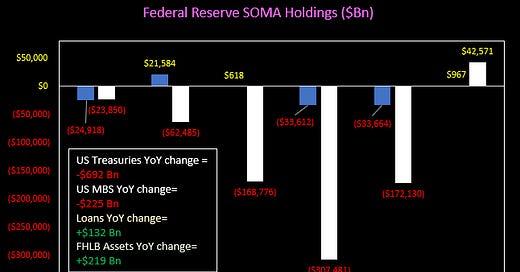

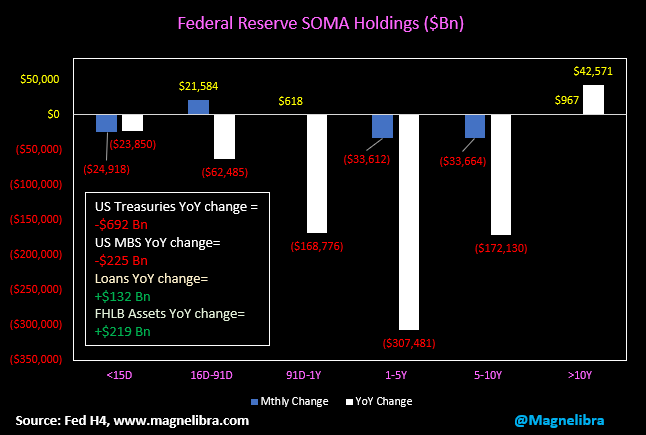

Let’s start things off today with a look at the latest Federal Reserve SOMA data that we track. We know that the Federal Reserve has reduced its record high balance sheet by a net $785Bn, which may seem like quantitative tightening, but they were supposed to reduce it by $95Bn a month, so they are short $355Bn even from their base case.

To add insult to injury the FHLB is offsetting nearly $220Bn of this tightening with their asset increase and if we add interest on reserves and the RRP net risk free interest pick up of $200Bn then its clear that quantitative tightening is nothing more than QT-Lite.

Its all slight of hand accounting and anyone that thinks rates aren't about to fall through the floor are mistaken, QE and ZIRP are the only real tools of choice in the modern day economy. The FOMC can't fool everyone!

We are here to provide the data to prove it. Lowering rates is DEFLATIONARY and that is the path for the future, just like every other decade in the last 40 years. Here is the chart of our SOMA data as of November 30th 2023:

After expanding their balance sheet by $5T in 2 years they can barely muster reducing by a net of $500Bn???

What this tells us is that prices and risk have taken so much from the future of total GDP, that the only supplement to keep things status quo is ever increasing balance sheets and zero interest rate policies. Covid was the cover to bail everything out that was clearly showing signs of failure in late 2018 before PBOC came in with massive liquidity injections.

Now we have a society conditioned to EXPECT ever increasing prices, in Real Estate, in Equities, in Wages, the Goldilocks scenario. Its a great mirage that keeps on giving and we won’t knock it, its worked up until this point, but its also creating massive dislocations in wealth, something that will eventually have to be dealt with, monetarily or politically.

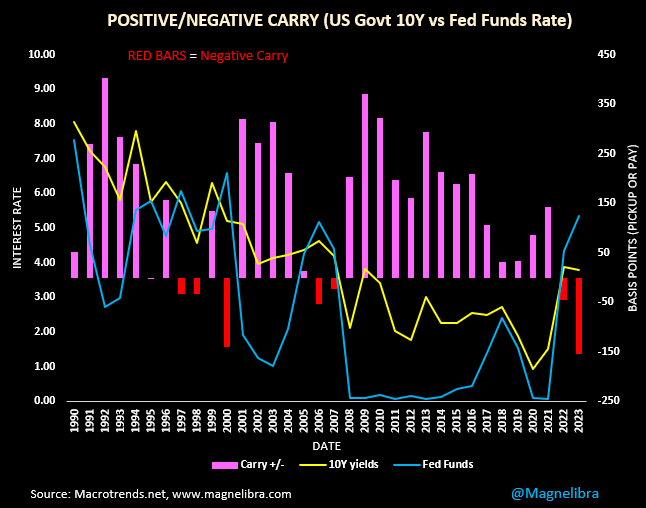

Alright so with QE-Lite out of the way and into the forefront, let’s look at the other chart we put on our Podcast yesterday, and if you haven’t listened to it, please do, and please share it with others. Here is our negative carry chart:

Red bars are an anomaly that clearly standout over the last few decades aren’t they? What will 2024 bring? Well you can listen to our podcast yesterday to find out!

