Alright, Traders and Investors welcome to another edition of the Magnelibra Markets Podcast. Today’s episode #41 is entitled “Hot ISM Forces Yields Higher”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

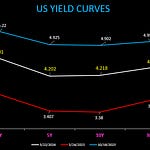

Yields were higher going into the ISM manufacturing number and post number yields continued to rally hard as ISM came in at a hot 50.3 level + 2 points higher than expected. 30Y yields rallied above our 4.40% threshold resistance:

5Y yields jumped as well pushing above the 4.30% level and near the last year and a half resistance area of 4.38%. This chart below is also the chart where we compare US debt levels and the corresponding interest rates with the amount the US treasury can expect to pay out in interest.

Here is a pic of the US yield curve today heavy price action with yields jumping:

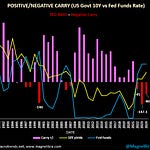

With bond yields ripping, many are laying off of those rate cut bets and dumping the front end weighted curve steepening positions. We aren’t really sure what to make of all this. Maybe what is going on is the FOMC and the US Treasury are deathly afraid of cutting rates too soon, because it could cause further capital to flow into Gold and hard assets and drive inflation even higher. This is the common core thinking, but we beg to differ. We often have cited our belief that it is higher rates that are now contributing to inflation via the risk free net interest pick up by the cash money hoarding crowd. What the FOMC needs to do is cut rates to start reducing that risk free interest pick up and throw some uncertainty into the risk taking crowd.

Although, maybe we are past the precipice of money making any sense. Maybe fiat money is truly inflating and there is no stopping it. IF that is the case, then war is the next step because this means money is becoming increasingly worth less and people’s labor wages are being discounted too heavily and this will eventually lead to a revolt by the working class. We have already seen some of this around the globe and the United States masks a lot of this with DC welfare initiatives and even at the state and local levels a lot of dependency upon state tax funded jobs.

So this is indeed very interesting times and very uncertain and unprecedented times. We are also noting the break out in Oil above $82. This seems to be pointing to the war theme as well and with what is going on with Ukraine/Russia/Israel etc, who can blame the speculative crowd!

Alright we have ADP and employment later this week, we have a bunch of FED speakers as well and we will continue to watch a strengthening dollar, higher yields and the equities markets seemingly ignoring all of this with their stingy consolidation here.

As far as today, here are the settlements which we included last Thursday as well as we corrected our US 10Y yield data. Obviously the bonds were battered as today as the ultra was down nearly 3 full handles and all the yields basically jumped double digits. The equities were mixed, the US Dollar strong and Gold and Oil continue to shine:

As far as our Futures Model Tracker, today’s moved liquidated some of the Gold short and it added onto the YM short:

As far as the MEGA8s, our hedged goal this week is to try and be patient and see if the QQQ end of week 448 call can trade above 3 for a sale. This is an educational tool to show our readers and listeners how you could hedge a static long basket and obviously it can be adjusted to fit any risk models via varying your sizes. Anyway the MEGA8s were up slightly led by META and GOOG. We will swap out Tesla this week for AVGO as it is now about $60Bn in market cap above TSLA:

Alright, we know there is some excitement around the upcoming eclipse and if you are in the location to view the total eclipse it will be one for the ages. These celestial events were coveted by the ancient people and that tradition of awe inspiring continues to this day. We love events like this because it shows the power of our Sun and Moon and reminds us how vulnerable our planet and we are. If something were to change on either of those celestial bodies, well let’s just say mankind would not be able to ignore, yes they are that important! Anyway, we hope you have a great rest of your week, we will be back more and as always our subscribers will get our daily trackers. We made this one a freebie podcast and we hope you enjoy our content. We hope the way we cover and track these markets allows you to dig deeper and find other avenues to invest your capital, to form unique baskets of equities, to then be able to formulate some interesting hedges. Remember, there are no free lunches, you have to take the risk, you have to limit the risk but you have to ultimately throw your chips on the table and not lose sight of the fact that money is devaluing and devaluing fast and its obvious this game is going to continue to not make much economic fundamental sense, that you will not be able to generally rationalize with certain moves, to try and make sense of all things, because sometimes, they just won’t make sense!

Hot ISM Forces Yields Higher