Israel Tactical Bombing of Iran

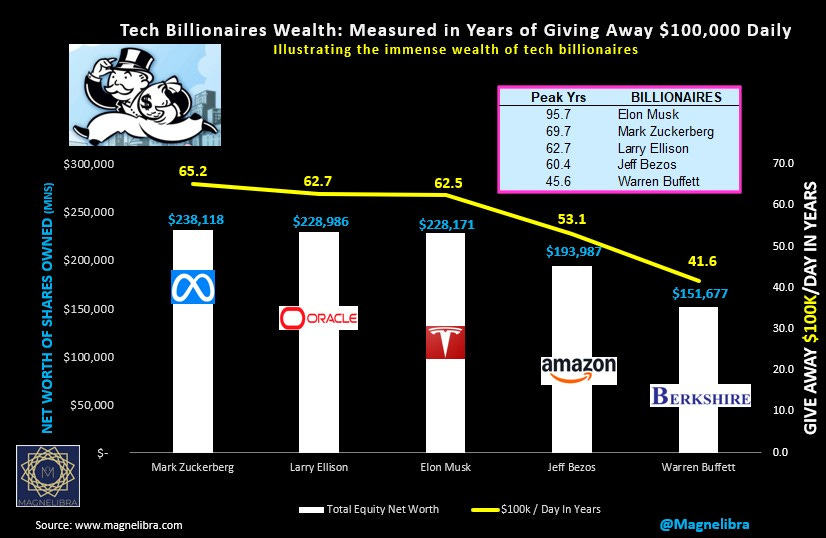

How many years can the tech billionaires afford to give away $100k per day?

As always MTR is not going to get into any opinions on the ongoing situation in the Middle East. As always we prefer diplomacy over war, that rests on our fundamental belief that war should only be used as a last resort option. Anyway, we understand complexity and we simply consider ourselves on many fronts as just mere observers. What we do rather is focus upon the markets reaction and try to decipher the impact of the increased volatility. The first thing we observe obviously is an increase in the expected range due to the volatility increase. With that we can look at the markets that are generally impacted and see which ones have stretched the band and are due for either continued expansion or if this is indeed your garden variety tactical response in regards to the current skirmish, well then maybe this is a one and done and the markets will just absorb this over the next few days and find balance.

Generally this is what we observe, there is this big spike then the market reprices and absorbs for the short term this spike and embeds it within in a more wider than normal price band.

One market we have been watching gain strength over the last few weeks, has been Crude Oil and even Wednesday saw decent buying, well what did they know??? Somebody always knows and price action sometimes exhibits these tell tale signs, and always after the fact of course! When we look at a chart of the Crude Oil futures, you can see that we held last weeks support and then this weeks resistance level at $66.10 was also the Bull/Bear pivot line, which we tested on June 10th and rejected at first but then on June 11th we finally broke through it:

For now we would suspect that we back in fill post this initial run up to $77.62, we would suspect a trade below $72 may see a push to $69.50 area where buyers will most likely have heavy support now, in anticipation of a response out of Iran most likely as the excuse.

Gold Futures also spiked on the news moving it past our $3451 weekly resistance, however we would not be buyers of it at that level, rather $3400 offers a much better location for patient longs, the war spike is reactionary and Gold tends to level out quickly and remove thee one off spikes:

The SP500 futures hit our weekly resistance earlier this week at 6065 and retreated rather quickly then the news of the missile attack sent it reeling from 6050 right to our weeks Support level of 5928 which was almost the low right to the tick! So you can see that the weekly range for this week is well intact as both levels have been hit. We suspect better sellers most of the day as nobody will want to go home long over the weekend, but all in all the rebound already finds resistance at 6010 and we suspect that will hold most of the buyers at bay today:

Real quickly looking at the QQQ ETF, we warned of a failure at these levels and a weekly close below the prior trend wedge which will hit if we close below 530, well for now we are below it and it could move our CTA indicator to a more neutral stance for the Nasdaq futures on today’s move, so we will keep subscribers updated:

For the answer to the question in our sub headline above as to, “how many years can the tech billionaires afford to give away $100k per day?”

Mark Z tops the group out at a staggering 65.2 years straight. He could liquidate just 1% of his equity holding and distribute the fiat proceeds as $100,000 randomly each and every day for 65 years straight! This is just a fun graphic to show how outlandish the wealth is and truly exhibits the insane fiat wealth that this group holds…the bigger their spread, the more invaluable the money becomes to them, that is a scary premise indeed…makes you wonder what they really value doesn’t it?

Anyway our goal is simple, to get you to think outside the box and to scrutinize your own game plans or maybe even hold your own advisors and managers accountable given the plethora of data and insight which we provide. We provide you with angles and insights into complex financial market movements and we cut through all the noise so that you can gain a better understanding!

We have all the MTR Subscriber data and trading trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system and perhaps implement some of our trading trackers into your own investment profiles! If you are sick of stagnating, sick of losing then join the ranks of MTR Subscribers!

We offer you a mindset that you cannot get anywhere else.

We offer you access to our data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes. You won’t be disappointed!

Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.