There is one technical chart we want our readers to keep an eye on and that is the Euro/Suisse spread, it continues to collapse. Its hard to believe that this spread was even during the banking crisis earlier this year, now its out over 9 full handles:

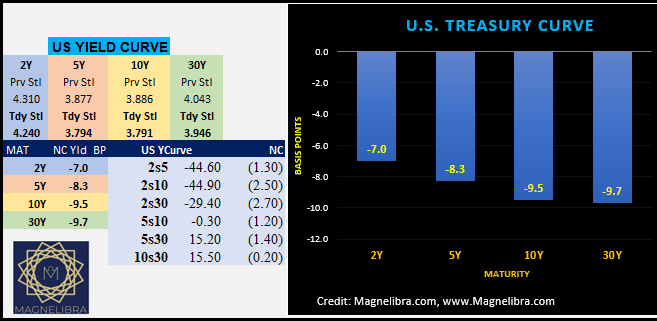

We also continue to see the US bond market continue its bull run as yields continue to fall across the board with the US govt 10Y at 3.791%. The 5Y auction yesterday posted a coupon of 3.75% which is 112.5bp LOWER than the October auction coupon of 4.875%, to say that is unprecedented is an understatement!

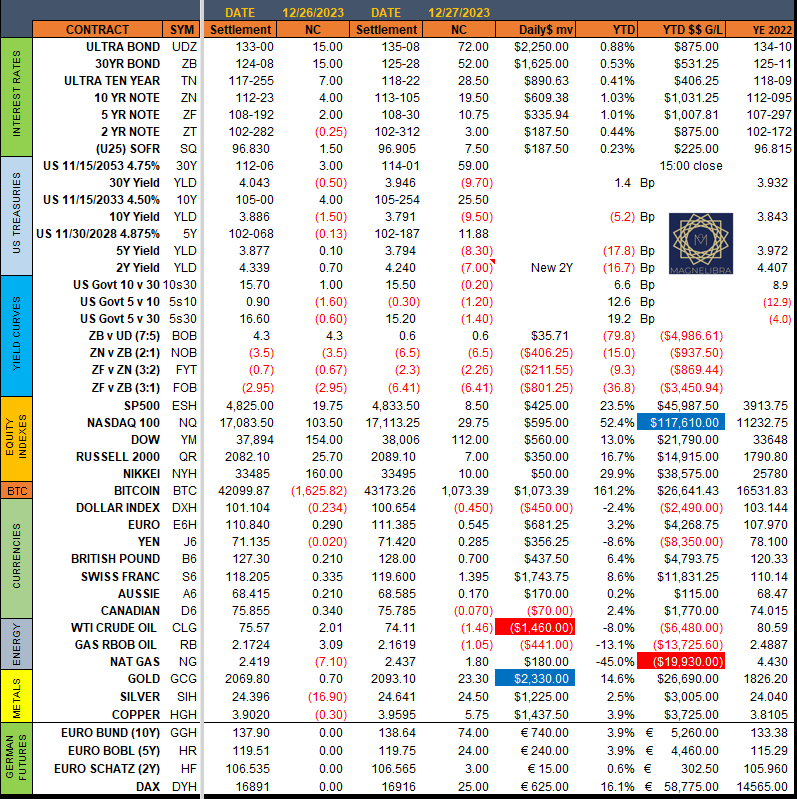

Here are the settlement prices for the markets we cover for this week thus far:

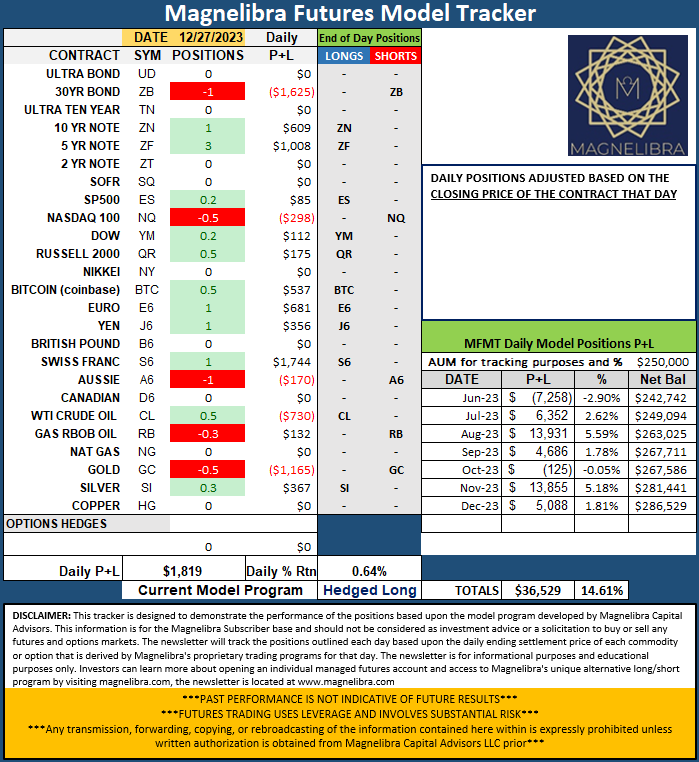

When we look at the Futures Model Tracker we continue with the Hedged Long:

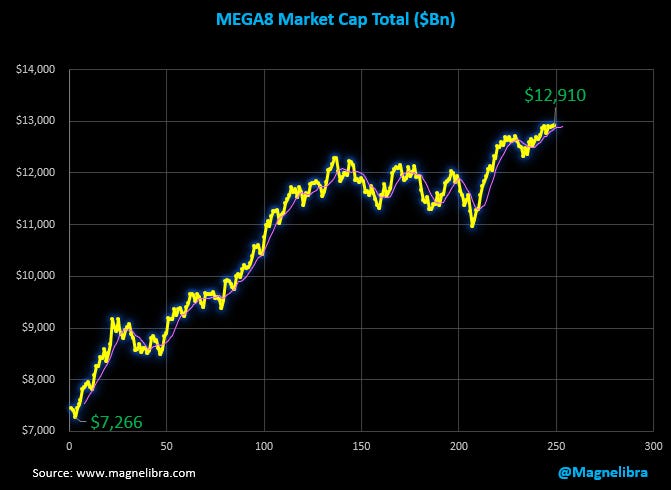

As far as the MEGA8s, they made a new ATH market cap at $12.91 Trillion:

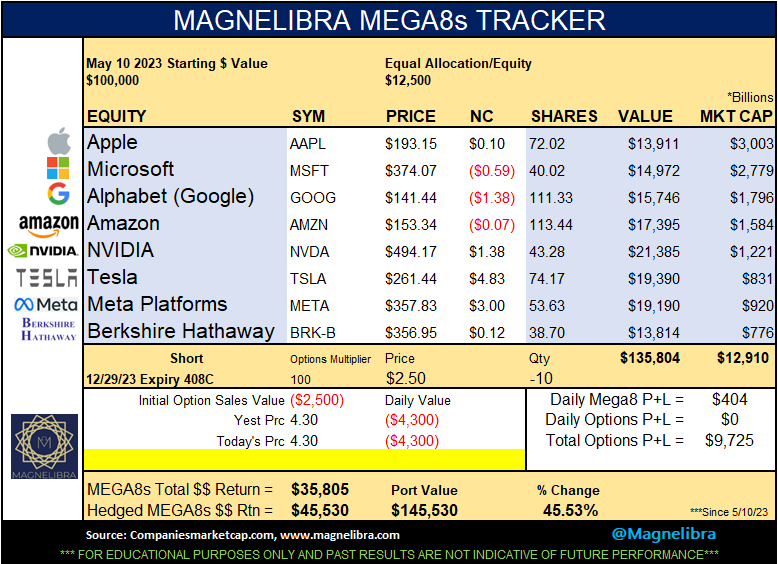

The MEGA8s has seen Tesla make some recent headway against the others with META continuing to lead the way:

Ok that is it for now, thank you for supporting our work, please share it if you can so we can continue to expand our knowledge base to our network and community. We will be posting intermittently here over the next week, so please be patient and we wish you all a very Happy New Year!

Share this post