Alright, Traders and Investors welcome to another edition of the Magnelibra Markets Podcast. I am certainly excited to finally being able to bring you another episode. I hope you are having a great weekend and Happy St. Patty’s Day where everyone is Irish for the day! Today’s is all about the green but the markets last week fizzled into the red by Friday’s close. Today’s episode #39 is entitled “Mega Equity Inflows Meet With Even Larger Player Outflows, Will the BOJ and FOMC Deliver a Deciding Blow This Week?”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

Ok guys, thank you for staying with us, as we noted over the last few newsletters and casts, that we have a major assignment that requires our attention on a daily basis. We are doing our best to juggle all the data with this new found assignment and we will not compromise our integrity of our content to just put out daily offerings with no substance. We may start putting out just the daily sheets to our subscribers in newsletter form and continue with a weekly wrap up podcast. Effectively we like to bring our audience a fresh perspective from the main stream narrative and in doing so, well putting out podcasts or newsletters just for the sake of putting them out, doesn’t do anybody a great service, so hopefully our subscribers respect that.

We know last week the inflation data has remained sticky and why not, liquidity is still massive, the FOMC balance sheet is still $7.5T, the RRP still has $415Bn in it and low and behold the equity markets saw record inflow’s last week:

What should be noted is that this record inflow was obviously sold into massively by larger more sophisticated investors taking profits. How do we know? Well we know because the Nasdaq had its first back to back weekly loss since October 2023:

Retail is once again being forced in at the highs and many are using this new found capital to monetize their gains. The inflation fight will remain sticky for some time, but fundamentally we believe this inflation is going to continue to erode consumer balance sheets, and ultimately lead to a massive slowdown. We feel this is something that will occur gradually as it has, then all of a sudden! Yes CPI YoY rose to 3.2% but honestly 3% is our actual inflation rate and we have proven this by showing you that the FOMC over the last 25 years has expanded its balance sheet by an annualized rate of 11% which has corresponded to an annualized 3% inflation rate. The FOMC continues to maintain that their target inflation rate is 2% but we know that is not true, its actually been 3% for many years now.

Now we have both the BOJ and FOMC this week back to back, Tuesday and Wednesday. Japan is widely expected to remove the negative rate peg and this could lead to a potential volatile market disruption. Then we have the FOMC who will decide on Wednesday and they are expected to keep rates unchanged. Can the global markets continue to rise despite the deteriorating consumer base globally? Can the rise with the continued destruction in the CRE sector where properties continue to be dumped at 50% or greater discounts? Can the markets continue to rise with Russia winning in Ukraine and no end in sight or no peaceful resolution in the works? There is a lot of uncertainty that is being countered by trillions in post covid stimulus still.

We keep hearing that the FOMC should keep rates elevated to combat inflation, however we disagree 100% with that thought, why? Because this economy benefits from higher rates in the form of risk free interest and when you have nearly $10T in liquid deposits and you want to raise rates to say 6%, well that is $600 billion of risk free net interest that is being deployed out to the top 10% let’s say to continue their spending spree ad infinitum. Whereas if the FOMC starts to cut rates, well, risk free interest pickup plummets and the purse strings tend to get a bit tighter all around. Access to capital is not the problem here, risk free interest is the problem and the residual inflation we have is still from the trillions that were created post Covid. However the longer time moves to the right, the more concentrated that capital becomes into the top 1% hands and the less power it has to generate inflation.

Yes we could be totally off our rocker to think like that, but we doubt it. When I am at the gas station and pump after pump shows $7, $10, $12, yea, umm there is a fundamental affordability problem and that is not inflationary. I won’t even go into the fact that the US Govt $2T perpetual deficit is massively deflationary…and unrealistic to believe this can continue for long.

One chart pointing out the household struggle is the massive debt balance, but honestly, $1.1T seems like a lot but considering since Covid its up a mere $300Bn which is 35% or so, but the FOMC balance sheet is still up some 100% in the same time, I believe this number still has room to rise, but then again, the US consumer base cannot print their own money either:

We also want to touch upon the fact that the alleged QT of the last 2 years is not QT, because if it was real QT, then reserves wouldn’t really be rising. You guys know the truth that the RRP program has more than offset this FOMC balance sheet drain and this is just further evidence of that:

Ok so all in all we view this weeks ebbs and flows as a precursor of risk off going into this weeks central bank bonanza. However we also believe that this could be the start of a much larger move out of risk assets based upon the setup we currently have. The FOMO won’t take long to fizzle out, and back to back weeks of Nasdaq losses is enough to warn us that major players have and continue to sell into this FOMO!

