Cross Currency Basis Swaps and Basis Trades are Making Headlines

April 8th Subscriber Data Trackers

As we noted in yesterday’s post we are starting to see the bond market volatility pick up. We are hearing a lot of chatter being thrown around main stream media about cross currency basis swap spreads and basis trading in general. Although main stream media has intertwined these two things, they are not the same thing.

So lets get things broken down, but remember, these are complex terms and complex trades, but that doesn’t mean we can’t simplify them. Basically its all about whether or not US Dollar funding is ample or scarce, if ample then spreads will narrow if scarce then they will widen out.

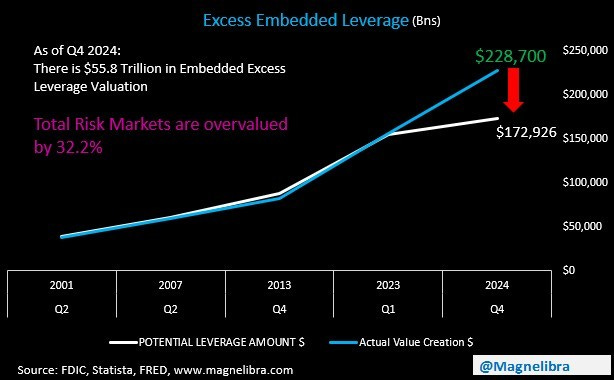

Obviously this is simplified but there are currency dynamics and interest rate dynamics that play deep into the heart of the global financial system. When trade is running smooth and central bank funding is ample then the world can expand and operate on a normal path, but as the monetary system grows and debt markets grow, well then even the smallest disruption can set of a chain reaction that quickly becomes a major systemic risk. Enter the Trump tariffs and this is a structural shift that many believed was not going to happen, so now we have a whole host of currency and interest rate risk lurking around the globe. We have massive leverage imbalance which we highlighted in yesterday’s post and this is going to cause some serious problems especially coming out of Asia.

Here is our imbalance chart we shared yesterday:

So with this in mind and so you are informed let’s touch on a few key points for this Cross Currency Basis Swap term and Basis Trade terms that we continue to hear.

A cross-currency basis swap (XCBS) is a financial derivative used to exchange interest payments and principal amounts denominated in two different currencies. It allows parties to access funding in a foreign currency while managing exchange rate risk.

Why Spreads Widen (Negative Basis)

High Demand for USD: If global borrowers rush to secure USD (e.g., for debt repayments), the basis becomes more negative. Non-US banks pay higher spreads to obtain USD via swaps.

Central Bank Interventions: During crises, central banks may offer USD liquidity (e.g., Fed’s swap lines in 2020), which can tighten spreads later.

Credit Risk: Counterparty concerns may widen spreads.

Market and Practical Implications

Cost of Hedging: A negative basis makes it expensive for non-US entities to hedge USD liabilities.

Arbitrage Opportunities: Traders might exploit mispricing between cash and FX swap markets.

Indicator of Stress: Widening spreads often correlate with financial market stress (e.g., 2008 crisis, March 2020 COVID panic). -Also this is what we are seeing currently!

Now lets move to the U.S. Treasury Basis Trade (Cash vs Futures Markets)

Purpose: Arbitrage between Treasury futures and the underlying cash Treasuries.

Traders buy (or sell) Treasury futures and offset the position in the cash market, exploiting price discrepancies.

The basis = Cash bond price – (Futures price × conversion factor).

Key Drivers:

Financing costs (repo rates).

Delivery options embedded in futures.

Supply/demand for specific bonds (e.g., CTD bonds).

Indirect Linkages

While they operate in separate markets, broader financial stress can affect both:

Liquidity Crunches:

A USD funding squeeze (e.g., March 2020) widens XCBS spreads and disrupts repo markets, impacting Treasury basis trades.

Central Bank Actions:

Fed interventions (e.g., swap lines, repo operations) can ease both XCBS spreads and Treasury basis volatility.

Hedge Fund Activity:

Leveraged players in both markets may face simultaneous funding pressures, forcing unwinds.

Example: In March 2020, hedge funds facing margin calls unwound Treasury basis trades while XCBS spreads blew out due to USD scarcity. This is also what may be transpiring right now!

So to sum up what we want you to know about these two:

XCBS: Currency funding tool, driven by global USD demand.

Treasury Basis: Arbitrage trade, driven by repo/cash-futures mispricing.

Link: Both are barometers of stress but respond to different mechanics. Liquidity shocks (e.g., Fed policy shifts) can correlate their behavior.

We suspect we are about to hear calls for the Federal Reserve to open up global central bank swap lines to alleviate some of this damage and US Dollar shortage. We are not a big fan of this intervention because it creates a moral hazard by which over levered players consistently rely upon central banks to bail them out. What is often deemed as a temporary measure ends up being much more permanent in nature! This isn’t QE per say but it is an intervention that creates open lines of credit for some term and leads to the same misbehaviors over time.

Anyway the risk’s are heightened now and many retail are back in catching the falling knife. We would not do that if we were you. This imbalance is large and these geopolitical posturing’s have a way of washing and rinsing even the strongest of wills. We recommend taking chips off the table and reevaluating your next big entries for the longer term! For now the markets continue to exhibit signs of liquidation and we are seeing this continue on into tonight’s session. We are seeing big sellers liquidating US long end treasury bonds and notes, undoubtedly Asian selling to raise cash! US Govt 10Y now trading 4.46% and we would think Insurers and Pensions would be backing up the truck here unloading some equity risk to buy some duration:

The Nasdaq futures are right back to our first buy zone for the week after a decent bounce earlier today, they are back testing this area at 16858:

The SP500 futures targeting the 4808 area now and since everyone is thinking market crash mentality now we added a little target bubble below for fun:

Ok we have all the MTR Subscriber data and trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system.

We offer you a mindset that you cannot get anywhere else

We offer you data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes.

You won’t be disappointed! Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.