Good morning everyone and Happy Thursday! Welcome to another edition of Magnelibra Trading & Research (MTR). This episode is entitled “PPI Plunges So Much for Tariffs are Inflationary!” Episode 31 of Season 2.

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

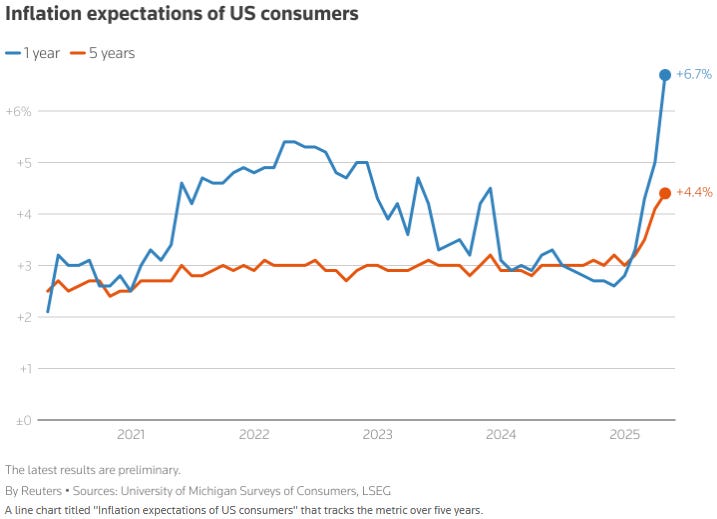

Well we saw this inflation expectations chart last month and with this months CPI and PPI data. PPI fell -0.5% MoM expecting a gain of 0.2% and YoY PPI stands at 2.4%. We believe the consumer is about to make a complete about face here now and expect this Univ. of Michigan survey to begin to roll back down:

Higher interest rates will continue to erode a lot of leverage and this leverage purge leads to discounts in pricing and an absolute lack of producers ability to pass off any higher input costs to the consumer. We know how the general public mind works, heavily focused upon the short term and completely manipulated by main stream media. However no matter what, this doesn’t change reality, individual perception can lead to a collective miscalculation and often presents us traders and investors an excellent opportunity to place asymmetrical bets.

Anyway we figured we would do a video its been awhile and it gives MTR a better chance of actually demonstrating to our viewers how we analyze the data and the charts.

For our free subscribers, you will get a first hand look at the daily trading trackers that our subscribers get. In reality our goal is to give you insight on how a commodity trading advisor looks at an overall market sector, how it tracks the trends (without giving away too much of the sauce) and provides you with an opportunity to use our evaluations within your own investing and trading constructs.

This is why we created this newsletter, we want the general public to gain a wider and more comprehensive understanding not only on how to trade, invest and navigate markets and volatility, but also to understand the drivers behind the markets movements. We focus upon pricing a lot and rely on technical market analysis, but we also fully understand the monetary systems plumbing that ultimately is all the fuel that drives liquidity and funding.

Its a lot and we hope that by reading, listening and incorporating what we do in your own processes that you will become a better student of the markets, and of life in general. We think it is important that you understand that what you do everyday greatly increases your odds of achieving your goals. We hope to assist in your learning process:

We offer you a mindset that you cannot get anywhere else.

We offer you access to our data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes.

You won’t be disappointed! Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

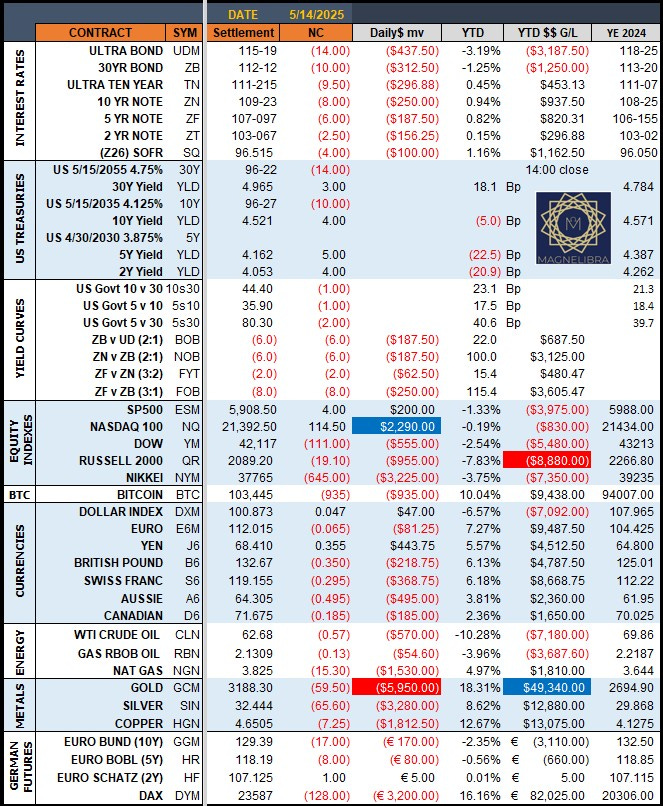

So with all that let’s start off with yesterday’s settlements and all the data that we cover.

