Thank you guys for joining me and welcome to Episode 15 of Season 2 brought to you by Magnelibra Trading & Research (MTR). This episode is entitled “Norinchukin Bank Implosion Contagion?”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

Most of you never heard of this bank before and hell if you are online looking Asian business websites, the banks implosion isn’t even front page news. Kudos to the Japanese always trying to keep things positive. For us mortals in the real world we have to pay attention to such things. Anyway, Norinchukin Bank is a cooperative bank that supports Japan's agricultural and fishing industries. It is not a commercial bank in the traditional sense but rather a central bank for cooperatives. Its financial health is closely tied to the performance of these sectors and its investment portfolio. We have to give a shout out to @DarioCpx on X, for keeping up us up to date on this topic.

Here are some of the key developments right now:

Resignation of CEO: Kazuto Oku, 65, will step down as CEO, and Chief Financial Officer Taro Kitabayashi, 54, is expected to succeed him effective April 1, 2025.

Financial Losses: The bank has reported losses of ¥1.4 trillion in the first nine months of the fiscal year, with paper losses on bond holdings totaling ¥1.57 trillion. (approx. $10.1Bn USD)

Challenges Ahead: Kitabayashi will face the challenge of diversifying the bank’s $300 billion investment portfolio and bringing in more outside talent to stabilize the bank's financial position.

Market Impact: The bank's securities portfolio has shrunk from ¥38 trillion to ¥35.6 trillion, with a significant portion of the losses coming from the liquidation of high-quality assets. They will continue to sell around $60Bn plus in securities to stem losses.

Insolvency Concerns: There are growing concerns about the bank's solvency, with some analysts suggesting that the bank may be in need of a bailout to continue operations.

The main thing that my listeners need to take from this is that banks that are holding onto US dollar denominated debt, especially foreign banks are taking on heavy unrealized mark to market losses. They are long or have purchased bonds during the ZIRP era (Zero Interest Rate Program) and assuming their average portfolio rate of interest on their holdings is around 2.5% and now with the US Govt 30 Yr at 4.75%, they are looking at massive unrealized losses of -225bp! (2.5% - 4.75%). We can assume a $DV01 (Dollar Value of 1 Basis Point) is about $1800 per $1m worth of bonds. So if you are a bank and you hold $1Bn worth of these bonds, well( $1800 x $1000) x 225 = $405m in mark to market losses.

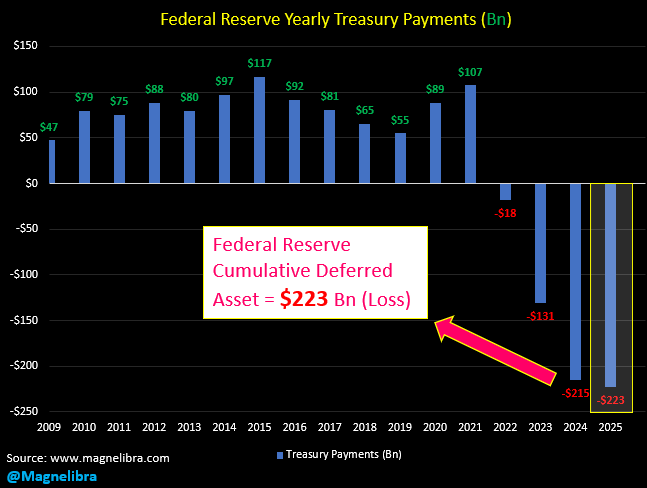

This is the kind of thing that destroys a banks ability to function, it destroys their capital ratios and its why higher rates are truly leverage killers. These average banks can’t do what the Federal Reserve and Central Banks can do, which is simply create “Deferred Assets.” Deferred Assets is a fancy accounting term for “Losses.” See the chart here, this is the Federal Reserves current unrealized losses $223 Billion:

So when banks fail, there is always the risk of others, because if one bank is in this boat, they are essentially all in the same boat. Now others may have hedges and better capital adequacy ratios, but the longer rates stay elevated the more risk of a massive blow up there is. Now stateside we haven’t seen this yet, but we are certain there are a few skeletons in the closet hiding now, whether this turns into something much larger is TBD.

As far as the FOMC minutes yesterday, here are a couple of highlights with our comments:

Concerns over balance sheet reduction and debt ceiling impact. Fed officials indicate that slowing or pausing balance sheet runoff may be appropriate.

Most Fed officials view risks to inflation and employment as roughly balanced. A few Fed officials argue that inflation risks outweigh employment risks in policy decisions.

One, the FOMC is always concerned about cutting their balance sheet, because they know it is the base money multiplier for all nominal risk assets, if they cut too much, leverage has to increase to supplant this contraction, adding risk.

