Non Farm Payrolls Higher, Equity Bulls In Charge!

May 1 Subscriber Data and MEGA8 New Look and Much More

Ok the big news today was the Non Farm Payrolls report easily beating expectations coming in at a whopping 177k while median economist expectations were down at 138k. So great news for the equity bulls who already started the day on firm footing with spill over effects from Microsoft and Meta as well as earnings from Amazon and Apple which were trying to put a little damper on the parade. However tidbits out of China conceding on some tariffs and ongoing negotiations, it seems the insiders must know something and are front running any future news now.

After our spurious report yesterday, by which we outlined that the insiders “always know” and that economic numbers, supply/demand, well, they ultimately do not matter to the overall nominal price of risk assets. The only thing that matters is the expansion of global M2 multiplied by some nominal risk factoring. If that is expanding, then we can expect risk assets to expand, should credit freeze up and get tight, well then we get bouts of volatility. Don’t get us wrong, fundamentally we know the overall consumer is bearing the full cost of these monetarists measures, but it doesn’t change the premise we have. I.E. for now someone and maybe a few someone’s are buying up risk assets right now. We aren’t stupid, this is a trend off the lows, we will not mess with and its why the Magnelibra CTA Markets Sentiment this week has moved all the equities back into Full Long status.

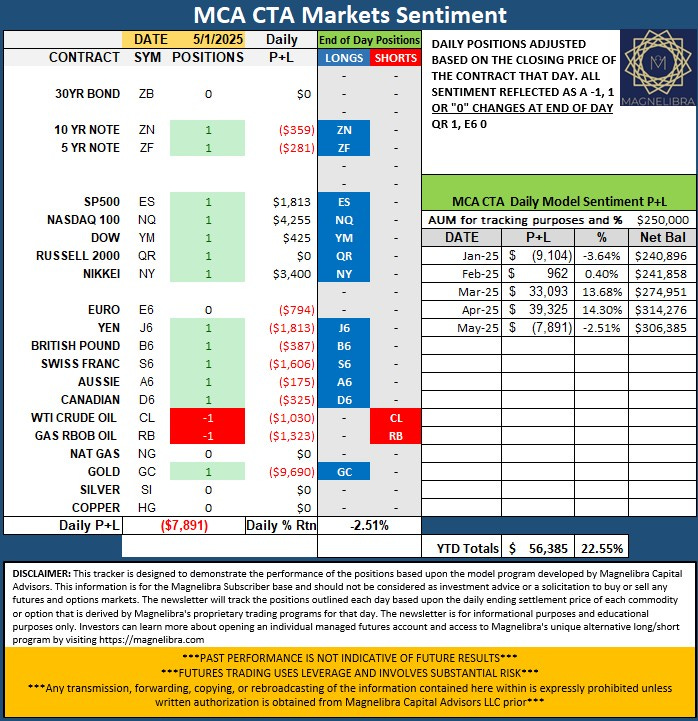

Magnelibra CTA Markets Sentiment Tracker - QR moves to 1 (Long), E6 move to 0 (Neutral):

We aren’t going to hide today’s post behind the paywall but this sentiment CTA tracker is our base fundamental bias for the markets we cover, a green 1 means the bias for that sector is long, a -1 means short and a 0 means a neutral status. We keep track via this educational research data via a daily P+L which enters and exits any changes based upon the daily settlement price.

It is apparent now that the markets have turned the corner and barring any further trade battles and lack of concessions, well the path of least resistance is HIGHER!

With that said, let’s take a look at the QQQ ETF. They have made a nice move off the lows and are now testing some decent areas of resistance from 480 to 490. Momentum is pushing on these points hard and we aren’t sure how high it will go but for now we expect the target of 511 to be hit and force the market to consolidate from there, where our expected range will then be 455 to 525 to battle within:

When we look at the Nasdaq futures, we have now installed a “long term trend line slope” in a dashed green line. This is our expected future magnet target as the market rebounds post any real new M2 expansion or FOMC QE program enactments and is the main slope the bulls are trying to regain.