Speaking of FOMO, let’s look at Bitcoin where the $68k level is our main bull/bear key now:

Magnelibra does have a fair value methodology for this and we can only tell you its around $43k for now and we do not care about all the ETF buyers out there buying these new highs. Yea we get the fundamentals of supply vs demand, but here is the thing. This looks great as long as buyers show up, let’s see how the ETFs handle their first 15% overnight plunge and how the NY open goes, then lets see if it is a sustained sell off, how eager the retail crowd is to continue to fund this. We don’t think this ETF demand will last, we also can’t fathom why people would buy Bitcoin via an ETF when you can do it all yourself and self store if you want. For us this is nothing more than Wall Street being able to generate some profits at the expense of the unwitting retail. We also know that the first sign of real market selling here will cause Coinbase to utilize their credit lines to disburse out to the ETF issuers because they will not want to exacerbate the decline in the price. Look we know this game, we know how it will go and we know that the prospectus’s outlined this credit line vs actual BTC transfer and for us, the light bulb went off. This was absolutely necessary to offer this to the issuers because Coinbase knows it cannot dump BTC into a down market without causing the ETF and the price of BTC to simultaneously plunge. So for us it makes us think one day we may see the ETFs trade far below NAV, but BTC will never be able to go below zero, but these ETFs can certainly fold..

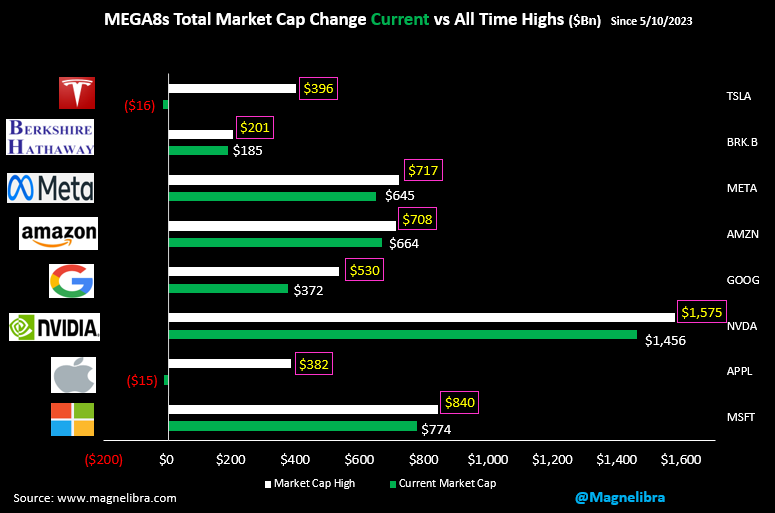

Continuing on with the FOMO theme which may be waning let’s look at our MEGA8s market cap total and all this FOMO lately has done nothing for them, in fact they have been sideways now for over a month:

We track this group with the Magnelibra MEGA8s chart here and a break of this trendline that supported it this week, may signal deeper probes lie ahead, but hey a 100% run from Nov 23, maybe some profit taking does make sense now no?

Well we mine as well show our MEGA8s tracker now as last weeks hedge worked out very well to offset the reversal of fortunes in this grouping. This week we will hedge with the Friday expiration QQQ 438C at $3.00:

Overall we can see that both Apple and Tesla continue to be the weak links and are posting negative returns since 5/10/2023 now:

One chart we want to look at now is META, sorry but this is a failure here and the close below $500 tells us sellers are indeed in control now:

Another chart we have shown before is the SP500 futures vs Nasdaq futures, it has been in a basing pattern for much of the first quarter thus far, this too confirms the rotation out of the MEGA8s and into the broader market:

Our last warning sign for equities here comes in the form of the US 30Y yields they have once again rallied up to that resistance area of 4.40%. With the BOJ wild card, its possible we get a spike up in yields here briefly but once equities get hit hard, we should see capital flow back into safety here of the bond market:

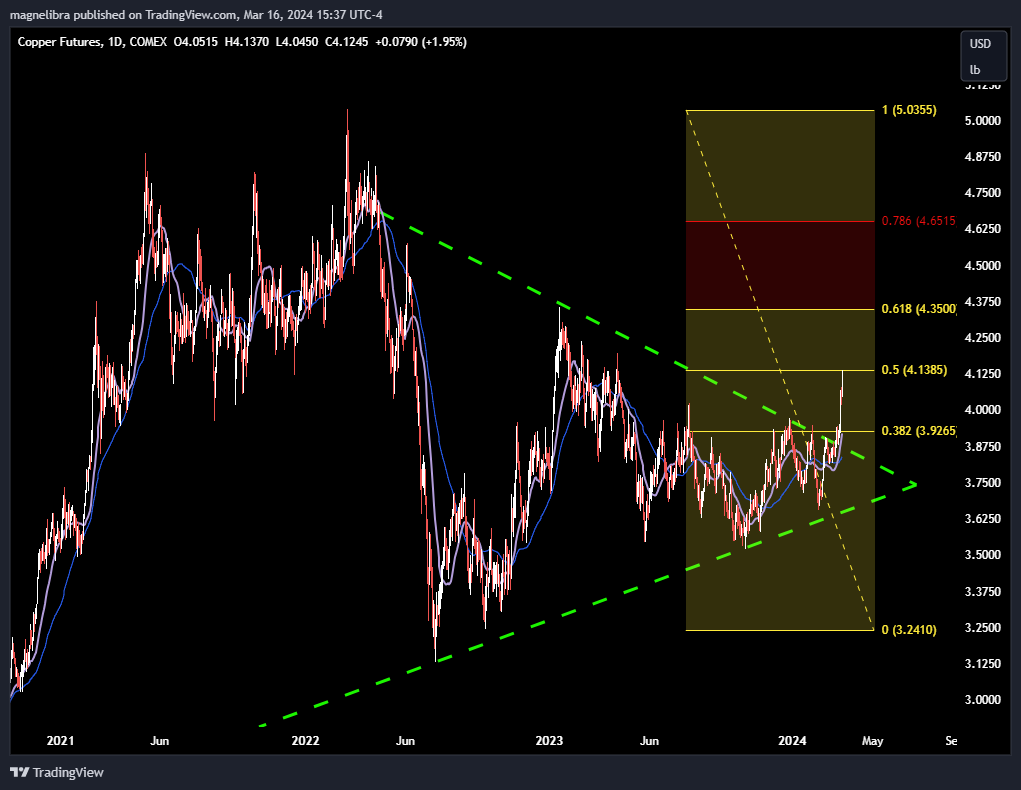

Our final chart comes in the form of Copper, we would like a back test to this breakout near 3.85 to get long some of this on our Futures Model Tracker:

As far as our Futures Model Tracker, no real changes to note and its basically unchanged on the month thus far:

Finally we leave you with last weeks settlements for the markets we cover. We will start to post these settles for our subscribers in our newsletter section at the end of each day. We will also post updates to our MEGA8s and Futures Model Tracker with any notable changes in our sentiment for the markets we cover. We rolled all the equites, energies and currencies last week:

Ok that is it, we hope you got something out of all of this. We hope that your trading mentality and investment mentality are improving, that they are seeing the financial landscape from a whole new perspective. We have a lot going on and we hope you continue to stay with us as we bring you content that we believe is relevant to you, that may be of keen interest and of some use in your own games that you are playing. We know a lot of people are starting to take their annual spring breaks and its quite noticeable on the streets of Tampa and St. Pete. We hope you are able to shake off those winter blues and come to the land of the sun and absorb some of that important Vitamin D! No matter what life throws at you, try your best to do your best and then nobody can ask any more from you. We only get one shot at this, so make it count! Till next time…cheers.

Mega Equity Inflows Meet With Even Larger Player Outflows, Will the BOJ and FOMC Deliver a Deciding Blow This Week?