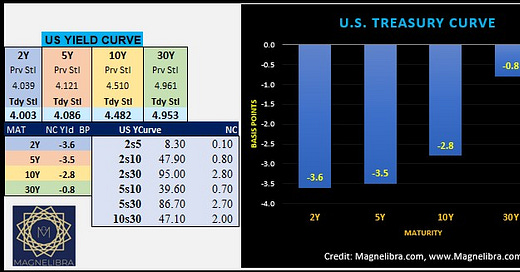

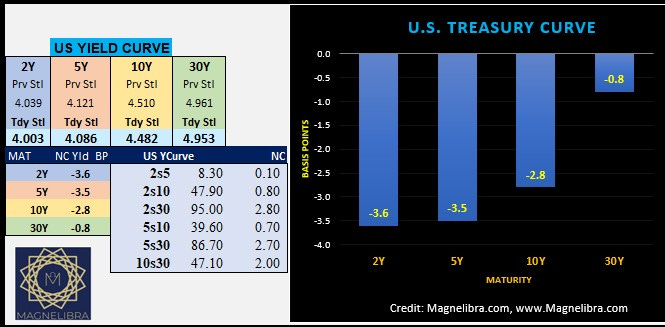

The U.S. bond market, saw the front end outperform yesterday and a bull steepening, which is expected when yields move lower. This is the case because the anticipation is for the FOMC to err on the side of caution and restart cutting rates. If the FOMC does indeed restart rate cuts, we would expect the yield curves to really steepen out.

What does that mean? Well take a look at the graphic below and look at the 2s30 and 5s30, we would expect those yield spreads to move from 95.00 and 86.70 respectively to move out to 200.00 basis points. This would indicate that the FOMC would most likely drop the Federal Funds rate down below 2%. Whether they do that or not remains to be seen, but that is what we would expect based upon historical action.

Now the FOMC could continue to allow rates to stay elevated and this would continue to starve levered players from being able to refinance at lower rates. We view this as certainly plausible, but is more a defensive posture by the monetarists to preserve their past mistakes of printing so much money. You see as the debt explodes, the ability to manage the balance sheet becomes ever more complicated. Why? Because even the smallest percentage rate move, means billions of dollars saved/spent.

We would like to see the FOMC cut its balance sheet below $6Tn, it currently sits at $6.7Tn but even at that, its still $2.7Tn or 69% higher than pre Covid levels.

Ok let’s take a quick look at the US Govt 10y yield chart this weeks resistance is set at 4.55% with support at 4.30%:

Taking a look at some other technical charts, the QQQ ETF continues to push into the highs with resistance up at 541 and support down at 511 this week. The QQQ is starting to push into the prior trend wedge, which a weekly close inside, would target new all time highs:

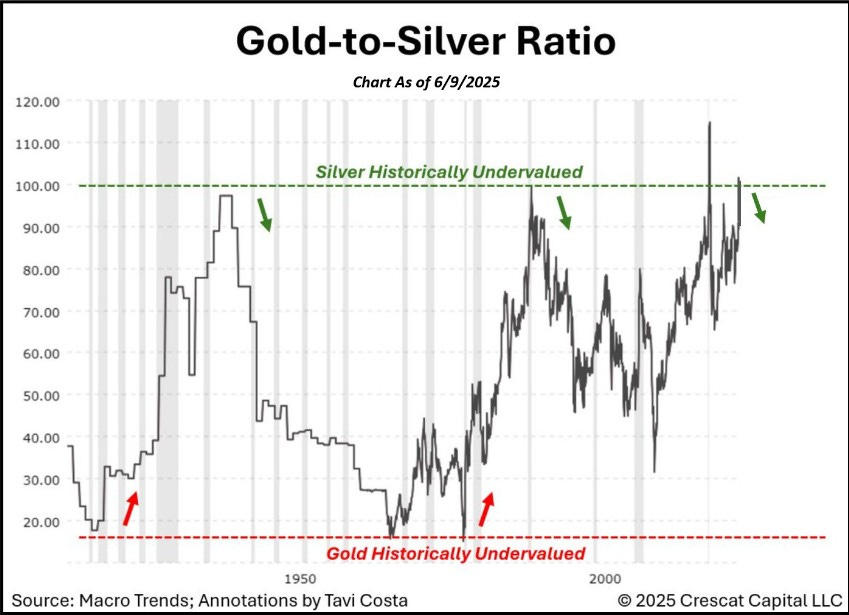

Crescat put out a Gold to Silver Ratio chart and it does highlight our purview that we touched upon yesterday, that is Silver is historically undervalued vs Gold:

Alright guys, we have all the MTR Subscriber data and trading trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system.

We offer you a mindset that you cannot get anywhere else.

We offer you access to our data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes. You won’t be disappointed!

Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.