Hey everyone welcome to another edition of Magnelibra Trading & Research (MTR). This episode is entitled “Quick Technical Look” Episode 29 of Season 2.

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

Ok let’s go through the charts on TradingView and see what stands out!

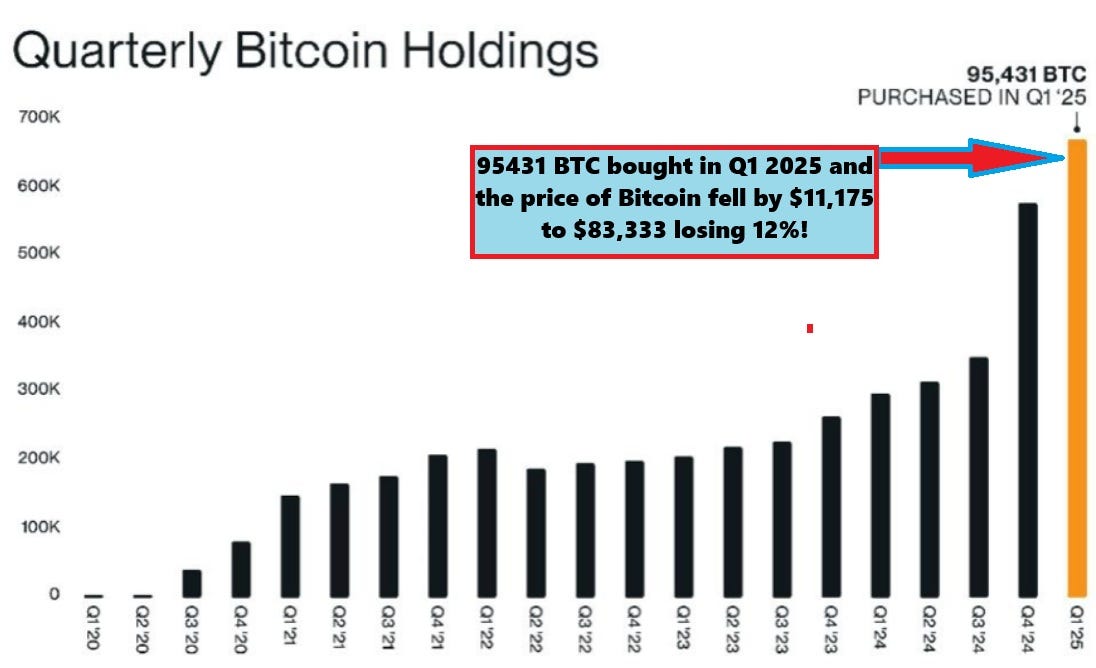

Wanted to share this Bitcoin chart data here in the show notes, we saw on X a lot of promotion for Q1 buying in BTC, well, we know there was a lot of buying, but we also know that the BTC price fell over Q1 as well, so what does that say about supply and demand???

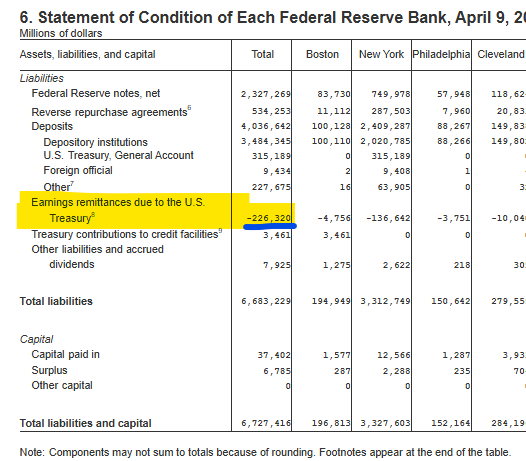

Also we wanted to show the FOMC deferred Asset number:

Alright guys, keep the positivity elevated and know that you are well informed, you have everything at your fingertips so no need to worry, start moving in the right direction, take hold of the reigns and stack the probabilities of success in your favor, every little step matters, every stumbling block that you over come is a step in the right direction, so stay at it and never give up!

You don’t owe it to anyone else, you owe it to yourself.

If your on the fence just know that by subscribing:

We offer you a mindset that you cannot get anywhere else

We offer you data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes.

You won’t be disappointed! Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Subscribe and be well informed today!

Support directly to our BTC address: 3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp

Share this post