CPI on Tap this Week, Yields Up, Equities Up, Risk in Play

Technical charts, Bitcoin, Monero and More Subscriber Trading Trackers

This week’s economic focal point will be the CPI numbers coming out on Wednesday. Estimations are for CPI YoY to up tick 2 tenths of a percent to 2.5% and for Core CPI to up tick by a tenth to 0.3% with YoY expected at 2.9% up a tenth. We will continue to expect the long end of the U.S. bond market to be on the defensive, with the front end firmly anchored by dovish global central banks, even if the FOMC is going to be in pause mode for now. We suspect there are some unforeseen forces behind the FOMC refraining from accelerating their rate cuts, and no we don’t think inflation is on their mind. In fact as our last post pointed out, the other global central banks seem more worried about deflation and a deteriorating economic picture than outright inflation.

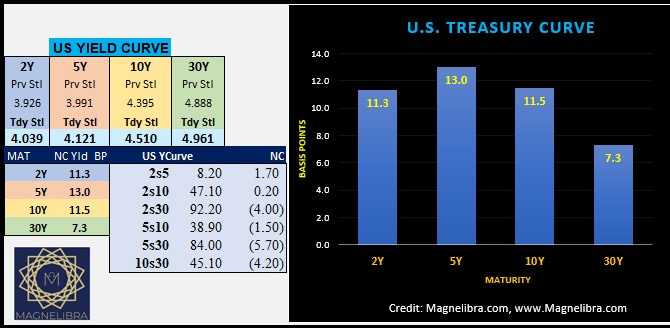

As far as the U.S. bond market, Friday saw a big jump in the front end with the 5Y +13bp and a decent flattening of the yield curve. We suspect we wills see bouts of this, but overall we suspect the upper bound of U.S. yields should be capped for now with the long end near 5% and the 10Y rate at 4.50%:

When we look at the US Govt 10y yield chart this weeks resistance is set at 4.55% with support at 4.30%:

Taking a look at some other technical charts, the QQQ ETF continues to push into the highs with resistance up at 541 and support down at 511 this week:

Looking at the equity futures the SP500 continues to look strong and seemingly is poised for an attack on ATHs:

The same thing in the NQ futures 22200 is the resistance target and 21375 is the support:

Looking at the Euro Currency future, decent selling off last week’s highs and now 113-26 is support on the week with 115-255 as resistance:

Crude Oil with a big run up last week and almost at the point where systematics will start to come in and set buy programs. We believe a push and close on the daily above 66.10 will accomplish this and $70 would seem logically if this occurs as the target:

Our last futures chart is Silver, the breakout of silver seems to be ushering in perhaps a little era of outperformance of Silver vs Gold. At 92.6 we still feel Silver is far too cheap vs Gold:

Alright guys, we have all the MTR Subscriber data and trading trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system.

We offer you a mindset that you cannot get anywhere else.

We offer you access to our data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes. You won’t be disappointed!

Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.