For now the futures are above the 1st weekly resistance and next week 20558 will become the 1st weekly resistance level. We assume we will be adjusting our Bull/Bear pivot and supports up and will share that chart this weekend. For now, just know this is real buying going through here now:

We expect the CTA crowd to catch on to what we already see in our own proprietary CTA modeling and most trend following CTAs will get confirm this week and start a fresh round of buying to push us back above that 20600 level. We suspect fast money will want to use some of this area to back and fill a bit, which could see the range push to 20750 down to 18800 for now.

As far as the SP500 futures, they are running into our resistance area at 5720.75 for now. Even with all the buying momentum this week, we will expect a few profit takers and perhaps adventurous shorts to take some pot shots here:

On the equity front, take a look at Netflix, GEEZUS!

META may close this week above our pivot and force a new bull move here, a close here we will target a move well above $760 now:

Even Apple which fell post earnings today is still above our pivot, so no technical damage done today:

Google is also nearing our pivot on a close and this too would be quite bullish:

Ok so I think you guys get the point, its as if the Carry Trade, Tariffs and the Basis Vol has all just magically blown away and renewed hope and vigor is setting in.

We do not care about organic economic principles here at Magnelibra, we have learned long ago that the FUTURE PROVES THE PAST!

That the insiders always know, that price action means more than any fundamental economic principle and we hope you are learning this slowly too! We promise if you stick with us, you will be well informed and well ahead of your peers when it comes to understanding our reality, our markets and life in general.

For now its BUY BUY BUY and until the pricing tells us otherwise, we will not fight it. Yes we will get selling, yes we will get volatility, but today, right now, at this single point in time, the markets are proving that levered money is a very powerful risk offsetting tool and this is something not to be trifled with!

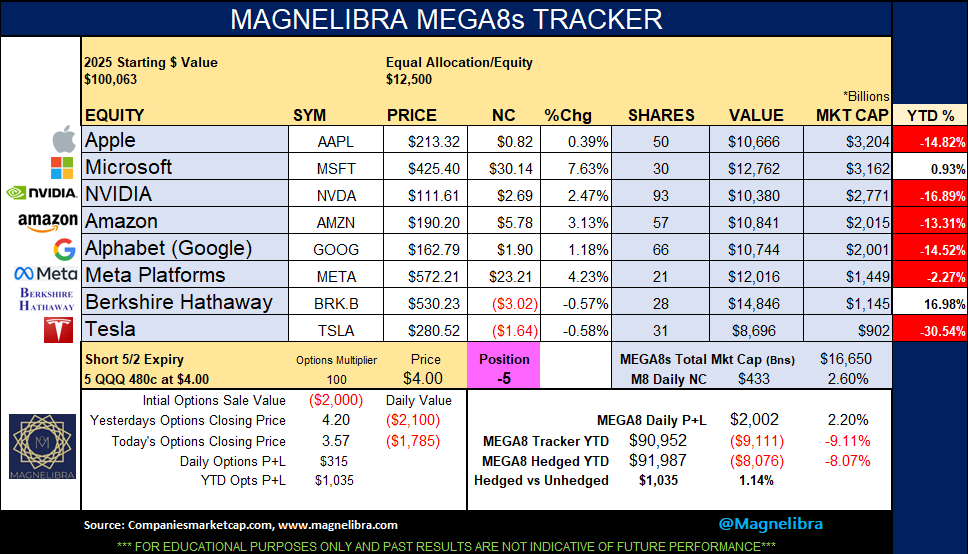

Ok lets take a look at the Magnelibra MEGA8s Tracker now, we have revamped it, to where it makes more visual sense. Also note that as of this writing this weeks option hedge the 488 Call is now flat at $8.00 a loss on the hedge but hey you can’t win them all and we will not fight this bull move with willful blindness, so you will see this weekend the $8.00 cover price for this option, normally we won’t let the hedges go past a 2x to 2.5x loss just for your newbies.

