Thank you guys for joining me and welcome to Episode 17 of Season 2 brought to you by Magnelibra Trading & Research (MTR). This episode is entitled “Nvidia Record Revenue, Kind of a Dud”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

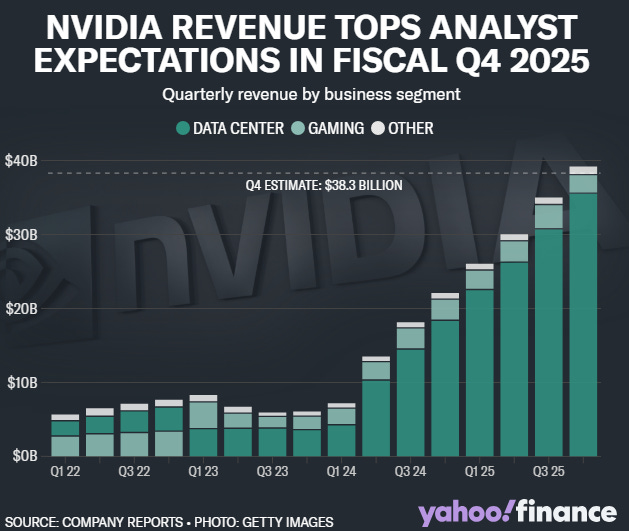

Nvidia reported record revenues, here is the data per Nvidia:

Record quarterly revenue of $39.3 billion, up 12% from Q3 and up 78% from a year ago

Record quarterly Data Center revenue of $35.6 billion, up 16% from Q3 and up 93% from a year ago

Record full-year revenue of $130.5 billion, up 114%

When we look at this chart we get a better idea of the 4x plus ramp in its Revenue YoY. The big question is can the company continue to deliver, with a 71% margin, we can only imagine time is going to work against them as competition will ultimately eat away at that figure. For now Nvidia seems to still be the darling of Wall Street, but ultimately much like all the other high flyers of late, profit taking will have to come sooner or later. Better valuations always lie ahead much like they did back during all the prior ramp up periods, 2000, 2008 etc.

For now the markets seem to be taking the Nvidia news in stride, Nvidia itself is -2.72% out of the gate:

We suspect the market makers would like to see this more towards $125 area than $130 but let’s just see how this one filters out. As we suspected in our options analysis yesterday, we really didn’t see much that stood out. There was so much interest on upside plays that today’s market pricing isn’t much of a surprise.

Ok what else do we have going on we saw a minor spike up in initial jobless claims coming in at 242k exp. 225k and Durable goods 3.1% expecting 2.0%. Tomorrow will deliver some key inflation data with the PCE and Core PCE Index prints, we feel the market will be closely watching these which hit at 8:30am EST.

Ok let’s take a look at the settles and rolling changes from yesterday, the US Bond market continues to see good positive flows, equities were fairly mixed, same for FX, energy was weak across the board and metals bounced from Wednesdays profit taking. Bitcoin was once again battered:

As far as the rolling changes Bitcoin -18.7% over the last 30 days with Nat Gas the continued outperformer +27.8%:

As far as Bitcoin, you guys know how we feel about it up here, we have showed our chart for quite sometime and being that we have followed Bitcoin since inception, we hope you trust our judgment. We are long time advocates of decentralized immutable ledger based systems and Bitcoin will always be the standalone OG.

However once Wall Street got involved, we feel Bitcoin devolved here as Wall Street created products designed to leverage and manipulate the fiat pricing of this instrument. For those that don’t understand, basically large firms are using Bitcoin as a speculative trading vehicle to manipulate the price up and down. What we noticed since the ETFs started gaining a foot hold was that despite the billions in fresh buying over the last 3 months, the price of Bitcoin went nowhere. This is an obvious tell that large players were using this liquidity to exit positions and perhaps to take up synthetic short positions as well. The same thing was occurring in the Nasdaq index and the MEGA8s for that matter. Anyway as far as Bitcoin, it would not shock us to see this thing continue to pressure down into and maybe below $70k before things stabilize, even then ultimately we believe the 200wkMA beckons:

We also know that StrategyB and MARA continue to hold massive amounts of BTC, something that we think increases their volatility and viability for that matter, but we get the all in premise and standing behind what you believe in, we just think they could be a bit more strategic in their accumulation strategy!

Here is the StrategyB covered call selling data:

Moving over the the US Bond market, yesterday continued the bond bid as yields dropped across the duration spectrum and its interesting to note that the 2s5 is still right at zero near inversion again, what will the FOMC do?

Things in yield curve land are shaping up like the curves may flatten a bit which will force the FOMC to think about cutting rates sooner than later as the bond market front runs the impending economic slowdown once again. Evidence of this is shown in the yield curves below, where we see the 2 Year sector vs the 5Y, 10Y and 30 Year losing ground. This is indicative of the downward slope that is depicted over the last month:

We don’t think people realize the significance of the recent developments in regards to Trump’s new Gold Card immigration visa policy. We applaud this policy as a tool for rectifying a lot of the imbalances that the U.S. has, in particular how this will set the stage not only for capital flows, but for the sheer reduction of our US debt pile and the absolute bullish case for the US Dollar and America in general.

The EB5 program is already doing this but at a much less revenue stream. Also, we know that many will abhor such a pay to play model but the fact of the matter is, many other countries already do this, so its not something profound. For us, we can only imagine the success of this program, but many will have a problem with it, but ultimately we can imagine 1m of these will generate $5 Trillion dollars and then think of all the budget cuts on top of this! We can already see the writing on the wall, no wonder the bonds are going up and yields are falling! If you think the US dollar has been strong, wait till this program gets rolling!

Ok onto the MCA CTA Markets Sentiment. You will notice that the SP500 moved to a +1 this in the face of all the other equities being -1. This is a proprietary input from our program and it doesn’t change the overall negative bias for the Equities in general as you can see 4 of the 5 components are -1. The Suisse moved to +1 as well:

As far as the MEGA8s data the hedge for this week is on as the QQQ523C which traded above $3.00 intraday yesterday:

Here is the overall market cap chart of the grouping basically at the same level it was back on July 10th 2024 which topped this grouping out the last time:

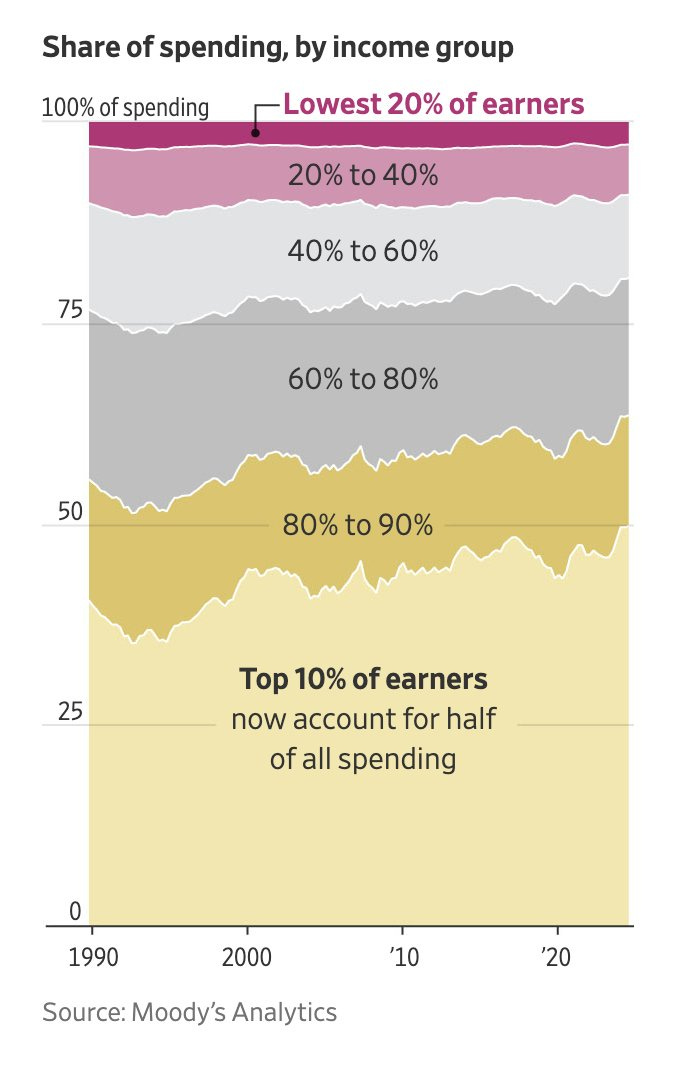

Ok finally we are going to leave you with a couple of data graphics highlighting the share of income. The first chart highlights that the top 10% of all earners now account for 50% of all total spending:

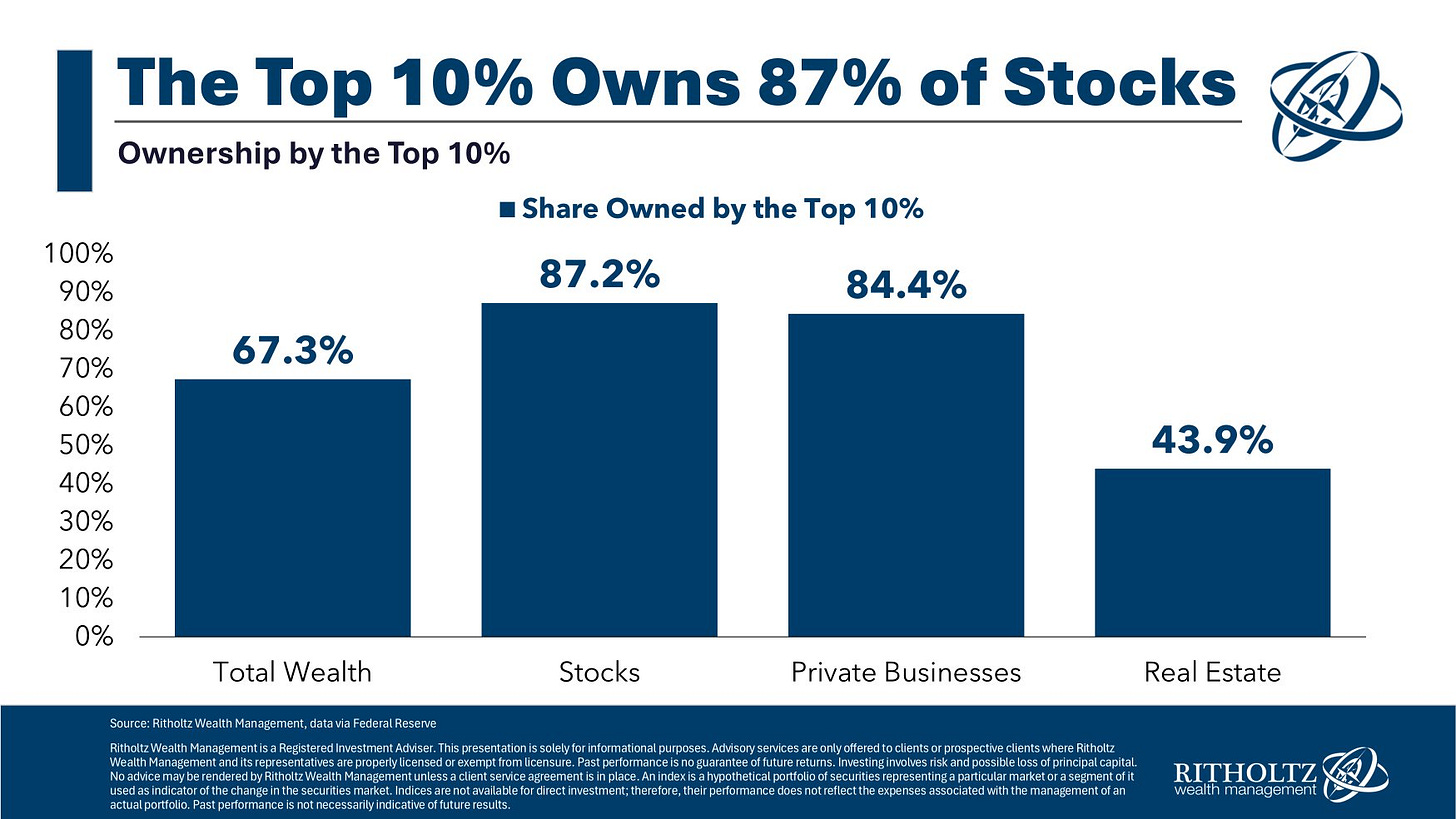

The next chart and one that is more meaningful we believe highlights that the top 10% own 87% of all the equities and 67.3% of all the total wealth. This really shouldn’t be a surprise, as we have noted time and time again that inflation benefits the top 10% and devalues the average labor utility of everyone else. The reasons for this are just purely basic economics in fact. If you think about it, and if you break things down to their simplest form, the basic premise is the more you have, the less concerned you are about prices. It is no wonder the FOMC targets nominal asset prices, these charts make it obvious, keeping equities, real estate and all risk assets in a perpetual rising price environment is the actual intent, inflation is just the byproduct of that monetary policy:

Ok that is it guys, we hope you received our message well today! Please everyone if you can hit that subscribe button, share our work or at least give it a like. We are giving you a mindset that over time will greatly enhance your understanding of not only financial markets, but life itself. Thank you for giving us your time today, have a great day, change someone’s life, be kind, do something out of your comfort zone and realize, that no matter what, your attitude shapes your reality so always try to look at the positive side of things. Even if you feel the opposite way, just tell yourself, good, I am glad this happened to me, start saying that, start looking at everything is good. I can guarantee you, your mindset will start to see everything differently, Till next time, cheers!

Support directly to our BTC address: 3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp

Share this post