In today’s earlier post we highlighted the Alphabet (GOOGL) earnings and looked at the options markets and focused upon the at the money straddle breakevens. We targeted the Friday expiry at the money $157.50 straddle. The straddle was priced at $9.40 at the time, which was implying a 6% move. We liked the technical set up above $151.75 area and a move toward $165 made sense. We looked at the $162.5/$167.5 call spread priced at $1.45 a 2.45x net risk reward profile. Well Alphabet hit it out of the park after the closing, and announced a new $70Bn stock buyback to boot, here is the data from Zerohedge:

EPS $2.81 vs. $1.89 y/y, smashed estimate $2.01 (Bloomberg Consensus)

Revenue ex-TAC $76.49 billion, +13% y/y, beat estimate $75.4 billion

Total TAC $13.75 billion, +6.2% y/y, higher than estimated $13.66 billion

Revenue $90.23 billion, +12% y/y, beat estimate $89.1 billion

Google Services revenue $77.26 billion, +9.8% y/y, beat estimate $76.31 billion

Google advertising revenue $66.89 billion, +8.5% y/y, beat estimate $66.39 billion

Google Search & Other Revenue $50.70 billion, -6.2% q/q, beat estimate $50.3 billion

YouTube ads revenue $8.93 billion, +10% y/y, missed estimate $8.94 billion

Google Network Revenue $7.26 billion, -8.8% q/q, beat estimate $7.13 billion

Google Subscriptions, Platforms and Devices Revenue $10.38 billion, -11% q/q, beat estimate $9.91 billion

Google Cloud revenue $12.26 billion, +28% y/y, missed estimate $12.32 billion

Other Bets revenue $450 million, -9.1% y/y, missed estimate $473.9 million

Operating income $30.61 billion, +20% y/y, beat estimate $28.86 billion

Google Services operating income $32.68 billion, +17% y/y, estimate $30.42 billion

Google Cloud operating income $2.18 billion vs. $900 million y/y, estimate $1.94 billion

Other Bets operating loss $1.23 billion, +20% y/y, estimate loss $1.12 billion

Operating margin 34% vs. 32% y/y, beat estimate 32.3%

Number of employees 185,719, +2.7% y/y, estimate 183,718

The stock is up 4.82% in the after hours market per MarketWatch:

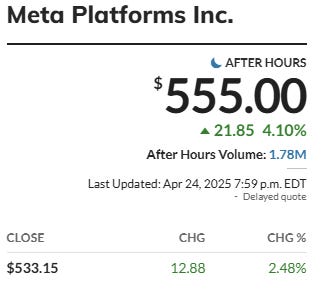

This is leading to a surge in other stocks as well, most notably META +4% as well:

So looks like tomorrow is setting up for a continuation run higher for equities. As far as the futures charts, the Nasdaq futures above 19200 area will target 19935/50 area now with support 19k:

The SP500 futures are bullish above 5340 and 5525 areas, 5420 is good support on the daily with 5660 the upside target now:

As far as the QQQ ETF, expect resistance to be heavy between 472/480 with multiple technical levels there, but buyers in solid control above 455 for now:

Ok that is it for now, we have all the MTR Subscriber data and trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system.

We offer you a mindset that you cannot get anywhere else

We offer you data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes.

You won’t be disappointed! Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.