MEGA8s Data Tracker -

The goal with this tracker is to show you that the markets largest equities continue to power the global economy and garner a lot of investment capital. We also know many of you invest for the long term and expose yourself to directional risk (long only). Our goal with providing some weekly hedge at times, is to show you that there are ways to still capture the upside while limiting the overall downside.

Also it is to note that the hedged version is not designed to outpace the overall unhedged portion over time, rather it is designed to offset against present and future downside risks. Anyways we hope you like the new look, we think it makes more visual sense. Sorry it took so long!

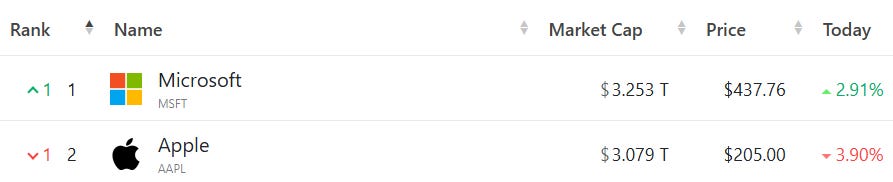

Also of note is that Microsoft has now dethroned Apple as the largest market cap stock!

Here is the MEGA8s total market cap chart now above the 50pMA a very bullish indicator right now and sign of good strength overall:

The MEGA8s technical chart is back above the resistance point, yet another good sign of overall strength:

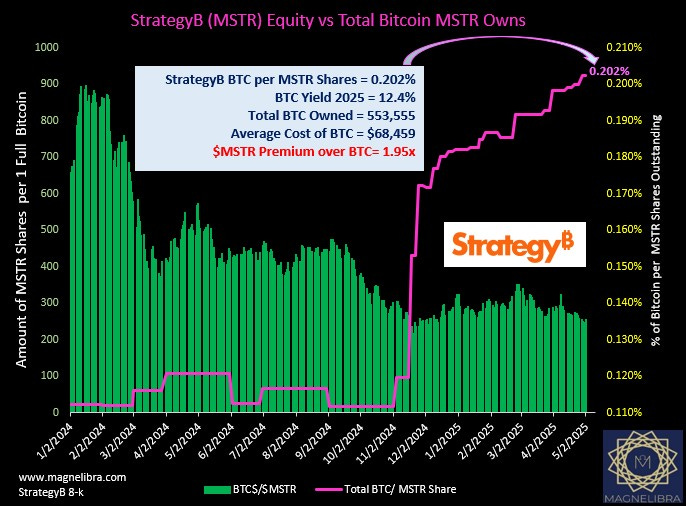

Ok as far as StrategyB our Bitcoin equity company proxy. They reported earnings yesterday, posting an EPS of -16.53, far below the forecasted -0.11. Revenue also fell short, coming in at $111.1 million against a projected $117.08 million. A good summary coming from TipRanks here:

The company now holds 553,555 bitcoins, valued at $52 billion as of April 28, 2025. In the first four months of 2025, they acquired an additional 106,085 bitcoins at an average price of $93,600 each. Strategy raised $6.6 billion through an ATM equity offering and issued a $2 billion convertible note, along with $1.4 billion from preferred stock offerings. They announced an ambitious "42-42" capital plan, targeting $42 billion in equity and $42 billion in fixed income by the end of 2027. The company is raising its 2025 BTC yield target to 25% and its BTC dollar gain target to $15 billion, reflecting confidence in further shareholder value creation. The call also highlighted Strategy's capital markets innovation, aiming to maintain a disciplined leverage ratio between 20% and 30%, while emphasizing a strong focus on capital efficiency and strategic Bitcoin accumulation.

