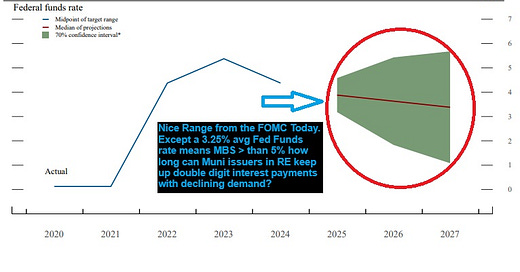

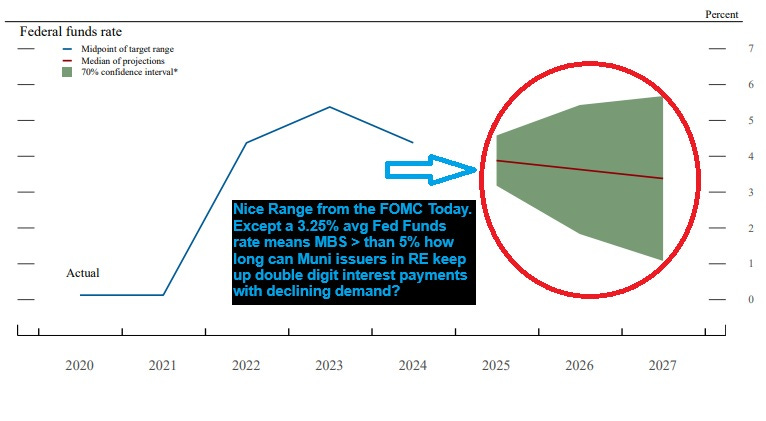

FOMC Sets 3.25% as the Fed Funds Range for the Future

Subscriber Daily Trading Data for June 18th 2025

Although it was widely expected for the FOMC to keep rates unchanged, what probably wasn’t in the cards was their “higher for longer Fed Funds average” chart in their post decision PDF. We highlight this in their graphic they shared and our comments in the box and show the longer term 3.25% Fed Funds median projection:

We can’t help but think many levered base players will be taken by surprise and suspect if this does transpire, that many will be liquidating a whole host of assets and prices for many things will plunge.

We have already witnessed this across the board in a lot of the recent commercial real estate transactions as leverage is being unloaded and losses mounting. We suspect the retail side for the home builders and all the buy downs they are committed to just to move inventory, will show up as major losses in the ensuing quarters. We saw this post from Lance Lambert, and we suspect we will see a lot more like this to come:

The FOMC themselves are stuck, if they cut rates and start increasing their balance sheet, they increase their positions and force more leverage onto an already saturated business and consumer base.

If they don’t cut rates and increase their balance sheet, they risk a stagnating debilitating deflationary spiral that if they don’t effectively manage it, could lead to a massive risk off event that could force losses to exceed their abilities to even band aid the problem any longer.

Look don’t get us wrong, the world has been sold the printing to prosperity theme by the global central banks, but one thing is clear, the boundaries of this monetarist action are showing up, we just believe many just aren’t looking.

We put out an X post saying the following:

The Federal Reserve deferred asset is now in its 4th year, showing a loss of $233 Billion. If we take the prior 10 years remittance average of $83 Billion and considering that we are on our 4th year of losses, then the U.S. Treasury is now out a staggering $332 Billion dollars of income. This transfer mechanism of FOMC profits to the U.S. Treasury has effectively been shut down, they now receive nothing from the Federal Reserve.

When people believe you can print money ad infinitum at no cost...understand 2 important things,

1. The real cost is increased budget deficits (taking money away from tax payers via less social programs and infrastructure spending)

2. Debasement of your wages (your labor income is devalued via the inflation of goods and service prices) All in all YOU pay the cost to the money printers, while they print to buy assets, you work so they can print. Get it?

Ok enough of the FOMC, we have a massive options expiration on Friday, $5.9 Tn notional:

Here is a great graphic from Tier1Alpha, 6000 level in the SPX has proven formidable, will it be so again this time?

The SPX chart needs a decisive close above 6000 or we risk the bears and sellers starting to gain momentum especially below 5775. The Bulls still have the ball and will have it until or if 5950 gives away on the daily:

We have all the MTR Subscriber data and trading trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system and perhaps implement some of our trading trackers into your own investment profiles! If you are sick of stagnating, sick of losing then join the ranks of MTR Subscribers!

We offer you a mindset that you cannot get anywhere else.

We offer you access to our data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes. You won’t be disappointed!

Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.