Hello Traders and Investors I hope you are having a great weekend and thank you for joining me for another edition of the Magnelibra Markets Podcast, I’m your host Mike Agne and today’s episode #38 is entitled “RRP Drain Continues to Support The FOMO Trade”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

Thank you guys for staying with us here and as we posted in our note last week, we have undertaken an assignment that takes a lot of our resources up and we will continue to try and balance our work load and deliverables the best we can. The last thing we want to do for our listeners and readers is deliver crap content, plain vanilla analysis, everything we do here comes from the heart, comes from years of market experience and we hope you understand. We figured the title of our last post FOMO was appropriate enough to drive home the point that the global equity markets are under the FOMO takes all and there really is nothing more to be said about that.

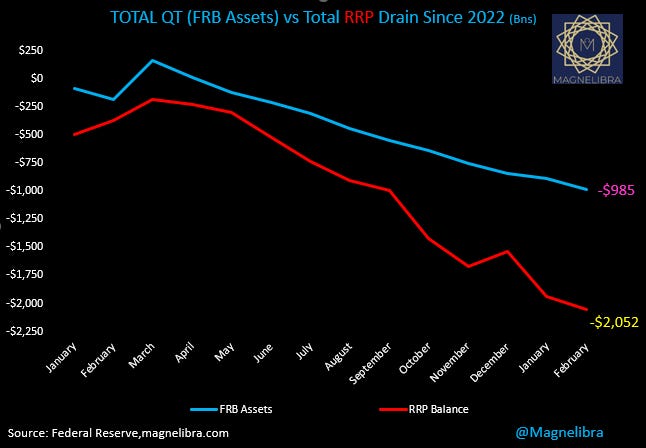

We know that the drivers are still the same AI Mania, Bitcoin ETF Mania and at the heart of it all is an absolute deluge of billions coming out of the Reverse Repo Market and finding its way into risk assets. As we have highlighted before, until this RRP is drained, the markets will exhibit a full on onslaught of risk on pure love and happiness. Here is the latest picture of our data showing total QT of the Feds Balance sheet being offset by total RRP Drain:

We know you guys can research these programs and find all the background information on what the RRP is and so we won’t waste time here. All you really need to know is the Federal Reserves reduction of its balance sheet has been offset by over $1.07T. That is $1.07T in excess liquidity to leverage and ramp up. So when we say interest rates don’t matter, well to the cash cows they don’t change their ability to leverage up, in fact higher rates for them is inflationary, because for all intents and purposes, it leads to both higher nominal asset price growth and higher net free interest pick up. We know this is counterintuitive to many, but these are not traditional organic financial markets, these are highly leveraged, highly financialized debt structures that allow for the massive dislocation and orchestra of the wealth to be acutely centralized to just a very small portion of the population.

We have said it time and time again, the equity markets are not a function or information distribution of the well being of our economy, they are the bank accounts for the top 5%, the very same group that can circumvent and bypass any financial market cycle by sheer economies of scale, in this case hoarded monetary scale.

So don’t be fooled into thinking this FOMO and euphoria cannot run further, it can and most certainly will. Also don’t be foolish enough to not expect an eventual massive reversion, that too will come one day, it always does. For now its mania time and the ETF Crypto land is now the new poster child of mania as this chart shows:

So be mindful of the chaos in our markets as people stumble over themselves to ride the wave. We have a lot of data this week and Monday is light but it picks up the rest of the week, but honestly the data doesn’t matter anymore. The market has proven that the money is still plentiful, so our only data we need now is to wait to see the RRP at zero and see how markets react.

One thing we have noticed is that the US Bond markets seem to have stabilized and we pointed out that 4.41/45% level in the US Govt 30Y last week and for now the markets are consolidating and yields are moving lower. Here is the 30Y:

So now we have yields once again moving down and the US yields are sitting right in the middle of their range:

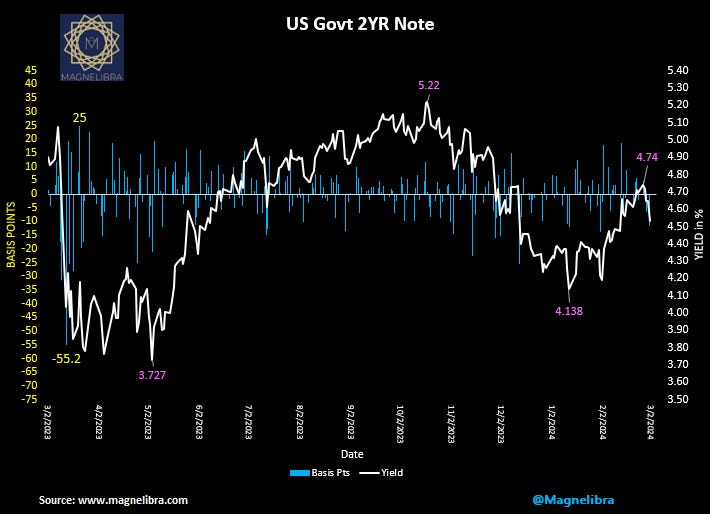

Friday saw a decent steepening trade led by the US 2Y dropping 11.6bp on the day:

What does the 2Y have as the catalyst for this fall this time? We aren’t sure but this is positive for the US bond market here in the short term:

Ok so you know our key now its the RRP, we will keep a close eye on that but for now, there is still some $440Bn or so that needs to be withdrawn till its at zero!

Ok let’s get onto the settlements from last week:

There are a few changes to the model futures tracker which had an abysmal Feb. but hopefully will regain some respect here in March:

When we look at the MEGA8s on Thursday the options hedge was working out well, then Friday came! We will continue to post hedges as we see fit and we know in the end we will be rewarded and will be able to demonstrate the value of that type of strategy. One thing it is exposing is that it seems some very large players are exiting Apple and Google, we know they have already discounted Tesla quite a bit. This is a change and it means that these stocks are being sold for something else, maybe AVGO? Whoever it is the makeup of the MEGA8s is sure to change as we see the affinity for a few names has waned:

The visual for the equities being sold in this group is obvious in this chart:

As far as a few technical charts, let’s look at Apple which is now below $181 once again:

Here is Nvidia, which is still quite bullish, but a weekly close below $816 would flip this chart to the downside for us:

As far as the futures markets let’s look at the Nasdaq what a bull run since 2023, 17775 is our new baseline support:

The SP500 is right at our absolute midline of our bullish parallel channel and 5000 is now the base line support here:

Finally the Ten Year Yields chart we like the 4.337% level which has held for now and this is quite bullish for yields to continue lower from here:

Ok that is it for now, thank you for staying with us. Do not try to be a hero in these markets and fade these moves. The markets are in irrational exuberance mode and there is nothing that will change that for now, it just has to run it course. We also wanted to introduce you to a new YouTube Channel we are watching, we highlighted this guys work before but he keeps bringing a fresh perspective on our past. Take a look at his content and see what you think. This is not related to any market information rather it has to do with our past and uncovering the truth.

Anyway here is the link, we think you will find it enlightening! My Lunch Break

We love this kind of stuff its so fascinating, too intriguing not to share. Till next time, please leave a like, share and definitely if you can, subscribe!

Share this post