Hey good morning everyone Happy Tuesday and welcome to another edition of Magnelibra Trading & Research (MTR). This episode is entitled “The ¥en is Everyone's Problem Now” Episode 30 of Season 2.

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

We wanted to touch a bit upon the ongoing Yen and the carry trade dilemma that seems to be causing the markets so much strife at this point in time. There are a lot of various dynamics at play and trust us, given the sheer size of the global fiat system now, it is impossible to ignore. In fact this has always been the global central banks monetarist regime problem, the more you deny organic economic dynamics of pure supply and demand, the more you distort the reality for everyone else. Ultimately what ends up happening is that the numbers grow so large due to years and years of bailing out fictitious nominal gains, that you end up with perpetually propped up financial markets. You entice everyone in by continued asset price nominal inflation but at the very real cost of real inflation to the average consumer. Now this game can go on decade after decade, but ultimately the future catches up with you and the present becomes a very real economic and financial nightmare, for both the retail labor and consumer base, but at the commercial and central banking level as well.

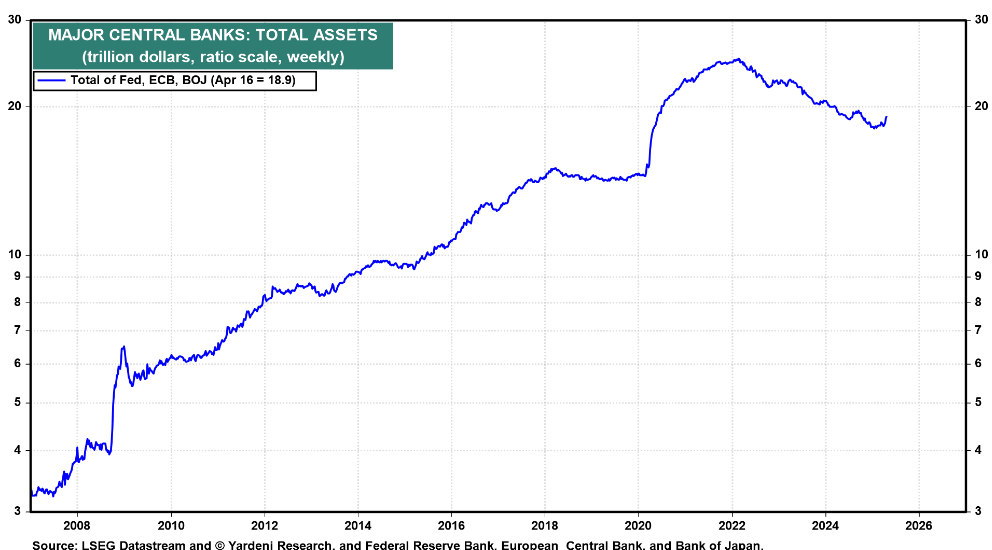

This is where we are at today, evidence of this are these large FX moves that we are seeing right now and in a globally interconnected financial system, by which everyone is now tied systemically to one another, this volatility can wreak havoc very very quickly. Basically what Magnelibra is trying to say now, is that you can no longer hide this charade of print to prosperity, that the money is becoming increasingly more worthless to the average consumer, they see it in their lack of affordability for their basic needs. For decades central banks have distorted asset prices to the point now that the only way they continue to rise, is if the central banks themselves grow their asset base and you guys know that our very own Federal Reserve (FOMC) has done so at a rate of 9.8% annualized for the last 30 years, kinda strange for an entity that wants to say it targets 2% inflation.

Anyway its not only the FOMC but every single global central bank has done the same thing, yes since 2020 they haven’t grown they retreated, but this is what you can do when you print double digit trillions all at once and spread it out through the economies, it BUYS you a FEW YEARS! Fast forward to 2025 and you can see we are back on our way up and those trillions didn’t last long to support things!

The big question now is, who is really better off because of all this printing, well we know that 1% control 50% of all assets or basically 10% control 90% of all assets but where does that leave the other 90% who control virtually zero assets in a financially incentivized world?

Ok let’s move on to the Yen story now, we can see that this year alone the Yen is +13%:

This is indeed very problematic and is most likely the result of the reversing of the Yen carry trade. We feel this is going to continue and that the Yen is about to put a whole world of hurt on this group that has reaped this virtually risk free arbitrage for so long. In fact when you look at the Yen, short term its hitting resistance here, but longer term, well see for yourself, they Yen is down 50% from the 2011 highs and we are basing out here:

There are many key dynamics at work here in regards to this Yen carry trade:

Yen Strengthening from Margin Calls:

Funds short the Yen (via carry trades) face losses as USD/JPY falls, triggering margin calls.

Forced to cover shorts by buying back Yen, further strengthening JPY.

Liquidity Crunch & Treasury Selloff:

To meet margin requirements, funds liquidate assets (e.g., US Treasuries), pushing yields higher and tightening global liquidity.

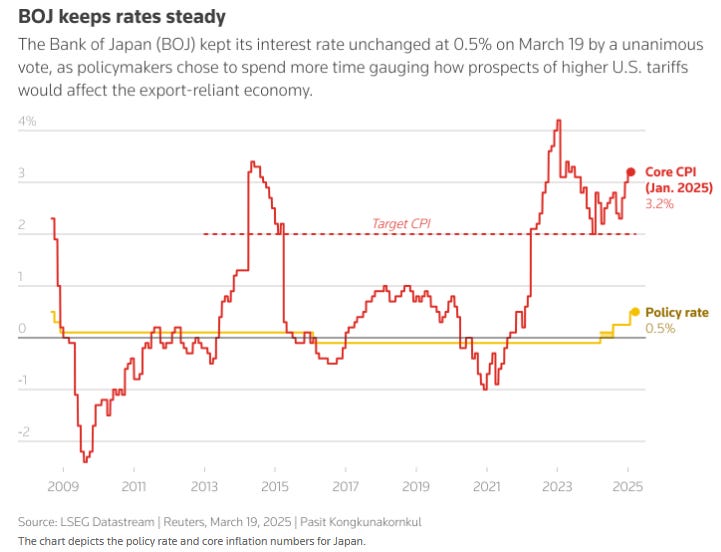

BOJ’s Dilemma:

The Bank of Japan (BOJ) prefers a weaker Yen to support exports and inflation, but tightening by other central banks (Fed, ECB) limits their ability to intervene effectively.

Who gets hurt?

Carry Traders: Hedge funds & investment banks face massive losses on short-Yen positions.

Japanese Exporters: A stronger Yen erodes competitiveness (Toyota, Sony, etc.).

Global Markets: Treasury selloffs raise borrowing costs, destabilizing risk assets (stocks, EM debt).

Why Yen Keeps Strengthening (For Now):

Market forces (unwinding carry trades) overpower BOJ’s weak-Yen policy.

If BOJ intervenes (selling Yen), it’s temporary unless Fed pivots to rate cuts.

The Yen’s strength reflects a violent unwind of leveraged positions, hurting speculators and Japan’s economy. The BOJ is trapped unless global monetary policy eases.

So who does this hurt ultimately you ask? Well let’s assume the Yen rises 20% and stays there, and let’s take a look at a company like Toyota:

1. Export Competitiveness Decline

Toyota prices its cars abroad (e.g., US) in USD.

If USD/JPY falls from 150 → 120 (20% Yen strength), a $30,000 Camry that previously earned ¥4.5M now only converts to ¥3.6M—a 20% revenue drop per car in JPY terms.

To maintain margins, Toyota must either:

Raise USD prices (losing market share to Hyundai, Ford, etc.), or

Absorb lower Yen profits (hurting earnings).

2. US Dollar Revenue Translation Loss

Toyota earns ~40% of revenue in North America (USD).

When USD weakens vs. JPY, those USD earnings buy fewer Yen when repatriated.

Using Toyota as an example and their most recent data as a baseline.

Baseline Exchange Rate (2024 Avg.): ~¥145/USD (for simplicity, using Toyota’s reported sensitivity).

2025 Yen Surge: 20% appreciation → USD/JPY falls to 120.

¥ Move: ¥145 → ¥120 (a ¥25 strengthening).

Toyota’s FX Sensitivity:

+¥50B operating profit per ¥1 weakening (USD/JPY ↑) → Implies -¥50B per ¥1 strengthening (USD/JPY ↓).

Estimated FX Loss:

¥25 move (145→120) × ¥50B/¥1 = ¥1.25T ($10.4B) operating profit hit.

Who Else Gets Hurt?

Japanese automakers (Honda, Nissan) – Same FX pressures.

Electronics giants (Sony, Panasonic) – Overseas sales become less profitable.

Japanese stocks (Nikkei 225) – Lower earnings → Lower equity prices.

The BOJ’s Problem

A strong Yen crushes corporate profits, worsening Japan’s economic stagnation.

But if the BOJ intervenes (selling Yen to weaken it), they risk:

Accelerating Treasury selloffs (if US yields spike further).

Inflation backlash (a weaker Yen raises import costs for energy/food).

Bottom Line

A 20% Yen surge is a double whammy—lower export revenue + USD earnings shrinkage. This is why Toyota and other exporters hate a strong Yen and lobby the BOJ to act.

What is the BOJ to do then??? This becomes the ultimate tight rope! There are no good options on this front!

Strong Yen: Saves debt dynamics but kills growth (stagflation risk).

Weak Yen: Boosts growth but risks debt spiral if yields spike.

Intervention? Temporary unless Fed cuts rates (Yen is a Fed proxy).

The BOJ hates a strong Yen because it kills exports, profits, and inflation—the three things Japan needs to grow out of its debt.

So who is ultimately at risk here?

Japanese Banks: Hold massive JGB portfolios; rising yields = huge mark-to-market losses.

BOJ Itself: Owns 50% of JGBs; higher yields = balance sheet chaos.

Pension Funds: Face solvency risks if bonds lose value.

Will the BOJ have to intervene and cap rates once again? Will see for now they continue to raise the policy rate and most likely will continue to have to do so until the FOMC decides to start lowering them!

Let’s be clear—this isn’t just a BOJ problem anymore. This is a full-blown stress test for the entire global financial system and the reckless money-printing experiment of the last two decades. JGB yields are exploding despite a stronger Yen—defying all traditional logic—because the world is now trapped in a feedback loop of rising rates, debt addiction, and policy desperation. Japan’s debt monster is just the first domino. If the BOJ loses control, the shockwaves won’t stop in Tokyo. They’ll rip through FX markets, blow up carry trades, and force every central bank to choose between financial stability and inflation. This is bigger than most realize—and the stakes couldn’t be higher.

Ok let’s go through the charts on TradingView and see what stands out!

Ok that is it for now, we have all the MTR Subscriber data and trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system.

We offer you a mindset that you cannot get anywhere else

We offer you data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes.

You won’t be disappointed! Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Listen to this episode with a 7-day free trial

Subscribe to Magnelibra Trading & Research to listen to this post and get 7 days of free access to the full post archives.