Good Morning Traders and Investors and thank you for joining me for another edition of the Magnelibra Markets Podcast, I’m your host Mike Agne and today’s episode #32 is entitled “Negative Carry is Why Regional Banks Struggle”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

So let’s just jump right into it shall we, let begin by taking a quick look at what continues to expose the real underlying risks to our economy. As we know Moody’s yesterday moved NYCBank to Junk status. Now we know this is the same bank that took over Signature Bank during last years bank crisis. So don’t you think its a bit strange that the very bank that the regulators bestowed for taking over the defunct Signature bank, is itself in trouble less than a year later? What seems to be happening is that the banking sector itself is being so tightly consolidated that in reality, there is only the top 5 and everyone else. That everyone else seems to be battling out and in doing so forced to make riskier and riskier type bets just to stay competitive. What seems obvious enough to us is that these banks are so naive or their executive committee so arrogant that they don’t understand the term “negative carry.”

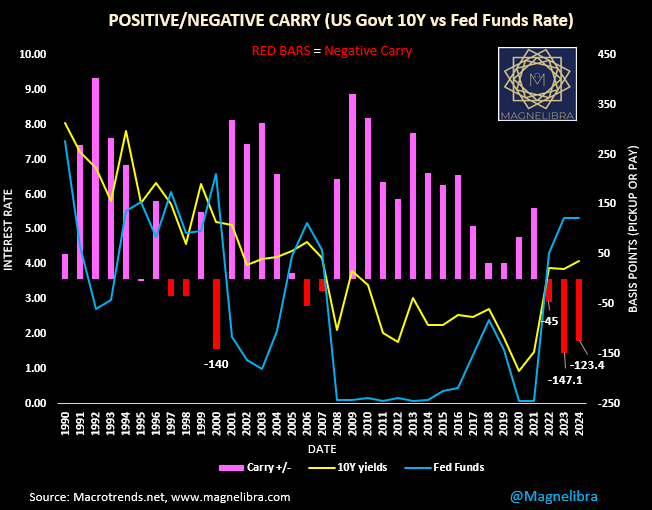

Many long time listeners have heard Magnelibra Markets say this term in the past and post a chart of it, which we will do so once again. For new listeners negative carry can be broken down like this, the word negative is as it implies obviously but the word carry in our case means monetary interest. In this case the interest one earns on its investment is less than the cost of that investment. Now we know this is being way over simplified and that there are caveats and nuances to all this. As far as the banking sector, lets assume you can borrow money at the Federal Funds rate 5.33% but you rollover and continue to buy 5 Year govt bonds which yield 4.00%.

So from this scenario you can see if the bank does indeed borrow money to invest in the longer term security, they guarantee themselves “negative carry” or a net loss because they are paying 5.33% for their borrowed money and investing at 4%. Effectively losing 1.33%. This is not how the financial system is supposed to work. Yields at the very short end, should not yield higher than longer dated maturities. The word maturity in this case is the 5 Year govt. note.

This leads to all sorts of problems when you have a monetary regime that spends a significant amount of time in this type of regime. What it exposes is the fallacy of our financial system, as if having $18T in deposits and only $2T in real cash doesn’t already expose, but people have a hard time understanding that also. However when you break it down into just the numbers you can then see why, everyone cannot monetize and sell at the same time, everyone can’t withdraw cash at the same time. This situation will get worse and worse the higher our debt grows. This is becoming very obvious now and many are effected whether the like it or even know it. The higher prices we are paying for goods and services is the very thing that keeps this kind of system in process, in play and as long as the people move further and further into debt, well the longer this system will maintain itself.

For now let’s take a look at the negative carry chart and its unprecedented run which is now into its third year which you can see never ever happens:

Now Jerome Powell can say that they can be patient and not cut rates given the ongoing data, but rest assure the longer he waits the worse it gets for the entire banking sector and no the FDIC cannot cover everyone!

Listen to this episode with a 7-day free trial

Subscribe to Magnelibra Trading & Research to listen to this post and get 7 days of free access to the full post archives.