Everyone please enjoy this free look at our Subscriber Only Daily Trading Tracker Updates. The goal with our subscriber only section is to give investors and traders a better look at the markets we follow and also provide our coveted Magnelibra CTA Trading Sentiment. You guys can incorporate this kind of strategy into your own trading and investing and or emulate the data, to implement facets of it. We also provide our MEGA9s Equity basket with our weekly hedge component so you guys can gain a better understanding of how to hedge a long only type of equity basket.

We know many investors have a longer term long only bias toward equities, and that is fine, however we want you to realize that your directional risk can be offset somewhat by giving up some of the upside to protect on the downside. We realize some of this is very sophisticated, but we also open our door for your questions, either direct in email or on the chat via Substack.

Our goal is simple, to get you to think outside the box and to scrutinize your own game plans or maybe even hold your own advisors and managers accountable given the plethora of data and insight which we provide. We provide you with angles and insights into complex financial market movements and we cut through all the noise so that you can gain a better understanding!

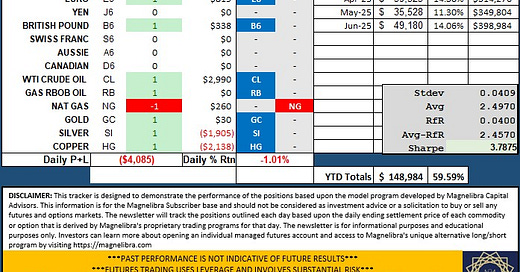

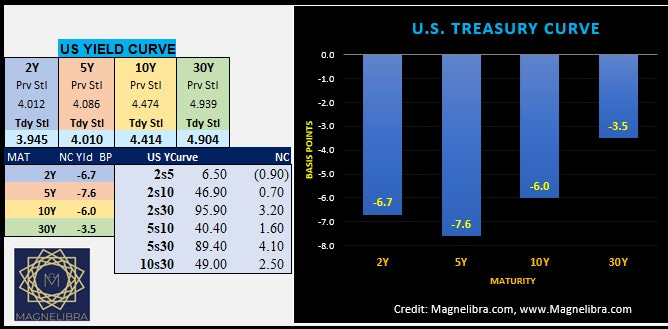

Magnelibra CTA Trading Sentiment (Our proprietary commodity trading advisory futures market sentiment long/neutral/short market flows indicator) The portfolio is made up of the core futures markets we cover and the indicators are for single contracts of the futures market, whether long, short or zero neutral. The P+L is generated via the starting daily position and the ending daily settlement. This is considered a high risk alternative strategy. However most investors should leave a portion of their overall portfolio within a high risk basket. Some of the percentages of the overall portfolio dedicated to high risk should vary from 3% to 18% depending on ones overall time to invest and risk profiles. We added the Sharpe to our data now as well for those quantitative types!

ZB, ZN and ZF all move to 0 Neutral and RB moves to +1 Long, equity market failure at these current levels on the week, will start to remove some of full long bias in equity complex:

