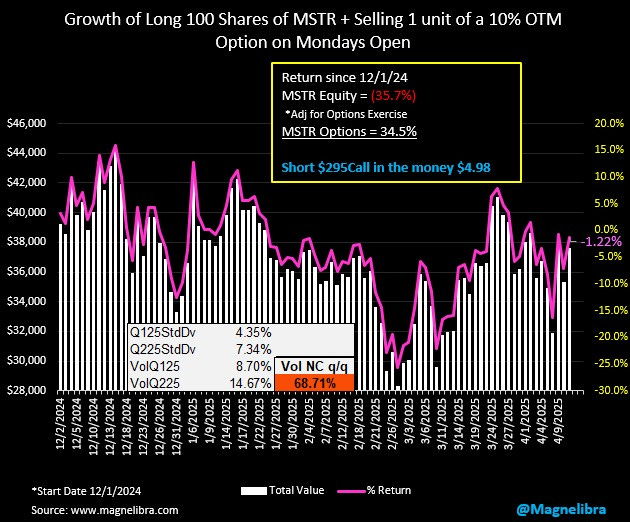

StrategyB (Bitcoin vs MSTR) Covered Call Tracker- Last Friday’s call settled $4.98 in the money and will resell a call on Monday’s open:

Ok let’s go through the charts on TradingView and see what stands out!

Alright guys, keep the positivity elevated and know that you are well informed, you have everything at your fingertips so no need to worry, start moving in the right direction, take hold of the reigns and stack the probabilities of success in your favor, every little step matters, every stumbling block that you over come is a step in the right direction, so stay at it and never give up!

You don’t owe it to anyone else, you owe it to yourself.

If your on the fence just know that by subscribing:

We offer you a mindset that you cannot get anywhere else

We offer you data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes.

You won’t be disappointed! Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Subscribe and be well informed today!

Support directly to our BTC address: 3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp

Share this post