Daily Settlement Sheet-

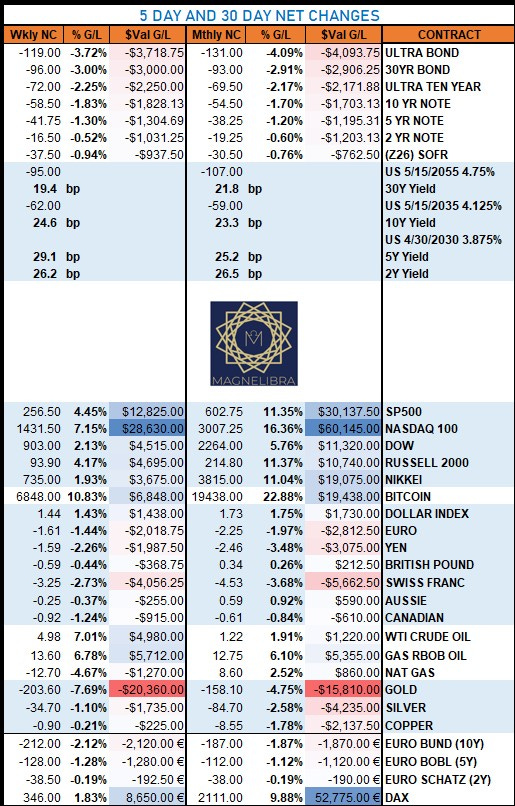

The 5 & 30 Day rolling changes-

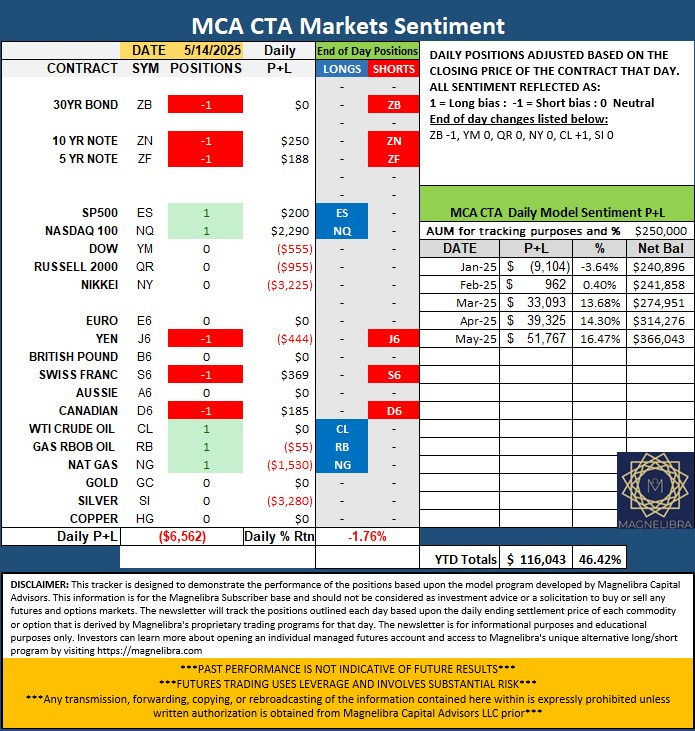

The next subscriber daily trading tracker is our proprietary Magnelibra Futures market sentiment indicator. This model is based off of our proprietary trend indicators and it assigns a “1,0,-1,” indicator for each individual market where a “1” is a long bias, a “0” is Neutral bias and a “-1” is a short bias. We cover individual markets but for sake of the overall trend we look at all the components that make up the total market segment, i.e. Interest Rates, Equities, FX, Energy, Metals. We have also assigned a profit and loss based upon these indicators which reflects being long or short 1 single futures contract to start each day or zero or no position for a neutral status.

