Hey guys, welcome to another edition of the Magnelibra Markets. Today’s episode #61 is entitled “Bond Auctions Well Bid & Home Inventory Rising”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

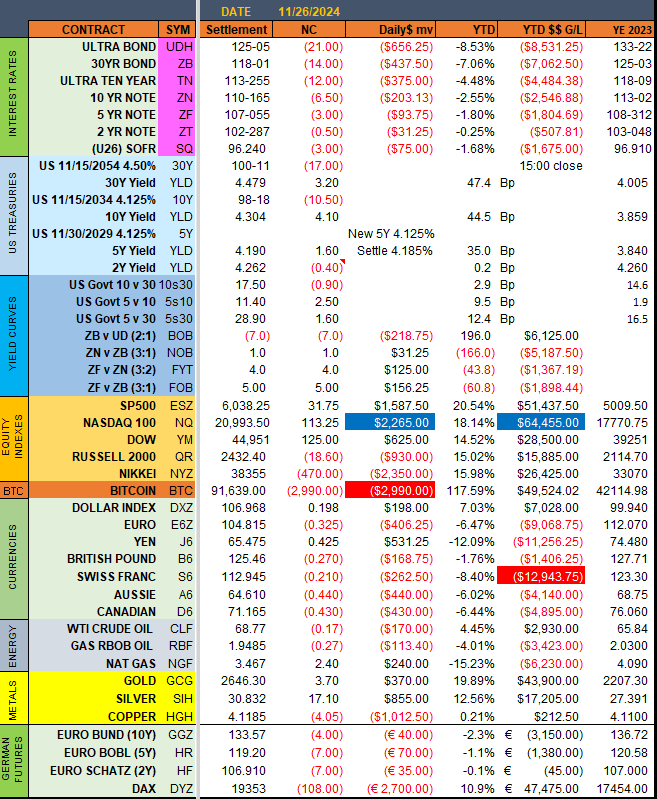

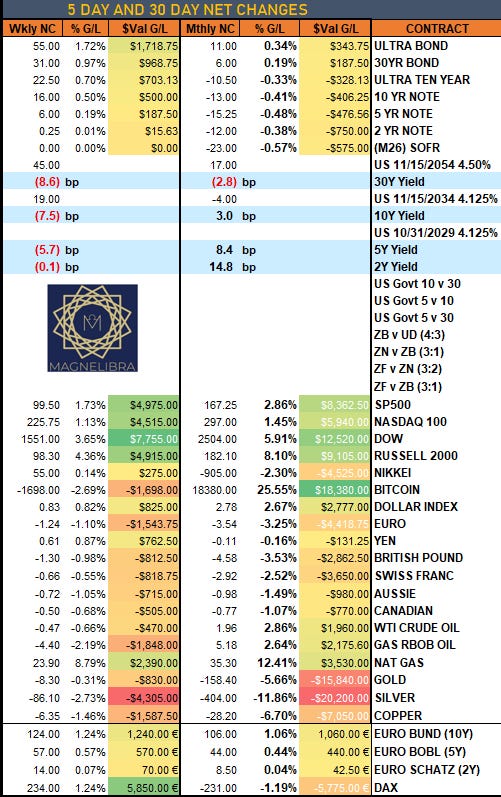

Hey everyone today will be a quick one, we just wanted to touch on the US bond market real quick where for the 3rd auction in a row we have a stop-thru, meaning the auction was well bid and auction yields (high yields) were lower than the WI (when issued) yields at auction time. This shows that the market demand was greater than expected and for us maybe the turn in the US bond market for lower yields has commenced.