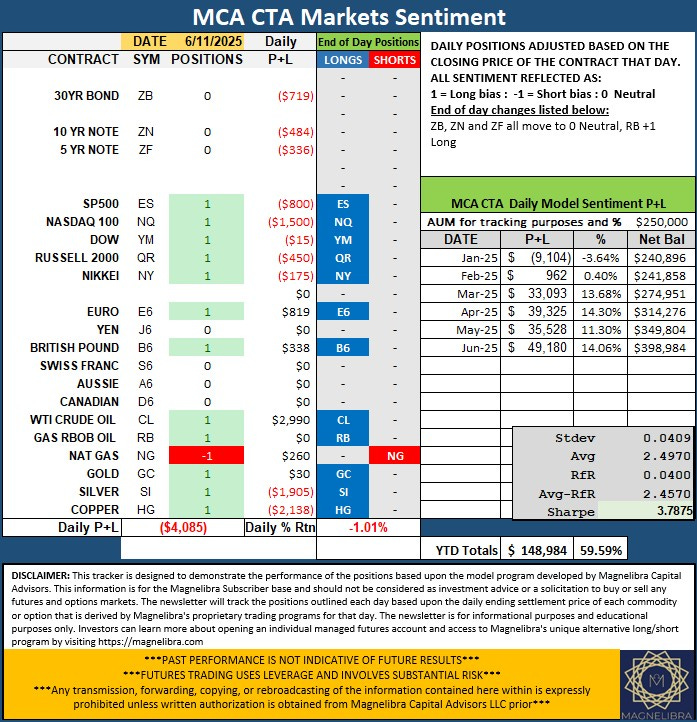

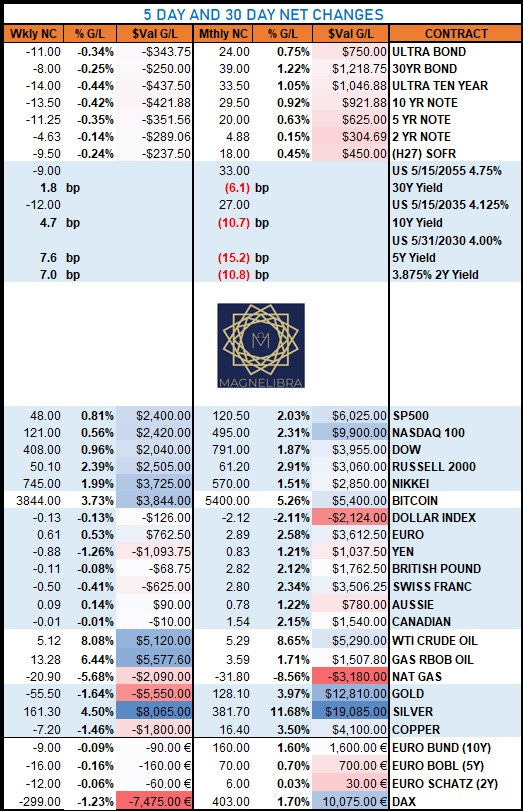

Daily Settlement Sheet (Magnelibra’s Futures and Cash bond market coverage of the daily settlement prices and dollar value of the contracts given move)

Bonds up across the board with the front end of the yield curve stronger, Equities all lower, FX all up except Aussie, Energy up sans Nat Gas, and boosted by potential MEast flareup talk and Metals mostly lower again:

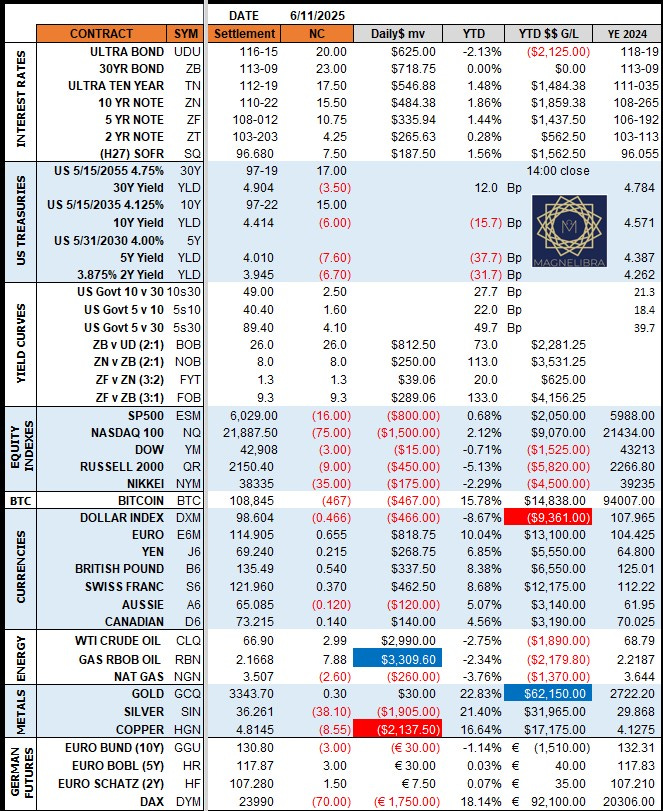

The U.S. Bond Yield Curve:

Decent steepening move post CPI with the 5Y the winner on the day:

The 5 & 30 Day rolling changes (The last 5 trading days and 22 trading days net changes)

Winners and Losers Data

Magnelibra MEGA9s Portfolio Tracker (Top 9 largest equities by market cap)

The basket lost $122Bn in market cap today and Microsoft regained its top stop. This weeks hedge is short 5 QQQ 533 Call at $5 which hit today. This area has proven to be formidable to get past, so we suspect a battle here between retail levered buying and continued institutional selling:

MEGA9s total market cap chart

The 21pMA trend support is obvious and indicated by the pink line. Any move back below the pink line would be our first indication of failure, but for now, status is saying higher and possibly targeting the long term bull slope line:

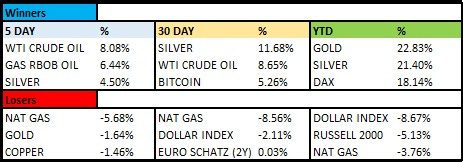

StrategyB/ BTC Trading Tracker (Bitcoin vs MSTR equity, Our MicroStrategy Covered Call Portfolio Tracker, Long 100 shares MSTR and short 1, 4% to 10% out of the money call on Monday’s open each week)

This weeks option sale is the $395 Call. Volatility continues to drop now -17.33% QoQ:

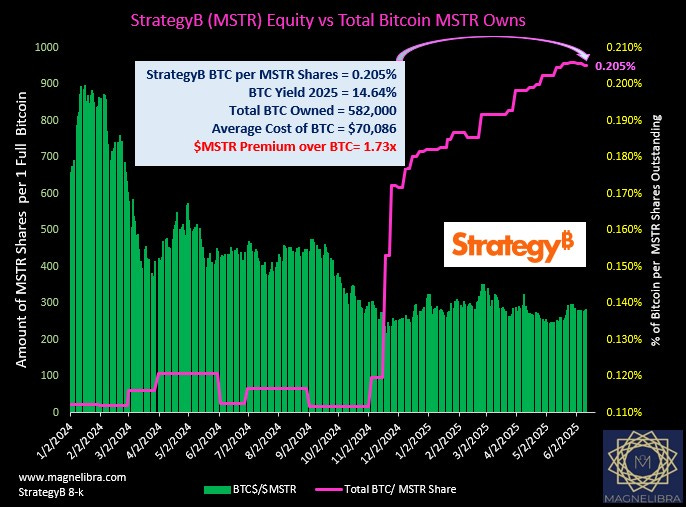

MSTR premium over outright Bitcoin is 1.73x, Taken from our earlier post today,

“word on the street is more hedge funds are piling into this reversion trade by which they are trying to short MSTR equity to match the intrinsic value of the per stock value of its Bitcoin. A basic understanding of this trade requires a few inputs. Basically assume the price of MSTR stock is $390. $390 buys you, .003577 Bitcoin (BTC at $109k) if you take our metric below of BTC/MSTR Shares ratio of .00205 and divide it from .003577 you get 1.74x or the MSTR Premium over BTC. Just so you know MTR does not believe the HFs can get this premium to far below 1.00 and at 1x the price of MSTR would have to be $225 at current BTC prices just so you know. $225 would be a 42% loss in MSTR equity from current levels for that to occur:

Ok that is it guys! Anyone interested in investing in XMR Monero please reach out, we have a link to Kraken and would be glad to consult anyone interested in getting involved here. As always we view these crypto currencies in the same realm as futures, high risk, high reward, and every portfolio should have a small percentage of their overall portfolio in investments like this. So if interested please reach out to the email below directly and we can discuss this further. The future of financial payment systems will be digital decentralized and we are still in the infancy of this fascinating technology!

If anyone is interested in working on a digital currency project and joining in as a core investor to help lay the foundation for what is to come, please reach out!

Thank you for supporting our work! Also if you aren’t a paying subscriber and you like what you see, please think about signing on, or at the minimum, share our work!

We appreciate all of your support and stay positive and know that you are well informed. The world is there for you to maximize your interests and expand your horizons and if you are lucky enough to be able to share it with someone, you are then truly blessed!

Start moving in the right direction, take hold of the reigns and stack the probabilities of success in your favor, every little step matters, every stumbling block over come matters.

You don’t owe it to anyone else, you owe it to yourself.

Support directly to our BTC address: 3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp