CPI Nothing, Markets Move On, Housing an Issue Now

CPI came in a tenth higher than last month and lower than the 0.2% which was expected. YoY now sits at 2.4% up a tenth. So much for all that tariff inflation, but as many MTR readers know, retailers will not be able to pass off any tariff related costs as consumers will balk and opt for alternatives. This was always going to be the case, but the MSMedia will continue to make you believe that tariffs are going to cause these massive price spikes. Well for those that understand our current economic fundamental set up, then you would realize that conditions outside of risk assets of course, continue to deteriorate.

This bifurcated system has been a long time in the making and purely a product of massive amounts of monetary stimulus over the last 3 decades. Many MTR readers have seen this FOMC asset increase data before, but we will share it again here. What it shows is that over the last nearly 30 years the FOMC asset base has increased at an annualized rate of 9.74%! That is a massive inflation rate, especially when their mandate is 2%!

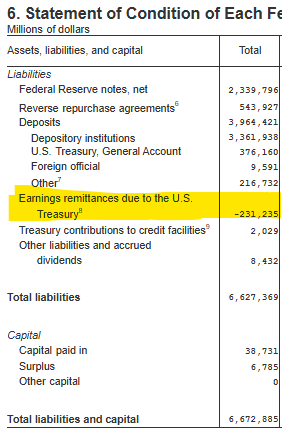

The fact that nobody but us talks about this is crazy, but we also want to point out that the FOMC has a deferred asset, which is their cumulative total loss of their portfolio holdings marked to market, and this value continues to grow, now at $231 billion.

This loss will not alleviate itself unless the FOMC cuts rates and cuts them aggressively. At their current rate, we would suspect the FOMC to continue to post this deferred asset all the way through to 2029 or beyond, meaning the U.S. Treasury is not receiving any profits returned from the FOMC until then.

Nobody talks about these things, which is quite strange, because for us the FOMCs balance sheet is honestly, the only thing that matters! We believe its the base layer of all leverage embedded into the system. Which means, that their elevated rates preference currently, is a direct attack on systemic leverage and until that leverage comes down, we suspect the FOMC will want to leave rates as is for as long as they can. Well as long as they can until something truly breaks, but with equities poised to attack new all time highs, its been the M.O. for the FOMC to target asset prices and let the general economy do what the general economy does…

So when we couple 7% mortgage rates and the fact that this rate removes about 70% of the available buyer pool, strictly upon affordability and the massive increase in inventory, well lets just say, the home seller no longer has pricing power! We believe many real estate sellers haven’t figured out that they will have to discount their prices or risk being over saturated and muted out by the millions of other homes currently for sale and currently in the pipeline as these charts suggest!

Look at this chart from at nickgerli1 on X, historical pessimism and rightfully so, the only difference is the late 70s had 20% interest rates not 7%, which tells you all you need to know about actual affordability, its abysmal, in fact it tells us that 7% is equal to 20% back then and the FOMC is dead on keeping rates right here for now:

Ok let’s take a quick look at the US Govt 10y yields are falling today -4.4bp to 4.43%:

Alright guys, we have all the MTR Subscriber data and trading trackers up next, we urge you to become a full subscriber and truly break through that barrier of understanding in regards to our global financial system and perhaps implement some of our trading trackers into your own investment profiles! If you are sick of stagnating, sick of losing then join the ranks of MTR Subscribers!

We offer you a mindset that you cannot get anywhere else.

We offer you access to our data across a multitude of market segments and structured in a unique way for you to easily understand market movements and the values of those movements.

We offer a more in depth vantage point, to incorporate our work into your own investing and trading processes. You won’t be disappointed!

Sign on today and feel the power of being the smartest person in the room, when others pretend they know, YOU WILL KNOW!

Keep reading with a 7-day free trial

Subscribe to Magnelibra Trading & Research to keep reading this post and get 7 days of free access to the full post archives.