Two, the fact they are still 67% above their 2019 balance sheet level is consistent with their double digit annualized inflation of their balance sheet, leading to higher and higher nominal asset price inflation. If they were concerned about inflation, they would cut their balance sheet faster and return it to pre2020 levels, but they won’t.

We also saw yesterday Trump and Elon talk about a DOG-E and a potential for a refund check to Americans. Well that would be the worst thing they could do, it would cause another transitory spike in inflation. I would rather they give a credit to destroy any type of debt one has up to a certain amount, this way you destroy credit and leverage all at once, non inflationary. Better yet, I wish they would just create the New American Sovereign Wealth Fund and fund it with the savings to start…If the FOMC is going to continue to expand its balance sheet, then the prudent thing to do would be to create a SWF and add equities to it purchased directly by the USGovt or funded via mandated allocations from the top public companies themselves.

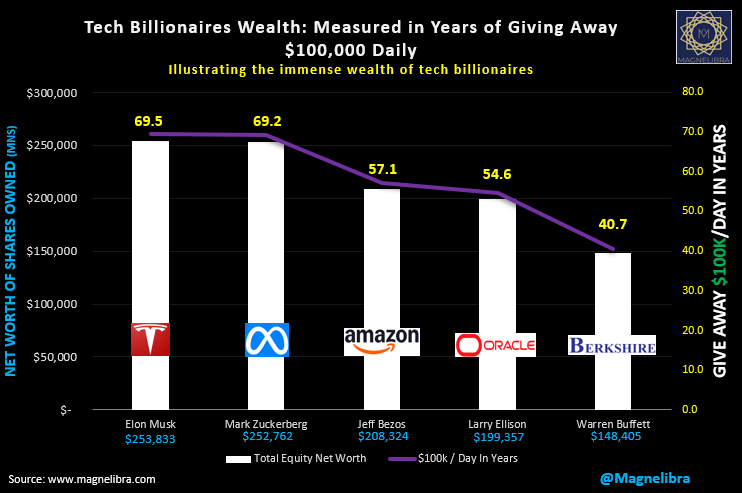

The wealth is so massively concentrated to the very few, its at absurd levels. We have shown this chart before, but we are going to post it again. What it displays is the top 5 tech billionaires and shows just how many days in a row 1% of their wealth could afford to give away $100,000. The Musk and the Zuck are battling it out for the top spot, a massive 69 years plus in a row:

Anyway, we thought our listeners should know what’s going on here and now lets turn and see how this is all affecting the Yen Futures. We like the basing pattern that is in place and the Yen is above 66.47 here and a good sign that bulls continue to add on here absorbing last weeks selling. We would not be short Yen here:

As far as the SP500 its been all sellers out of the gate here and were sure the bank news and Walmart not helping things here. The SP500 futures new line in the sand for the bulls on the daily is 6097. They risk dragging in further mechanical selling below there:

Speaking of Walmart, they are getting pounded today, sales were up 4.1% YoY to $180.6 billion. The company expects next quarter’s revenue to be around $167.2 bn, near estimates and non-GAAP profit of $0.66 per share was above analysts estimates. However forward guidance was a disappointment sending the stock lower -6.6%:

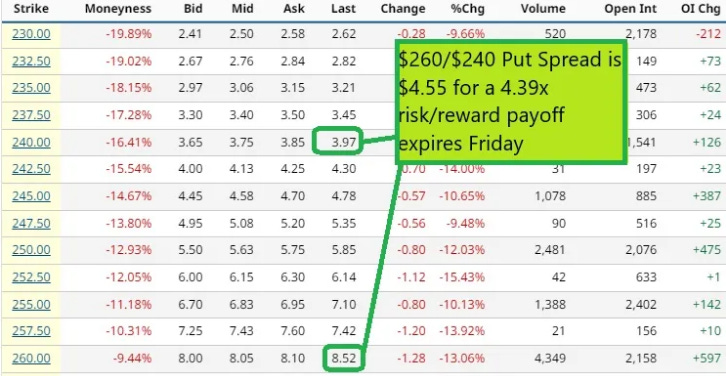

Looking back at yesterday’s free post we touched upon Carvana and a potential for earnings to see selling after wards. We highlighted the $260/240 put spread for about a 4.4x risk/reward payoff. Well Carvana today is -15% trading $239, -$42.50:

The Put Spreads we highlighted yesterday shown here in our post which was valued at $4.55 yesterday is trading $16.20 today, so congrats if you played that yesterday, a settle below $240 by Friday would realize the full value of the spread or $20:

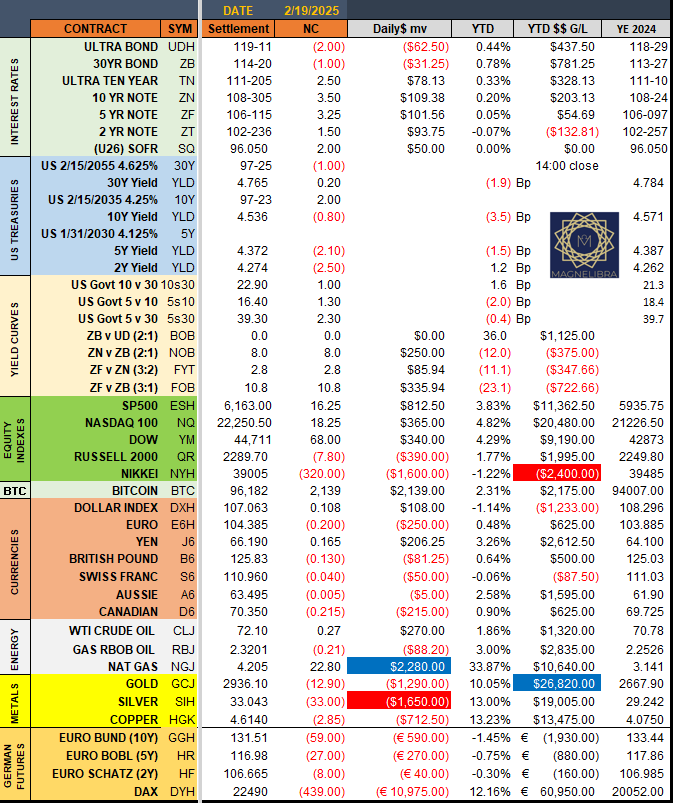

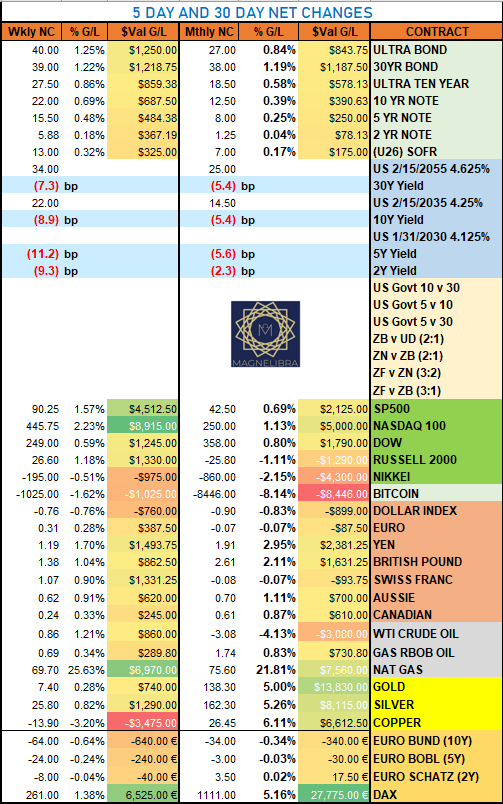

Ok let’s get to yesterdays settlements and rolling changes data:

Nat Gas continues to be the star with the polar vortex continuing to assert itself and Bitcoin continues to be the biggest loser:

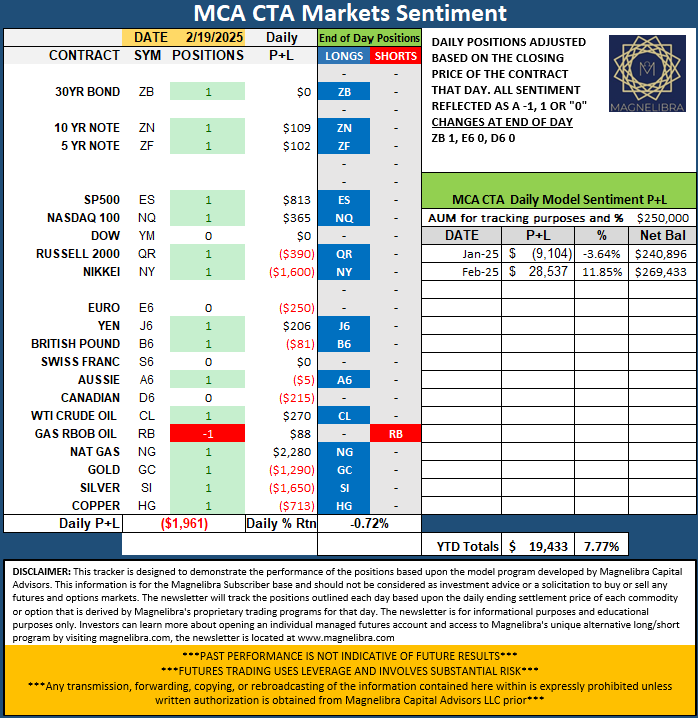

When we look at the Magnelibra CTA Markets Sentiment Tracker we suspect if markets continue on as they are this morning we may start to see some of these move to neutral status at the end of the day:

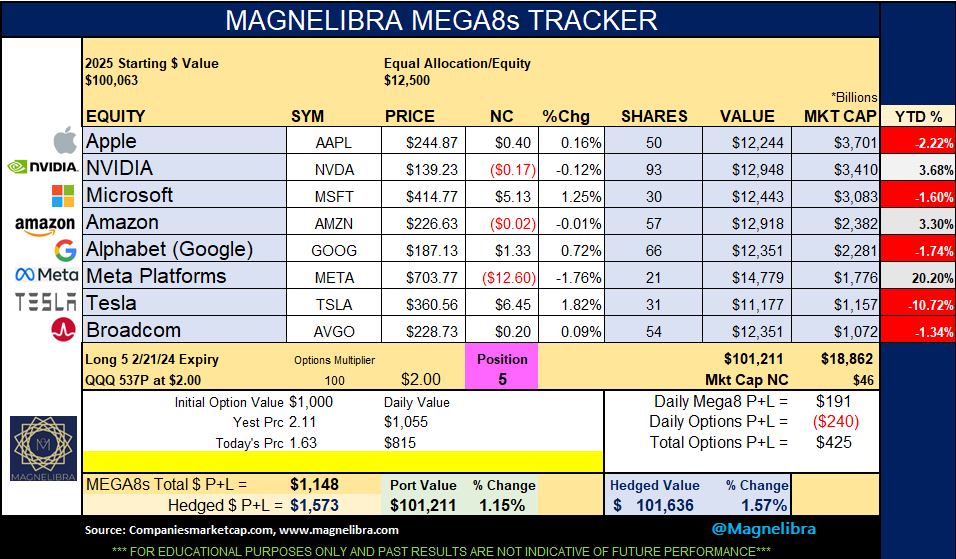

As far as the MEGA8s Tracker, the hedge for this week is the outright put in the QQQs as opposed to a short call. We continue to see the group struggle on the year as a whole. This tells us there is a lot of instuitional selling and or rotation out of this grouping. The systematic selling can be hidden on a daily basis, but cumulatively we can deconstruct it via the performance. Honestly this group sans META has been lackluster for sure:

The market cap chart continues to consolidate around the 50pMA:

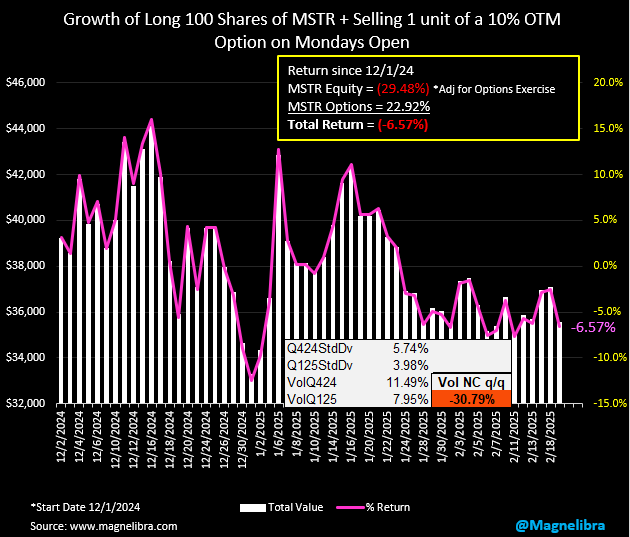

As far as StrategyB (MicroStrategy formerly, symbol MSTR), well the stock was pounded yesterday losing 4.56% on the day. The call selling strategy continues to weaken as Vol QoQ is down 31%:

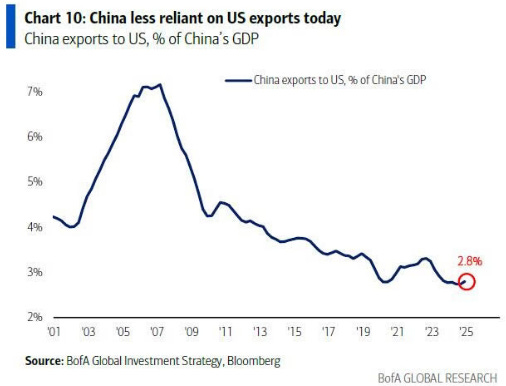

One last chart we wanted to share from EEAGLI was this chart of Chinese exports to the US. Honestly if this data is correct, it kinda caught us off guard, we thought Chinese exports to the US as a % of their GDP was higher, 2.8% seems awfully low. With China’s GDP around $18T US, their exports value is roughly $504Bn with the U.S.

Ok that is all guys, we hope you received our message well today, we hope you hit that subscribe button and we hope you can at least share our work so that others can enjoy the insight that MTR provides. Till next time, cheers!

Support directly to our BTC address: 3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp

Share this post