Retail sales posting a big drop month over month this morning coming in at -0.9%, here is the chart from ZeroHedge:

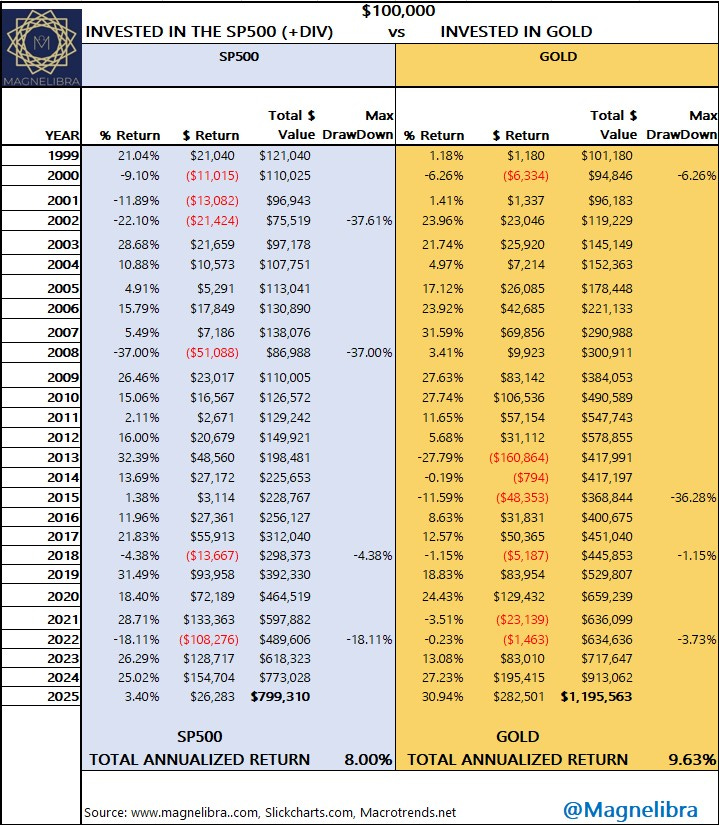

We really shouldn’t be surprised at this as we often talk about the bifurcated economy, the one that engulfs the bottom 90% with debilitating debasement and the one that is focused upon risk assets and their every single price movement. Speaking of risk assets, we posted this chart on X last week and last weeks data shows that on an annualized basis for the last 27 years Gold has destroyed the SP500 in total return, in fact its not even close. So while all your managers push you to stay long only and convicted, know that you simply could have bought physical gold and outperformed the SP500:

This is data that many equity managers will deny and they will die on that hill, they will deny the data…now don’t get us wrong, we aren’t advocating rushing to sell everything and buy gold. Rather we want you to understand the data and what it suggests, it suggests that for a given amount of volatility, you should restructure your portfolio’s to maximize your long term returns. Basically don’t be naive, don’t be a fool, be proactive in your research and your portfolio. This is why we do what we do, we want you fully educated so that you are your best advocate. We know you have other careers that this is not your focus, that is ok, it is our focus and we hope we summarize it all in a way that allows you to understand these financial risk assets in the proper way.

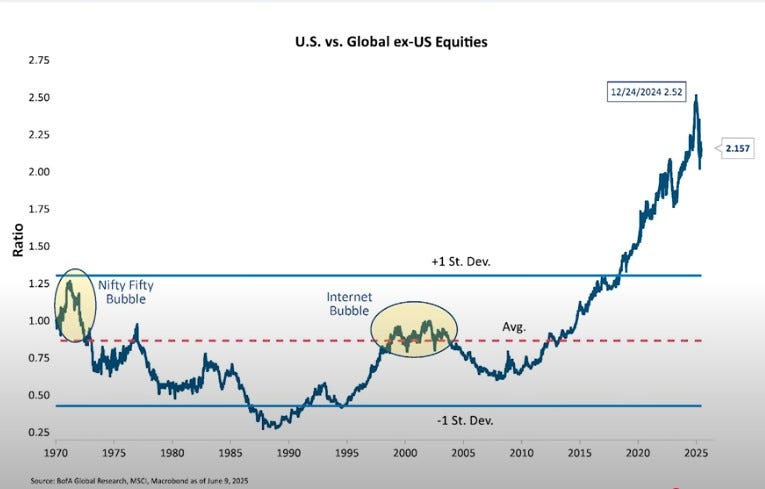

Another chart we saw was this:

We suspect the world will continue to diversify out of U.S. equities and disperse them elsewhere. This is most likely not just profit taking, this is a trend reversal of this most concentrated risk trade, so keep this in mind. Also keep in mind that this is very dollar negative…

We have the FOMC this week, but 99.9% of the anticipation is for rates to remain on hold. We agree with this call and we would suspect the US 2Y to provide a bit more directional bias prior to the next cut, for now the FedFunds/2Y spread is 35bp. We would suspect the 2Y to move below 3.557% prior to the next FOMC rate cut:

When we look at the SOFR curve, its extremely flat and quiet. Historically this seems complacent. We know things look calm now, but as we have said it time and time again, as soon as we get a negative NFP, well the FOMC will panic…for now the curve is quiet:

Ok onto some of the technical charts and note these charts for the SP500 and Nasdaq are of the Sept. futures, we have not officially rolled our settles page to September but will do so after today’s close. As far as the SP500 the first weekly resistance level comes in at 6095 and we are trading back below there. An hourly close is important at that level, so above we can trend higher, but below shorts will remain in control:

Same can be said for the Sept. Nasdaq futures:

In August Crude Oil we have weekly resistance levels up at $78 and the bull/bear pivot moves to $66.75 with our first support at $69.50:

We have all the MTR Subscriber data and trading trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system and perhaps implement some of our trading trackers into your own investment profiles! If you are sick of stagnating, sick of losing then join the ranks of MTR Subscribers!

We offer you a mindset that you cannot get anywhere else.

We offer you access to our data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes. You won’t be disappointed!

Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.