Welcome to another edition of the Magnelibra Markets Podcast. Today’s title is Negative Carry and Why the FRB or Federal Reserve Board will Cut 300bp Next Year

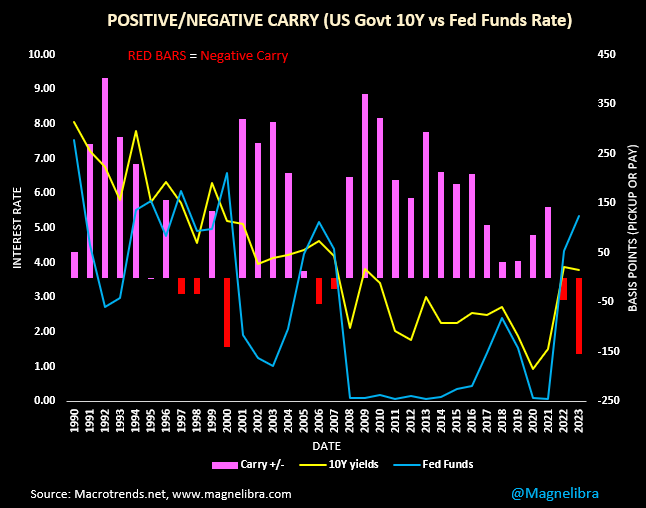

We wanted to share a couple of charts with you in regards to the inversion of the US Govt 10Y and the Federal Funds rate. We feel that in order to look forward to 2024 its best to put a little historical data into context, especially something as important as “Negative Carry!”

Negative carry is a term that Magnelibra uses quite often and in its simplest terms, what it means is that the financing rate for the shortest term or duration is higher than the investment return rate for a longer duration investment. For our point here we can look at duration as a time horizon, with the shortest being the overnight rate all the way out to the longest duration say, the 30Y treasury bond.

So we don’t want to complicate things, all things considering if you borrow $100 to invest in a 10Y govt bond and your yield is 3.80% then borrowing capital at the Federal Funds rate, say 5.25% means you are taking an actual loss of 3.80 - 5.25 = -1.45%

This is what we mean by negative carry and its the environment we have been in the last 2 years. This is what makes QE and ZIRP, quantitative easing and Zero Interest Rate Policies, so formidable. Not long ago you could borrow for 0.25% and buy US govt 10Ys for 2.00% resulting in a 1.75% pick up just for having access to all the QE capital!

So when we are in a regime, like we are in now, a negative carry regime, you can see it quickly erodes those risk free arbitrage games. Furthermore, what it does to institutions that hold these longer duration bonds, when interest rates spike, the current value of those bond holdings drop. So a 2% 10Yr bought at par (100.00) with current yields at 3.80% is now worth 85.00. This is why you see all the staggering HTM or held to maturity losses that banks are holding on their books. HTM losses aren’t really a big deal unless you start to lose your deposit base and have to sell assets at a loss, but this is why the FRB created the BTFP, so banks that need to, can pledge those underwater HTM assets and receive the full par value.

Despite all the work arounds that the FRB and global central banks do and maintain, it doesn’t change the fact that we are closing out our second year in negative carry. Something historically that doesn’t bode well for risk assets once the economy does start to turn south. Long time Magnelibra readers know that we are waiting for the first negative non farm payroll prints to usher in the real recession. Once this occurs we believe risk assets will start to discount the severity of the recession and prices will then readjust accordingly.

Here is the current chart with the latest data of the spread between the US Govt 10Y and the Federal Funds rate:

From this chart we can see historically see that in both prior instances of negative carry scenarios, led to sharp contractions in both the economy and broader risk markets. We saw back to back negative carry years in 1997-1998 and then again in 2000 which led to the market top and meltdown into the 2000-2001 period. The inversion back in 2000 saw the 10s/FF spread widen to -140bp. The next period inversion was a bit shallower -55bp and came in 2006-2007 time frame. We all know what happened next the GFC, the great financial crisis came and saw the markets top out in October of 2007 and proceed to lose 60% (Nasdaq Index) to the lows in November 2008.

So fast forward to today, yes we know the FRB balance sheet expanded from $4T in 2020 to a high of $9 Trillion in May of 2022. So yea $5T goes a long way to solve even the most dire of problems, which is why we continue to have $3T in excess deposits. If the FRB didn’t more than 2x their balance sheet, things would look very different today. This is just the excess needed to combat even a shallow recession in the future, we would expect the next downturn to come with massive rate cuts and for the Federal Reserve to expand their balance sheet well past $9T once again.

So with this negative carry in mind and with the bond markets calling for 150bp in cuts next year, is the bond market wrong or are they underestimating the reality that history has taught us over the last 40 years?

Well we think the base case for the US Govt 10Y next year will be around 2.75% on its lows and probably lower, but we need a base case right? So if we assume that 2.75% is our target, one which we believe is conservative, then this means in order for the Federal Funds rate to reassert a positive spread value we will need a substantial rate cutting regime. We do believe the Federal Reserve will try to slow play this at first, but its rare for them to not acquiesce to the markets on the dovish easy money side. If we assume just a +50bp garden variety positive spread figure then we would be looking at Fed Funds rate of 2.25bp or a massive 300bp in cuts. We have this visual aide showing where this spread would normally be given this scenario:

So given the about face by Powell and Company, we can only assume the data that they see is not looking good and that they will need to act sooner rather than later. I believe they will be well behind the ball here but will opt for 50bp clips as opposed to 25bp cuts. This is our base case for 2024 in regards to the trajectory for rates.

Share this post