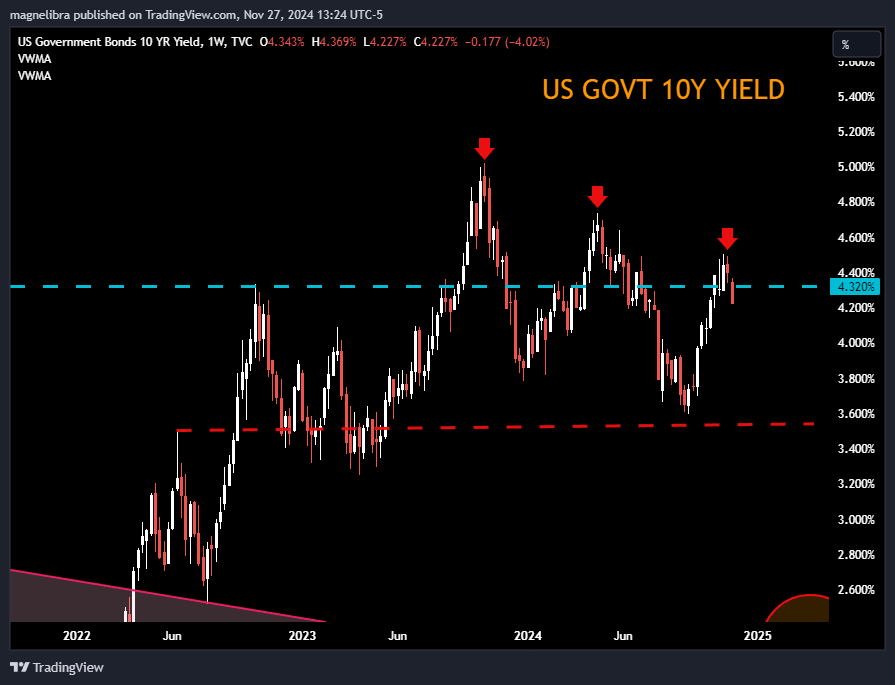

Right now the US bond market is taking it all in stride as yields are dropping across the board with the bonds now dropping -7.4bp, Tens -8.1bp and the 5yr leading the way -9.1bp on the day:

The US Govt 10YR yield chart has rolled over and is poised to close below our weekly pivot of 4.32%:

This mornings GDP print was as expected and headline PCE rose 0.2% MoM with YoY at 2.3%, we don’t expect this to be a big deal, nor do we expect it to affect the FOMC in December. We truly feel that the underlying fundamentals still point to a very big slow down coming in Q1 2025. Evidence of this in one area that we can tell is the uptick in continuing unemployment claims. 1.907m Americans are counted as continuing jobless claims, the highest in 3 years:

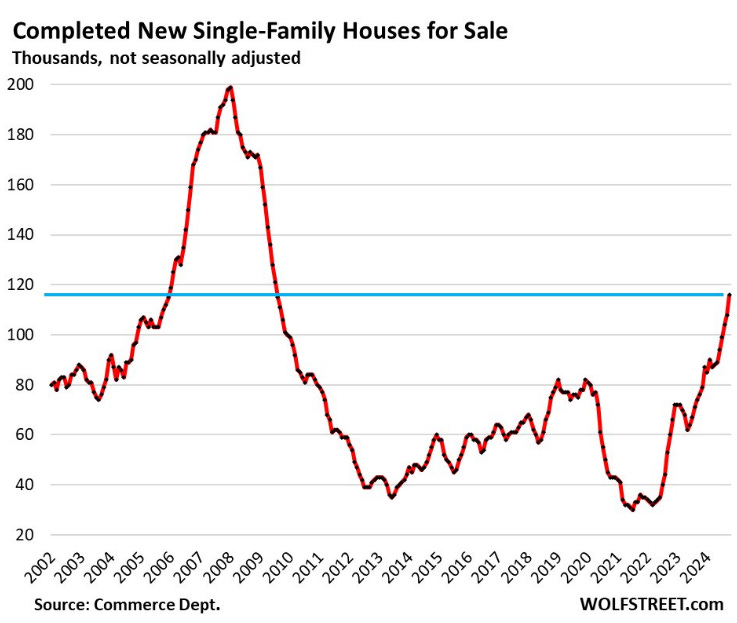

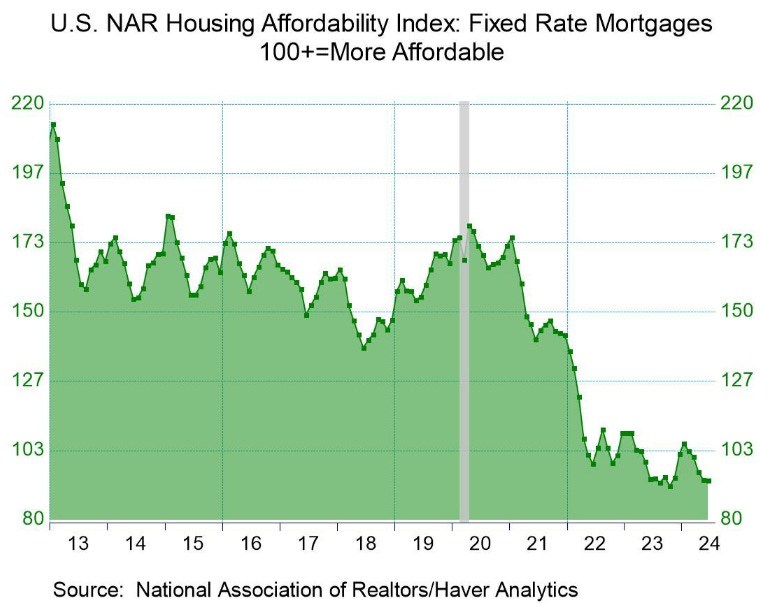

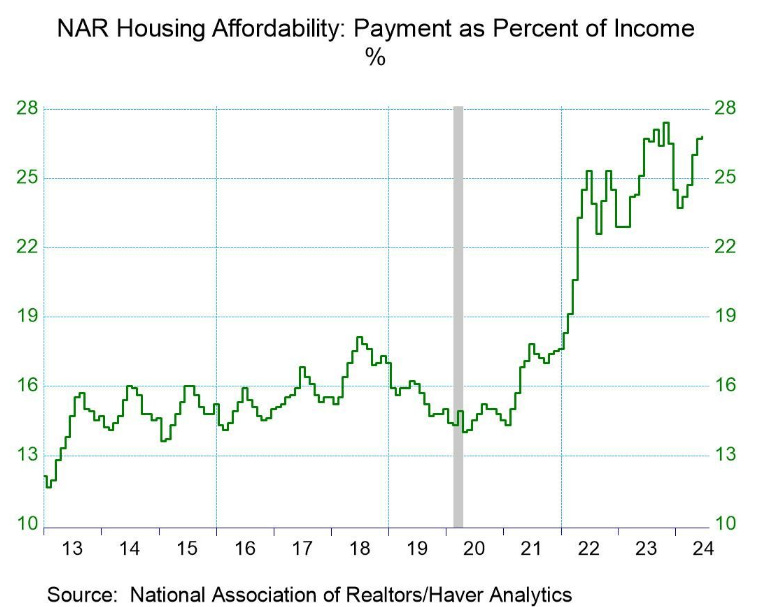

Another chart that concerns us is the supply of housing for sale. New single family houses for sale continue to climb now reaching back to 2010 levels. Will this inventory start to reflect in price cuts? Will it even matter considering affordability is at decadal lows?

Looking at it in a different way from 2010 to 2020 the average percentage of your housing payment vs your income was around 14%, it is now 27%. Some optimists will say that is only a 13% increase, but realists understand it as a 93% INCREASE! What does it mean, if you make $100k and your yearly home cost is $14k, now it is $27k, where it really constrains new home buyers is in the debt to income ratios. So we expect housing to start to reflect even more inventory and more price reductions in 2025:

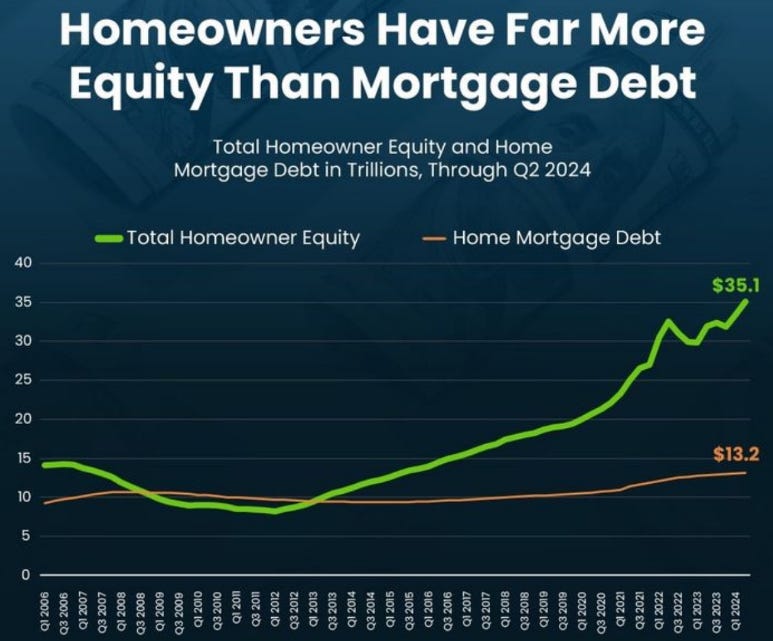

Here is another data point, we know there is plenty of locked up UNREALIZED wealth in home equity. The problem is extracting that wealth before housing prices fall. Like everything else its just a reserve asset of unrealized wealth until you MONETIZE IT! The problem is rates are too high and homeowners who have all this locked up, may not need to realize it, not yet at least:

Let’s transition over to MicroStrategy, yes we continue to comment on this, but we want to make sure our readers and listeners are well informed. Here is what we know, we know MicroStrategy equity has a ratio of 1 share is equal to .00172% of a BTC, We know that their main product is VOLATILITY. What do we mean by that, well MSTR is issuing Convertible Debt with additional common equity to fund BTC purchases. This Convertible debt relies on the equity to exhibit volatility so the Convertible bond holders can not only delta out their position but take advantage of the Gamma. This is the convertible bond holders real juice, they take advantage of the volatility, by stripping out this volatility they turn a static investment into a high powered money generating tool. However this requires volatility. Let’s listen to Saylor on CNBC to this point:

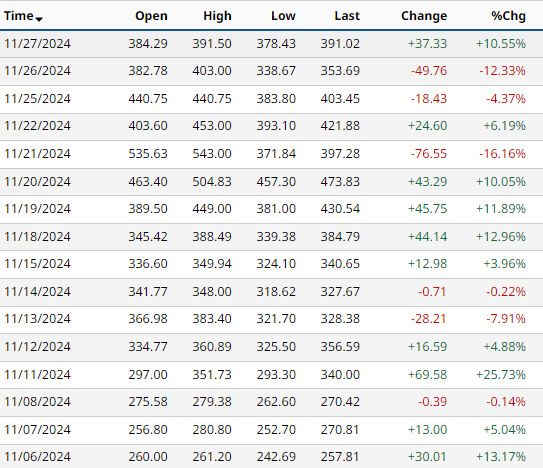

So here is a picture of the equity volatility in the stock, double digit percentage daily net changes, now that is some Vol to exploit right there:

We know their vig is 2.33x meaning the stock trades at a 2.33x premium to their core Bitcoin holdings value per share. So we know their biz plan is constrained by the Law of Large Numbers, eventually volatility will collapse. So time becomes the enemy here, point is why issue $42Bln over 2 years? Why not max it out issue as much supply as the markets can swallow. I would suggest $100Bln CB and $100Bln in equity as quickly as you can. $200Bln worth US dollar fiat to convert into BTC. I would then only buy BTC on down ticks and acquire 2m BTC now vs later. The result will most likely double their total share count, give MSTR a $360Bn or > intrinsic value, resulting in a per share intrinsic price of $800. They would then move their per share Bitcoin value to .0053 from the current 0.172. Should Bitcoin start to rise significantly they can slowly sell off some holdings and start buying back the stock…that is what we would do, but will see what he has in store.

