Good Evening, Traders and Investors welcome to another edition of the Magnelibra Markets Podcast. Today’s episode #44 is entitled “Markets Jolted By Geopolitical War Mongering and Banks Interest Income Outlook Uncertain?”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

Also for those that have Spotify, you can now find Magnelibra Markets on there, here is the link to our last post, Spotify Link:

The Iranian retaliation toward Israel began this weekend with an onslaught of kamikaze drones which were met with a barrage of Patriot Missile Defense Systems. Further hitting equities was the downbeat outlook on Interest Income from the US banks. In our last podcast we talked about how higher rates are increasing the inflation via the risk free net interest pickup and the banks themselves are obviously a big beneficiary. JPM Chase even noted it and as reported by Reuters,

Interest rates, which are at 23-year highs, have continued to buoy the company’s net interest income (NII), which came in at $23.2 billion — up 11%, or up 5% excluding First Republic. NII gave JPMorgan and other major banks’ earnings a boost in 2023, following a period of consecutive rate hikes.

But it’s largely anticipated to slow this year as the Federal Reserve weighs potential interest rate cuts.

That last part is important to note, because if the FOMC does indeed begin to cut rates, this will crush one of the banks profit centers and shrink their net interest margins. This could also all occur at a time where charge offs and delinquencies start to pick up steam, all leading to a disastrous few quarters or even end up being a more prolonged slow down to come.

We did highlight the JPM Chase options for Friday and the chart structures risk of falling back into our longer term channel, well here is the updated chart which shows JPM now back in the trend channel after closing at $182.79 down $14.66 or 7.42% on the week:

It will be very interesting to see how the banking sector reacts to this move and overall despite earnings beats from the group on Friday, the equities suffered and that is very telling.

With retaliatory strikes most likely to be ongoing, this could lead to a further or greater escalation but for us, we view war as an opportunity to appropriate more money and essentially understand that there is never a real big ordeal, just more protracted skirmishes and geopolitical posturing. Remember there always needs to be an enemy and the populace always needs a reason to live in fear, status quo as we like to call it, nothing ever really changes. Yes we know this is hard for a lot of you traditional types and pro this or that types to understand, but when you have studied monetary systems and how agendas are brought forth, you too might see and understand that as much as things change, nothing ever really changes.

However all that thought aside, we have to be cognizant of the recent price action in equities and we have to point out that now, 6 out of the last 7 weeks for the Nasdaq Index have closed with lower weekly levels than where they opened:

No don’t get us wrong, we could have a major up move to start the week, but like the old adage states, “its not where you start but where you finish that matters.” With that, we can only say that a close below 17850 will put in a significant long term top and force a lot of trend following players to begin to sell.

When we look at the equity technical charts, they all tell the same topping story. The SP500 futures dropping below the midline of our trend channel now with 5200 as resistance and resell levels now:

The Russell 2k Futures back below our 2022 major topping threshold:

The Nikkei is now down 5 out of the last 6 weeks and failing at the major nominal long term price area of 40k:

We know that equities have been bolstered by the massive post covid stimulus which the top 5% now use to continually add to their hoard. We also know that the equities have been supported by the RRP drain as well providing a more than $1Trn offset to the quantitative tightening that the Federal Reserve has done via the reduction in its balance sheet. As this next chart points out, the RRP drain has easily absorbed this QT move:

What is not working in the equities favor is the historical precedence set by consecutive “Negative Carry” years as displayed in this next chart. For those new Magnelibra followers this chart simply displays the yield difference from the Federal Funds rate vs the US Govt 10Y rate:

Negative carry refers to the cost of your short term funding (Fed Funds) and the return on your long term investment (10Y govt note). When the Fed Funds is higher than your 10Y rate this is when we refer to it as negative carry. We are in unprecedented modern day unchartered waters and we know the Commercial Real Estate sector is feeling the effects as building after building across the country are being dumped for 50% or greater losses. As we often talk about, we know pension funds, state pensions, insurer investments have the bullets to absorb these losses, but as rates cycle back down, and the economy worsens, well the situation will become much more dire.

Alright, let’s get to the settlements from last Friday as equities were pounded on news of a pending Iranian attack and bonds were the safe haven bid led by the front end. Crude wasn’t too shaken and this does give us some concern as to the validity for higher prices there. The dollar was well bid and energies and metals as well stronger on the day:

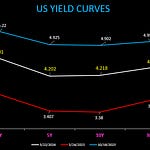

We like this safe haven bid in the bonds and the yield curve shows the strength of the front end, by front end we mean the shorter term notes vs the longer term bonds:

As far as our Magnelibra Futures Model Tracker, it had its best day in some time. For those new followers this is our cross sector allocation modeled after our commodity trading advisory program. In this educational tracker we also benchmark the model via an end of day profit and loss which is based upon the prior days overall program positioning. As always this is not investment advice but an educational tool designed to display how we create a long/short alternative investment approach:

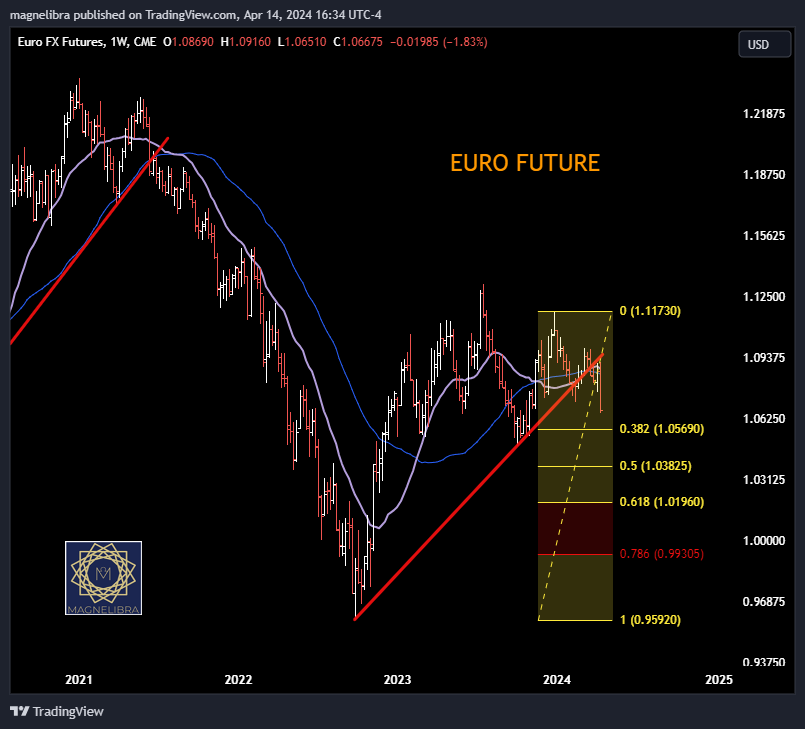

Before we get to the MEGA8s lets look at a few futures technical charts. First up the Euro Currency the break of the longer term trendline plus the retest two weeks ago and now this weeks rejection solidifies the short bias here and lower pricing ahead:

Same goes for the Suisse Franc:

As far as Crude Oil and the geopolitical strife, we would have suspected a bigger move higher, the fact we don’t have one, tells me that the sellers maybe in control here short term, and a push above $89 would be needed in order to change this weaker tone bias:

As far as the metals, both Gold and Silver charts continue to impress:

We prefer silver over gold here as the ratio near 84x seems excessive and would like to see Silver stabilize and hold the gains better than gold.

Ok let’s take a look at the MEGA8s where last week we missed the QQQ 446 Call hedge by about .50, but none the less we will target another hedge this week and will await a bit of a higher move to get into one. For those new followers this tracker is based off the top market cap equities in the US. We noticed in Q2 of 2023 how capital was being deployed mainly to the big names and started this tracker then. As you can see we track both the unhedged and hedged valuation as an educational tool to compare the varying profit and loss generated from both a static long only vs hedging this group via selling index calls, usually QQQ but sometimes SPY. Our goal with this is to find changes in large investor sentiment and to demonstrate how novice investors can hedge a static long only portfolio of individual stocks:

Nvidia and Broadcom were the weak links on Friday, Nvidia can remain strong as long as it is above $825 in our opinion on the weekly, below and you risk a lot of late to the game buyers that will start to dump:

Amazon technically is not setting up well for the bulls, it has failed once again on the weekly chart here at prior resistance areas of $187-$190:

Berkshire has also confirmed for us a major topping pattern, and will need a close back above $415 on the weekly to change our mind:

Ok that is it for now, sorry there was a lot to get to on this one but we know that it is important for us to explain our thesis each and every time. We have many followers from many different walks of life and not everyone understands things the same. So we do our best to explain exactly what we mean and convey it both vocally and visually. We leave you with a little musical piece, we believe our taste in music covers a very wide genre and when certain songs stand out to us for certain reasons and at certain times we share them. This song is I Remember Everything from Zach Bryan and Kacey Musgraves, we love it and wanted to share it with our audience! Here is the YouTube link to the song, Zach Bryan/Kacey Musgraves I Remember Everything

Zach Bryans voice coupled with Musgrave who has a classic country sound is excellent, we hope you like it…we will be back with more this week please share our work, think about becoming a subscriber and supporting our work and we hope you continue to learn and understand markets from our unique perspective. We have 25 years worth of market experience and we hope our insight generated from our decades of ups and downs helps you accomplish your goals, till next time.

Markets Jolted By Geopolitical War Mongering and Banks Interest Income Outlook Uncertain