Magnelibra CTA Futures Markets Sentiment- As far as at the close yesterday, the following changes are added to today’s markets, the ZB is -1, the YM, QR, NY & SI all move to a 0 Neutral and CL is +1. This tracker tracks both the daily Profit and Loss and the monthly as indicated on the right side of the graphic. Obviously this is all for educational purposes and it merely is for demonstration as to what you could expect from a basket of futures markets in regards to overall dollar risks involved from using single contracts. Futures are highly leveraged and offer an investor a much more high risk, high reward opportunity and we look to define the overall risks and encapsulate that for you in graphics like this:

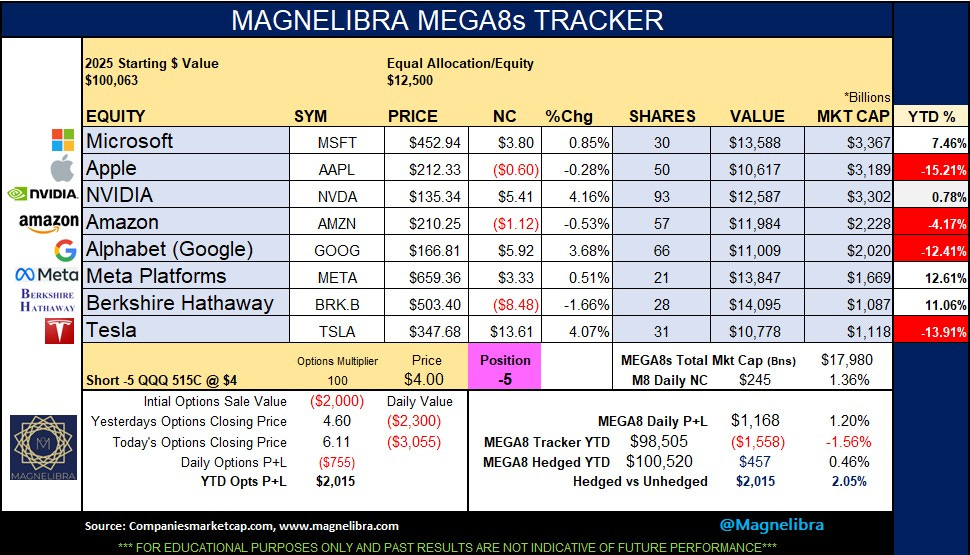

In addition to our CTA model sentiment, we have an equity based investment graphic that we call the MEGA8s. This consists of the 8 largest equities based off of their total market cap. We actually cover the top 9 but we only show the top 8. We know the AI investing world is very binary and it operates on a +1/-1, invest or sell algorithm. Given that its easy to see how and why investment capital can get highly concentrated, because if a stock is going up, it will attract more capital, if it is going down, vice versa, it will be continually sold off till a rebalancing takes place. With that in May of 2023 we created this data graphic. We know a lot of investors are “long only” and operate with a strict long term long bias.

With this in mind, we added a “hedged” opportunity for our subscribers so that if they are following a long only investment theme like this, that there are ways to hedge these types of long only strategies. In general we keep it very simple, opting to usually sell the QQQ ETF call for the week. We believe this is a good proxy for this MEGA8 and we share our analysis in this graphic and present the strike price and dollar amount that we believe would offer a decent hedge for this type of basket. Obviously every investor is different, but this tracker is designed to provoke you to think outside the box, to realize that you don’t need to get too exotic with your investments in order to maximize your gains and minimize your losses!

MEGA8s Data Tracker - The group added $245Bn in market cap or 1.36% and this weeks hedge is the QQQ 515C at $4 and this tracker is short 5 units of that weekly strike which expires on Friday. Tesla continues their big run and now half of the group is back to positive on the year! You can see that we keep track of both the outright MEGA8s and our hedged profit and loss YTD:

Here is the MEGA8s total market cap chart now above the 200pMA of the total market cap settling around $18Tn, just an epic run off the lows. You can also see the Long Term Bull Slope that we have now and this is the expected target now as long as we stay above the 200pMA:

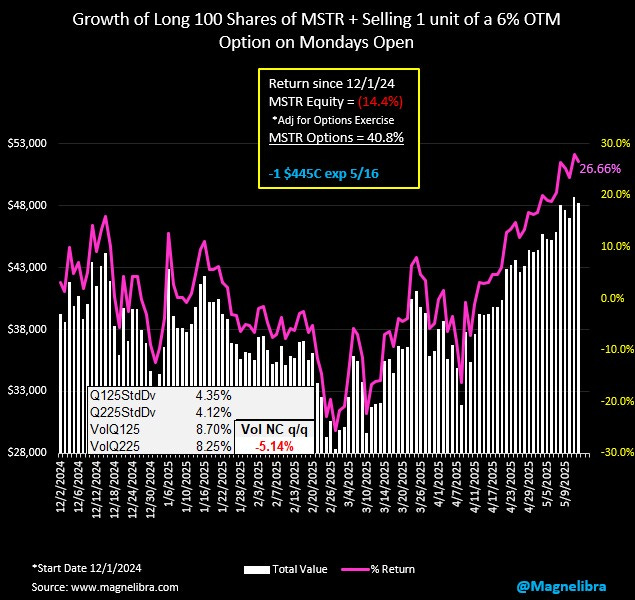

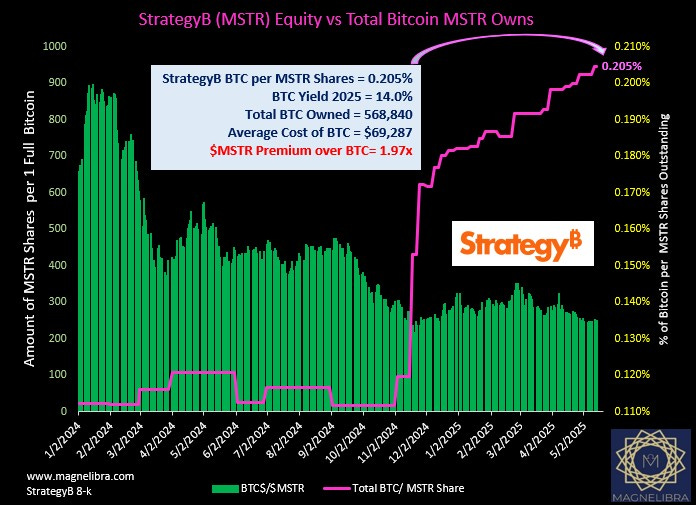

Our next trading tracker that we cover relates to the Bitcoin Treasury company known as StrategyB or formerly MicroStrategy. Long time MTR readers know we have been involved with and have covered Bitcoin since its inception. We are firm believers in decentralized P2P technology as the future and once StrategyB went down this path of converting debt and equity into Bitcoin, well we couldn’t help but think this is going to be a fun one to watch. So we created the trading tracker that simulates what owning 100 shares of MSTR and selling a weekly OTM (out of the money) call option might return. This is a fascinating story, one that will either become the poster child of asymmetry investing or a Harvard Business Review case study for all future MBAs to learn from! Yes we know not everyone has $50k to toss at this kind of strategy and that is ok, we do this so that everyone can understand the mechanics behind the scenes and look at how a lot of larger investors are selling the volatility in this stock to reap the rewards of this kind of strategy that the company is employing.

StrategyB (Bitcoin vs MSTR) Covered Call Tracker- This weeks short call is the $445 strike. We also want to note the continued plunge in overall volatility now down 5.14% QoQ. The call selling strategy is +26.7% over the last 6 months however given the decreasing vol here if BTC doesn’t continue to run up in a steady fashion, we would expect this equity to lose steam:

MSTR premium over outright Bitcoin to 1.97x and their average BTC acquisition price rises to $69,287. We expect the premium to continue to decrease from 2.0 down to 1.5x. Their BTC yield thus far is 14.0% for 2025 right below their target 15%:

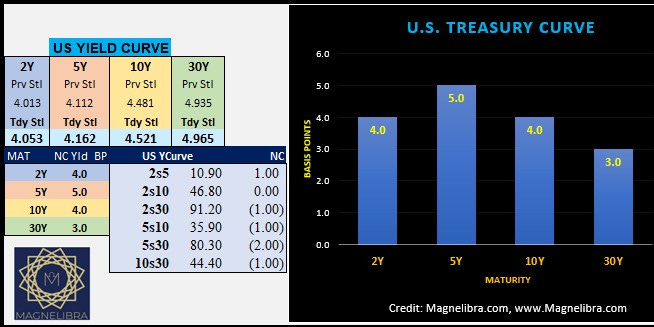

We also like to keep an eye on the US bond market and everyday we track this via the U.S. yield curve. The yield curve is a good visual representation of the bond market capital structure in regards to the future shape of the overall yield curve. In general a positive sloping yield curve is a normal curve, meaning the longer the duration or maturity the higher the interest rate. There are times when the curve is steeper and there are time where the curve is flatter. Both have their own nuances and dynamics and you will learn these terms if you stay the course with us. Right now the U.S. Bond market is caught somewhat as interest rates are staying elevated based off of recent historical lows, but in the larger time frames, many would consider a 4.50% 10yr yield quite low historically, so its all general perspective. However these rates do play a major role in financing costs for both our government and consumers as these rates dictate finance charge rates across the board. We expect this battle to continue between the administration and the Federal Reserve who are in charge of managing the interest rate levels in this country.

As far as the yield curve yesterday it was more of a parallel shift across the spectrum as the bond market continues to see higher yields:

Thank you for supporting our work! Also if you aren’t a paying subscriber and you like what you see, please think about signing on, or at the minimum, share our work!

That is it for now, we appreciate all of your support and stay positive and know that you are well informed. The world is there for you to maximize your interests and expand your horizons and if you are lucky enough to be able to share it with someone, you are then truly blessed!

Start moving in the right direction, take hold of the reigns and stack the probabilities of success in your favor, every little step matters, every stumbling block over come matters.

You don’t owe it to anyone else, you owe it to yourself.

Support directly to our BTC address: 3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp

Share this post