Ok so just wanted to add a few things today on the recent developments involved in GameStop. As a sidenote, if you haven’t seen the movie Dumb Money, it does a pretty good job of outlining the nuts and bolts of the move GameStop had in 2021. It is on Netflix if you have it and I would recommend watching it. Anyway GameStop stock is at it again but first the X profile on RoaringKitty the man behind the move and the main character in the movie:

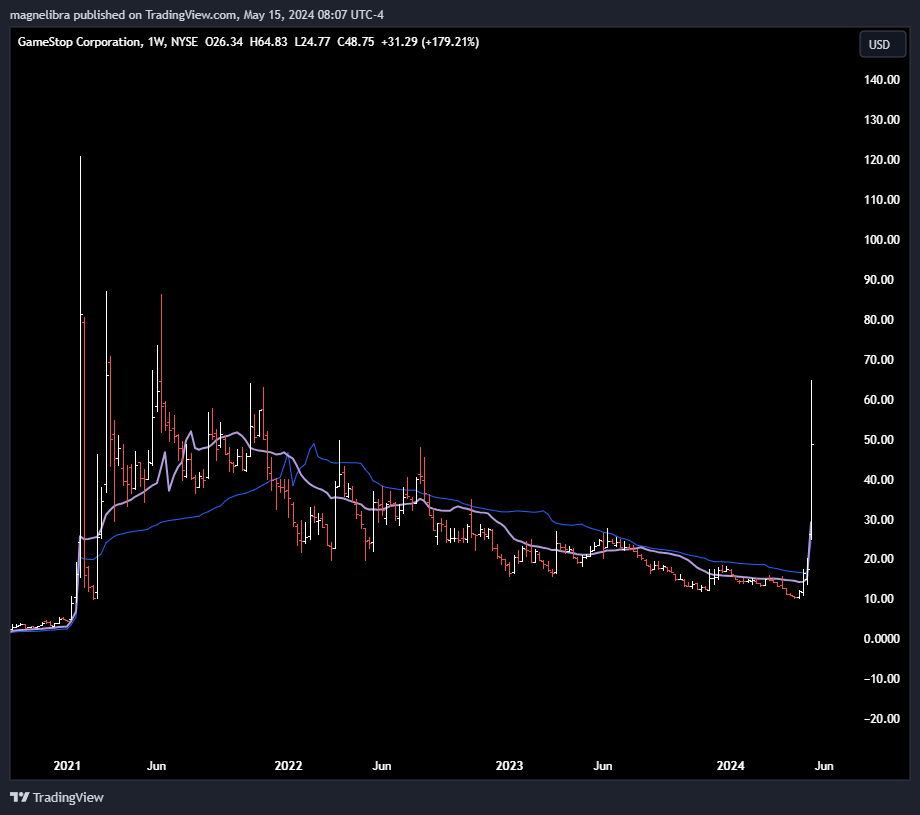

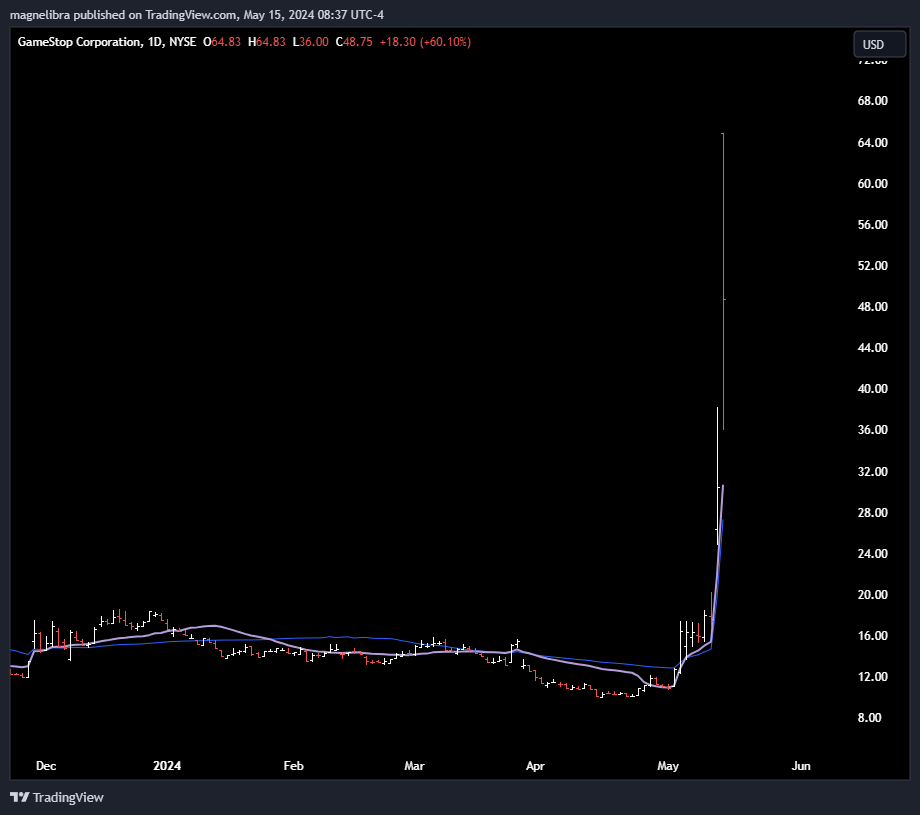

Here is the chart of GameStop now showing the move back in 2021 vs today:

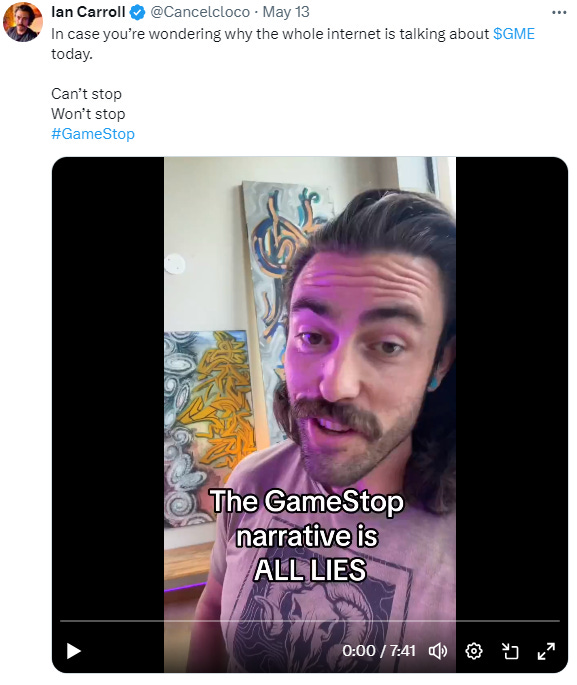

Another account you guys should follow is @Cancelcloco on X he does a lot of great research into subjects that many won’t explore on their own in regards to the who what and where behind a lot of things in our system. I don’t always agree with things but the research is in depth and informative. Here is a link if you have X to watch his post on GameStop the other day IanCarroll@Cancelcloco on GameStop

What he talks about in the video is the short interest in GameStop. What he exposes is a few things, one there are multiples of naked shorts against GameStop. The official count of the shorts is 26% but in reality, there are an estimated 1.5bn shorts when there are only 305 million shares outstanding (5x)…well how do you get that many shorts?

Well large funds use rehypothecation, which is simply claiming ownership of something without actually owning it. It happens all the time in the US treasury market and we get a whole host of failure to delivers…but that is a subject for another time.

So now think about this, if there are 1.5bn shares short and the stock moves $1 then theoretically every $1 move higher will result in a $1.5Bn loss, a $10 move is $15bn. With this in mind let’s look at the current move.

We have gone from $10 to $60. This should result in a theoretical $90Bn loss, this is going to be tough to hide. Now even if we take the actual 26% of the short interest which is 79.3m shares, so even with that this move to $60 its a $4bn loss. So whoever is rehypothecating and claiming ownership they are going to be forced to bail. The actual shorts that have the real claim as denoted in the actual reported short interest, well they may have some staying power, but still their losses will mount and be self fulfilling should GameStop continue to rise. Everyone has a breaking point and it will be interesting to see this transpire again.

No matter what, it does expose the fallacy of our markets, there is so much wealth concentrated and so much collusion at those levels that the price of anything can be set automatically. The great Ken Griffin of Citadel said it himself, “They set the price of a security” Well he wasn’t lying.

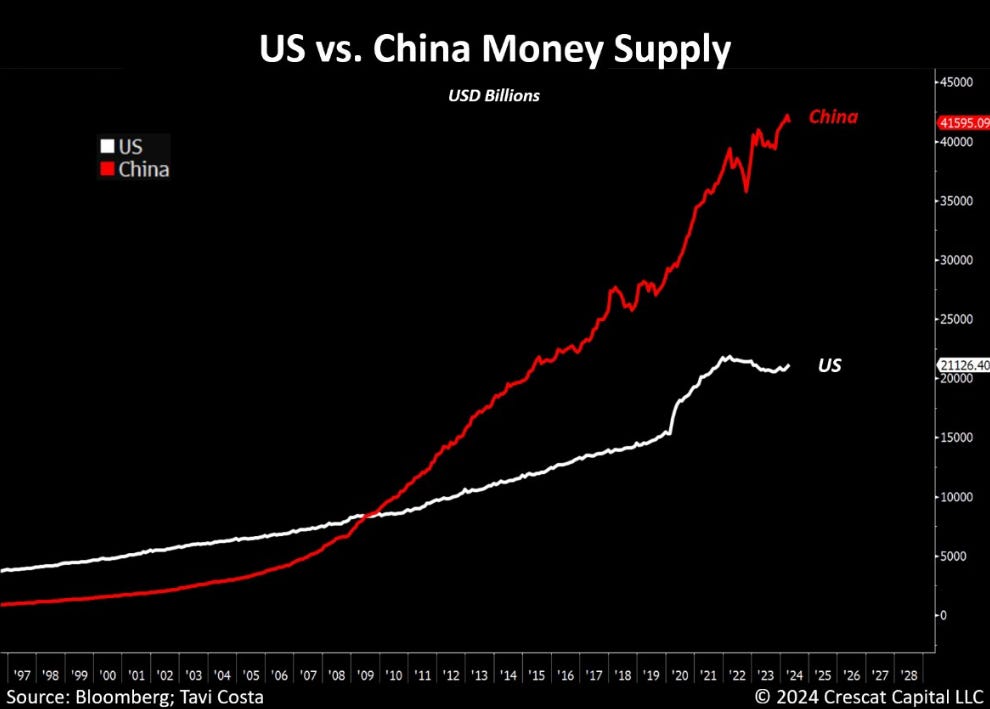

What do we mean by the money can overwhelm, well take a look at this chart and you might get a glimpse to how much printing has gone on to subvert natural economic processes:

How much of that Asian money has left China???

Alight CPI just came out +0.3% vs +0.4% mom. Year over Year as expected 3.4%.

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.