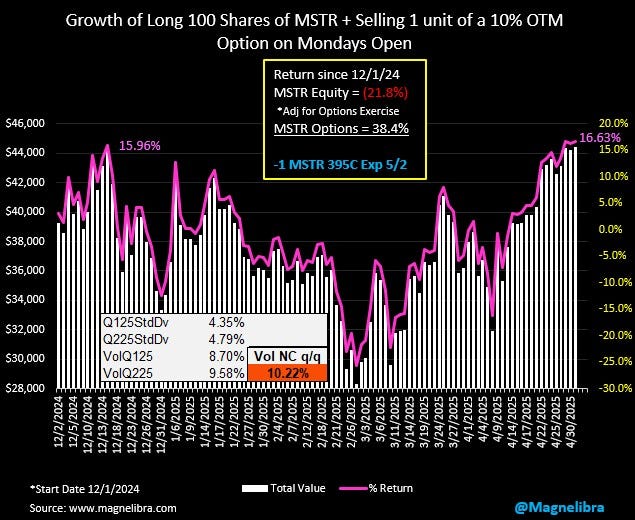

StrategyB (Bitcoin vs MSTR) Covered Call Tracker- The short call this week is the $395 strike-

MSTR continues to trade around a 1.95x premium value vs outright Bitcoin.

As long as the price of Bitcoin rises MSTR will do well, if it doesn’t, well then it would be a problem. For now Bitcoin is seeing good buying once it broke our $87.5k resistance point and its now poised to retest the highs once again, if we can get a weekly close here above $97.5k would set that stage for a nice run at the highs:

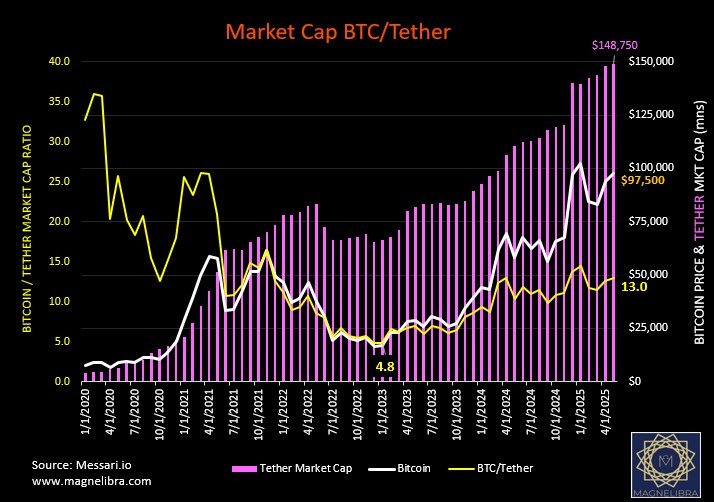

One other interesting chart is our tracking of Bitcoin and Tether, we continue to see Tether mint and mint, now up to $148.75 bn, the US Treasury must love this new source of demand! As far as the BTC market cap to Tether, its trading at 13x:

This tells me that there may be plenty of fuel for another big BTC or Alt Coin run up, so watch out!

