Thank you for joining us for another edition of the Magnelibra Markets Podcast, I’m your host Mike Agne and today’s episode #11 is entitled “Non Farm Payroll Beats Again but Revisions Paint the Real Picture!”

What a morning thus far and as we warned yesterday, you had to be aware of both numbers, the payroll report and the ISM at 10am Est. First let’s look at the payroll data where the number came in at +216k above the 170k consensus and so much for our call of the under but we know with the revision next month, we will be proven right. So the trend of higher than expected to only be revised down a month later continues.

When we look under the hood of the data we can see the Socialist construct already taking shape as the US govt was the largest employer adding 52k jobs and keeping up with their 2023 avg of 56k per month which was double the 2022 average. Sorry we do not believe the US govt should be the largest addition to jobs each month, that’s not how a Republic is supposed to work.

Another data point, a scary one at that was the fact that in December full time jobs fell by 1.5m, with multiple job holders at record highs, as are part time jobs. So in today’s world 2 jobs =1 and well, that’s not a good thing by any means.

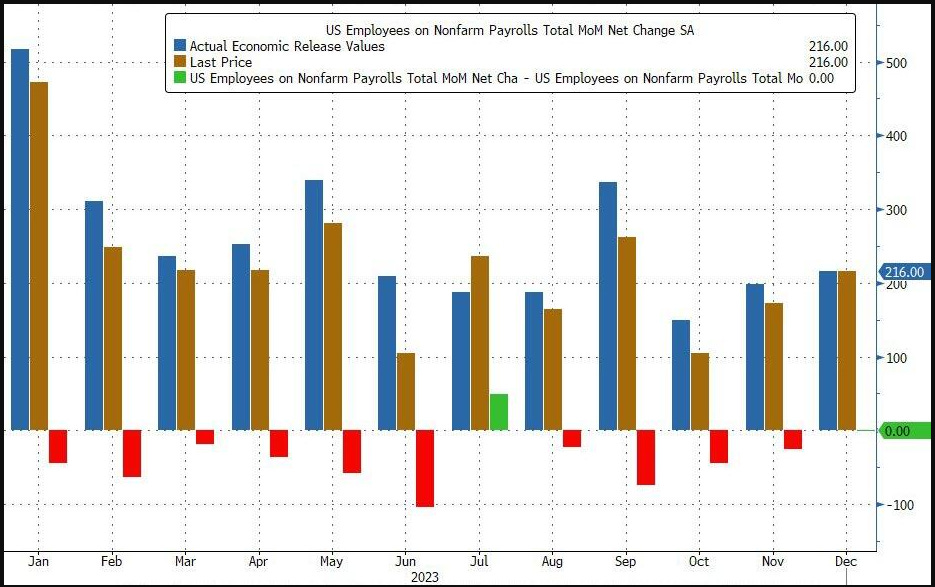

So as we noted prior, we continue to see monthly beats followed by revisions and Zerohedges charts denotes the revisions in Red on their chart with October revised down -45k jobs from +150k to +105k and Novembers data was revised down -26k from +199k to +173k. So you can see the obvious trend here:

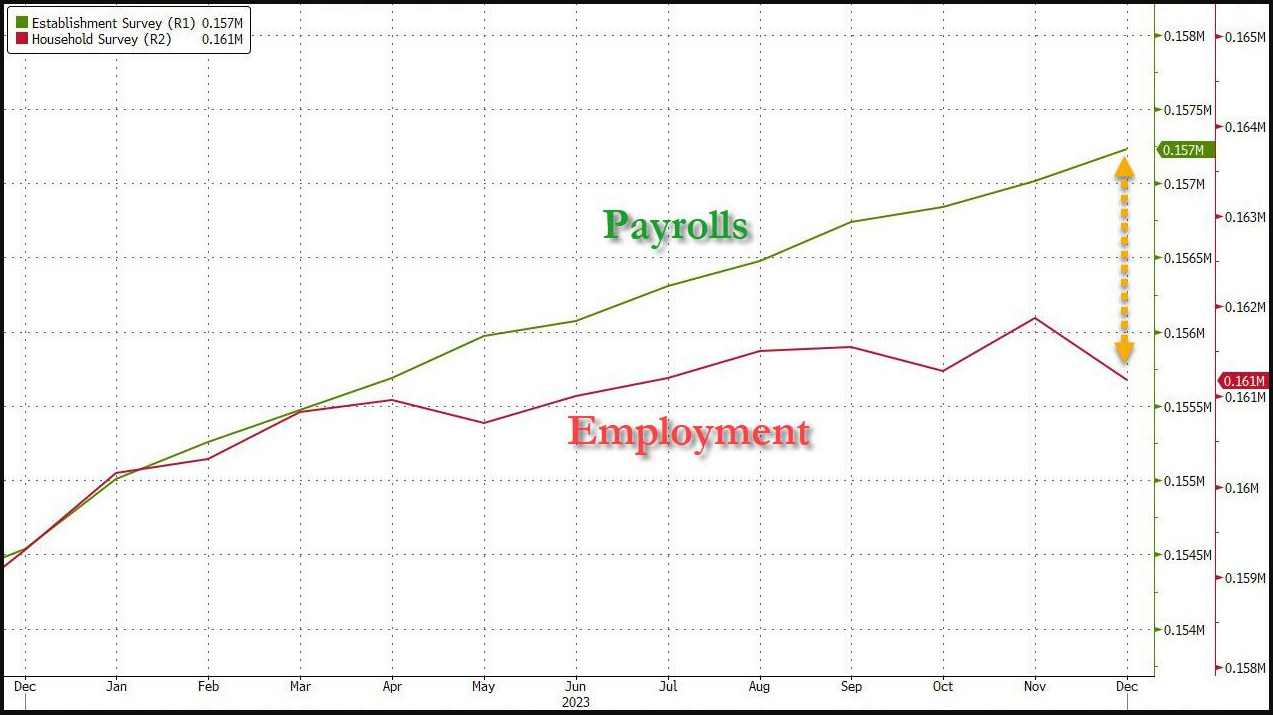

We can also see how the Payroll prints continue to diverge from the Establishment Survey, so how long can the administration keep this smoke and mirrors up:

Look we don’t get into the politics of it all, we don’t care who is in power when it comes to data, it is what it is, yet when it skews reality, we will call it out no matter what party is in place. Anyone with a brain understands what it takes to survive the kind of inflation that we have and obviously it takes many more than one job to do so and that is the reality that cannot be masked!

When labor becomes a burden, then many begin to question the worth of it all and many become dependent upon the state. This is the exact scenario we are seeing play out and in a not so obvious way, but we all know how that goes, gradually then all of a sudden. If the economy is so great then we should have a more equal distribution of opportunity and wealth but that is not the case at all. We have a fat tail dispersion and that is more akin to serfdom. You can see it and its obvious now more than ever and becomes increasingly obvious if you look at major metropolitan areas. The divide between the haves and have nots is widening and its is everyone’s duty to see that this doesn’t get out of hand, because these things have a tendency to crumble just societies.

Ok so let’s take a look at some of the markets reaction off of these numbers. First let’s look at the Ten Year Futures. We can see the NFP downdraft dropping tens down half a point until the algo’s dug under the hood of the data then the market stabilized. Then the ISM number came out posting a 50.6 nearly 2 points lower then expected and the market rallied over half a point and has continued to press the highs all morning:

As far as the equities, lets look at the Nasdaq futures reaction once NFP hit the Nasdaq dropped by about 100 points to the lows at 16334.25 but rallied smartly off that area and continued to rally into the ISM number. The green line on this chart is the top of the trend channel that we follow on the weekly and its now back outside of it, so this is a positive sign. A close this week above 16550 is key so lets see how the day finishes out. Ultimately we would like for the bulls to get it back into the maroon area which would take a move back above 16777, but first things first:

Staying with the Equity theme, Statista put this nice graphic together showcasing the sector contribution to the overall return of the SP500 last year:

We have been hearing whispers that the US big banks will most likely come up with some sort of proprietary stable coin of their own. We aren’t sure of any concrete details on that but we are certain that something flipped for the big banks in the latter half of 2023. We know that the biggest banks keep on getting bigger and apparently there aren’t any real too big too fail worries with this, nor are there any anti trust or total deposit worries, because the data suggests the top 5 are taking down increasingly more and more of the total deposits:

Considering JPM continues to grow let’s take a look at their stock we like this channel it is riding in and we suspect that an attack on the $190/$195 area before seeing sellers:

Ok we will be back later with the settles and trackers, we just wanted to get this post data info out to our subscribers! Till next time, cheers.

Share this post