Bitcoin is still wandering between $90k and $100k:

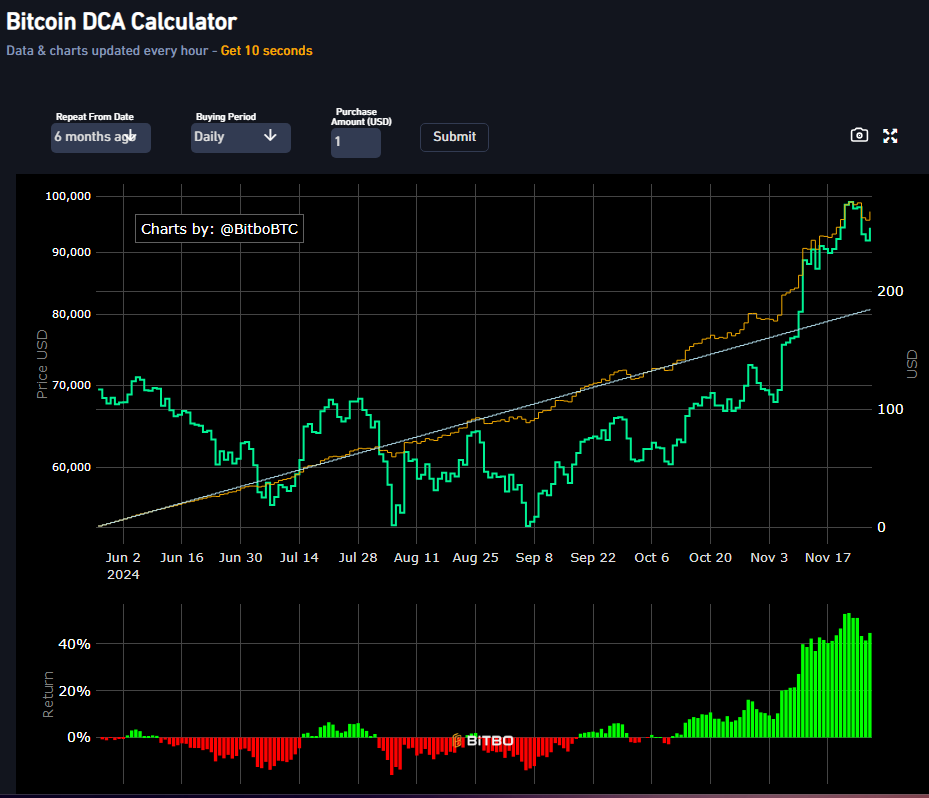

We will expect selling to accelerate if we get down below $90k and move toward support at $76k. We like to use the DCA ($ Cost Avg) chart calculator from BitboBTC. We suspect all the new buyers within the last 6 months if employing a DCA methodology have a breakeven at about $76k this is where they begin to take losses. So we know its not perfect as an indicator but it gives us another data point:

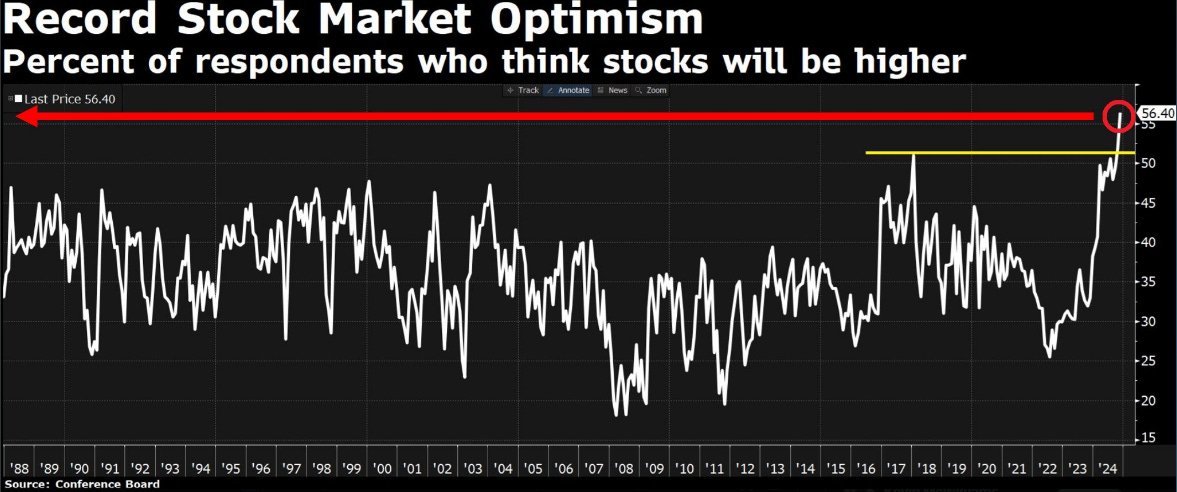

Right now equities are down a bit with the SP500 futures -23, the Nasdaq -211 points. We also know equity optimism is at record levels:

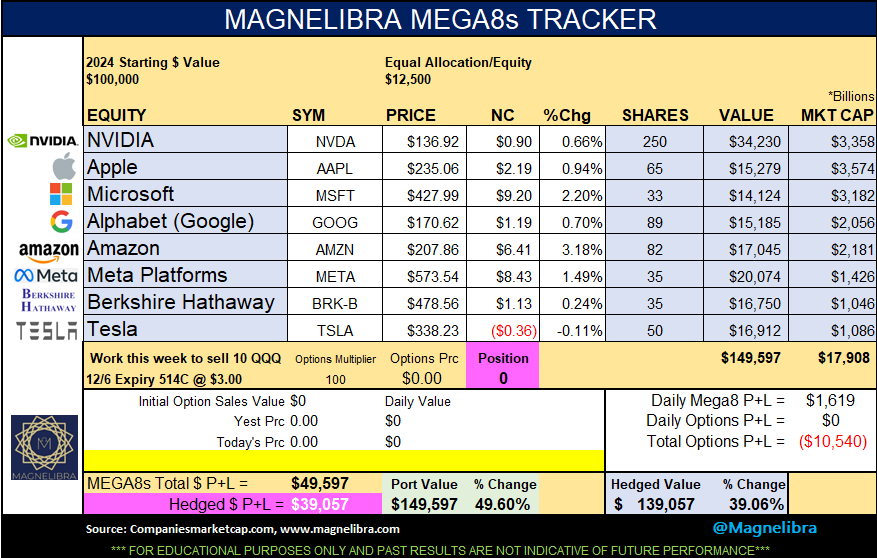

As far as yesterdays MEGA8s and settles we will update the hedge if necessary but its not close to that call strike price yet:

Thank you to our supporters, we are just a few away from 500 and we hope you guys can share our work to get us there! Till next time, cheers.

DISCLAIMER: For educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and is not for everyone. Such investments may not be appropriate for the recipient. The valuation of futures and options may fluctuate, and, as a result, clients may lose more than their original investment. Nothing contained in this message may be construed as an express or an implied promise, guarantee or implication by, of or from Magnelibra Capital Advisors. Magnelibra the Commodity Trading Advisory and its proprietary long/short commodities, futures and options managed accounts may hold long and or short positions in the various futures and markets that Magnelibra covers. We will never claim that you will profit or that losses can or will be limited in any manner whatsoever. Past performance is not necessarily indicative of future results. Although care has been taken to assure the accuracy, completeness and reliability of the information contained herein, we make no warranty, express or implied, or assume any legal liability or responsibility for the accuracy, completeness, reliability or usefulness of any information, product, service or process disclosed. If you are interested in opening an individual managed futures and options account to compliment your overall investment portfolio you can visit our website at https://magnelibra.com for more information. We are implementing a new trading program launching at the start of the new year, which will include access to Bitcoin futures and options. Please contact or make inquires directly to our introducing broker Capital Trading Group, please contact Nell Sloane at nsloane@capitaltradinggroup.com

All Rights Reserved Magnelibra Capital Advisors LLC 2024

Share this post