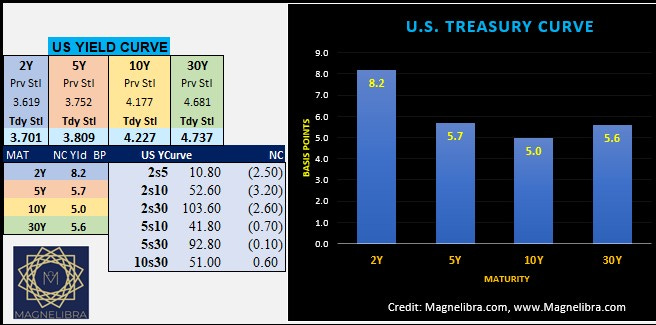

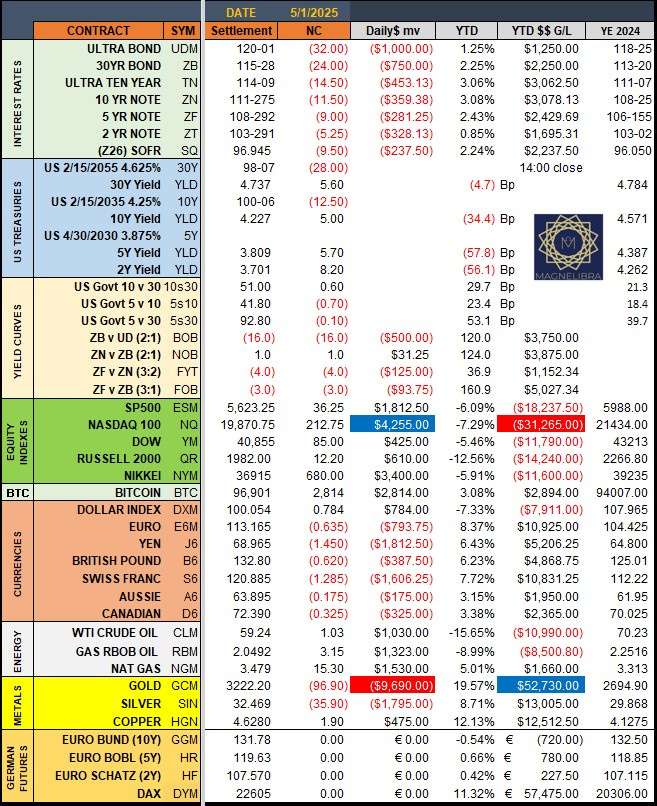

Ok we leave you with our daily settles and overall net changes and a quick look at the US Govt Yield curve yesterday, today the curve is flat once again as the NFPayroll report put a damper on future rate cut expectations, but you all know where we stand, the US Treasury needs lower interest costs, and in the future, they will get it!

Daily Settlement Sheet-

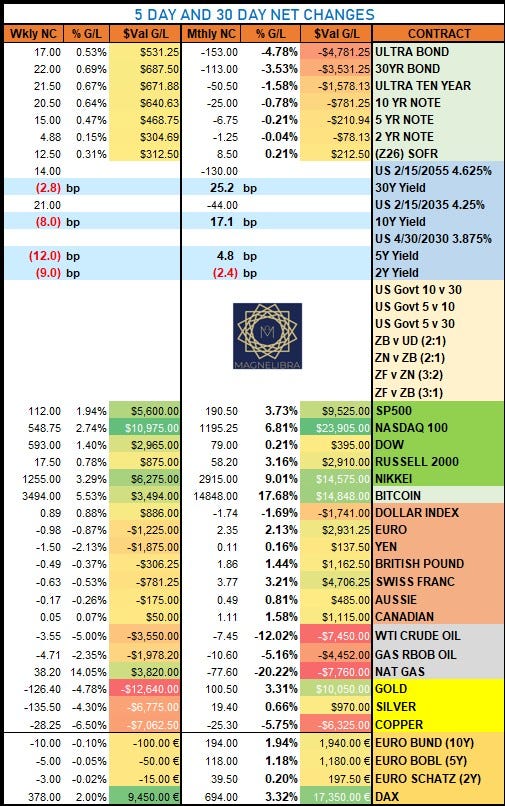

The 5 & 30 Day rolling changes- Bitcoin the big 30 day winner + 17.7%

Alright guys, that is it we have Palantir and HIMS earnings after the close on Monday, we also have big boy US Treasury auctions next week, so a decent supply coming, some $339Bn in total including new 10s and 30yr Bonds. We will take a look at the Palantir and HIMS options over the weekend as well, maybe add some color for our next post!

Thank you for supporting our work! Also if you aren’t a paying subscriber and you like what you see, please think about signing on, or at the minimum, share our work!

That is it for now, we hope you have a stellar weekend, we appreciate all of your support and stay positive and know that you are well informed. The world is there for you to maximize your interests and expand your horizons and if you are lucky enough to be able to share it with someone, you are then truly blessed!

Start moving in the right direction, take hold of the reigns and stack the probabilities of success in your favor, every little step matters, every stumbling block over come matters.

You don’t owe it to anyone else, you owe it to yourself.

Support directly to our BTC address: 3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp